|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Tuttle Capital’s 2x Long BONK ETF could launch by July 16, drawing speculative interest.

- BONK’s spot net inflow jumped over 100% to $1.68M, signaling strong investor demand.

- A positive funding rate and technical breakout above the 20-day EMA suggest bullish continuation.

BONK, the Solana-based meme coin, is seeing renewed investor interest following a recent filing by Tuttle Capital with the U.S. Securities and Exchange Commission (SEC). The post-effective amendment hints at a potential July 16 launch of a suite of leveraged exchange-traded funds (ETFs), including a 2x Long BONK ETF, sparking a wave of speculative activity and optimism among crypto traders.

Investor Sentiment Soars with Over $1.6M in Spot Net Inflows

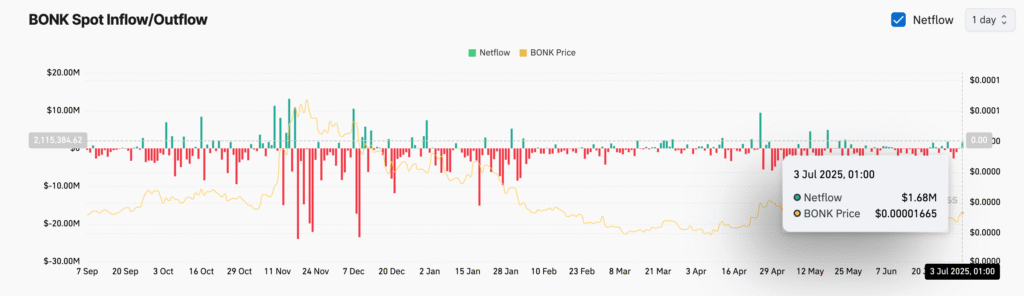

The most immediate impact of the ETF buzz has been a dramatic increase in BONK’s spot net inflow, which has surged over 100% in the past 24 hours to reach $1.68 million, according to data from Coinglass. Spot net inflow represents the direct capital entering an asset, often reflecting bullish sentiment and growing demand.

Such a sharp rise in net inflow indicates that both retail and institutional traders are beginning to view BONK not just as a meme coin, but as a serious speculative asset poised for broader market participation—especially with the possibility of a leveraged ETF amplifying exposure.

Positive Funding Rate Reflects Bullish Derivatives Market

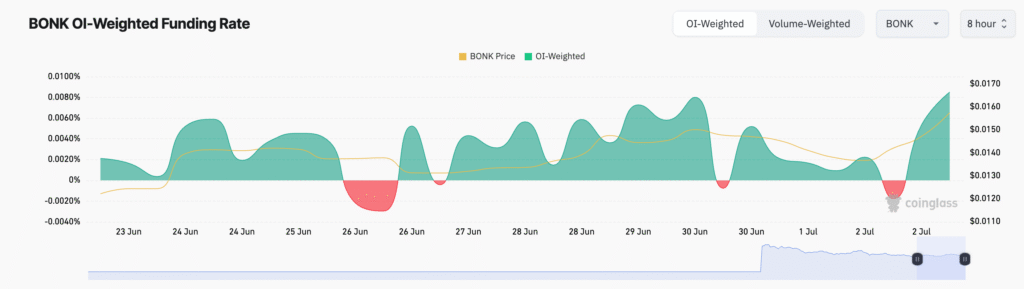

Alongside spot buying, BONK’s futures market is also heating up. The coin’s funding rate currently stands at +0.0085%, indicating that traders are paying a premium to hold long positions. In perpetual futures, a positive funding rate shows that bullish positions outweigh bearish ones—another strong indicator of upward momentum.

This sentiment aligns with the broader market’s response to leveraged ETF products, which often lead to increased volatility and volume in the underlying assets as traders position themselves ahead of a launch.

Technical Breakout: BONK Clears 20-Day EMA Resistance

Technically, BONK has also flashed a bullish breakout signal, moving above its 20-day exponential moving average (EMA) to trade around $0.000016. The 20-day EMA now serves as dynamic support at $0.000014, reinforcing short-term bullish momentum.

Also Read: BONK Price Prediction: Meme Coin Could Soar 176% by 2026 Despite Bearish Trend

If current conditions persist, bulls may push BONK’s price toward its next key resistance level at $0.000018. However, failure to sustain demand could lead to a pullback to $0.000012—underscoring the asset’s inherent volatility.

The filing of a 2x Long BONK ETF by Tuttle Capital has reignited enthusiasm for the meme coin, driving spot inflows, increasing futures demand, and pushing it above key technical levels. While speculative, the momentum appears to be building.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!