|

Getting your Trinity Audio player ready...

|

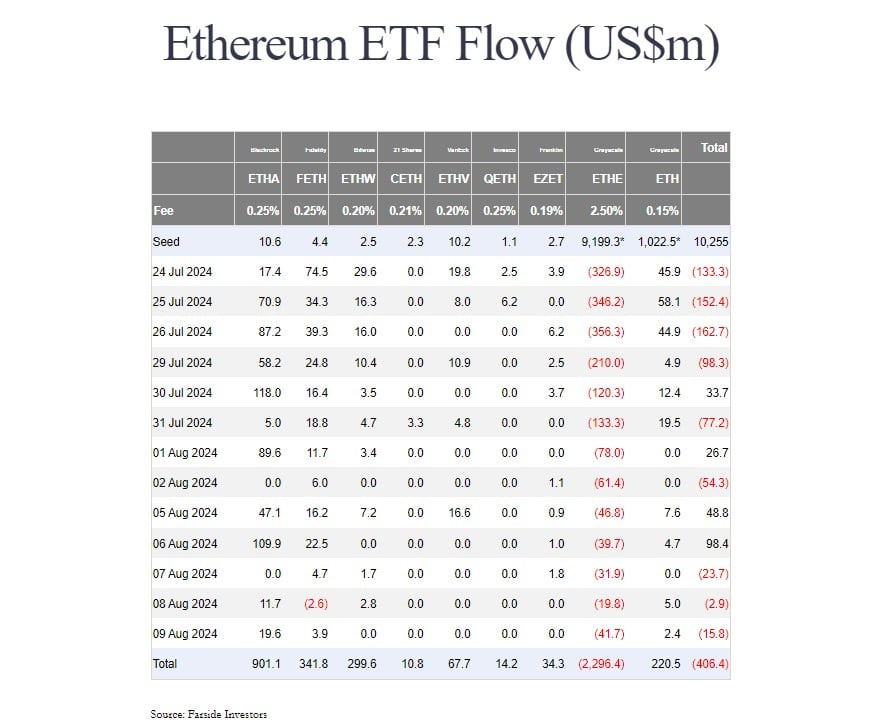

BlackRock’s iShares Ethereum Trust (ETHA) is on track to become the first US spot Ethereum exchange-traded fund (ETF) to amass $1 billion in net inflows within just three weeks of its launch. This rapid accumulation of assets under management (AUM) has positioned the ETF as a major player in the burgeoning crypto investment landscape.

While the $901 million in net capital garnered thus far is impressive, it falls short of the meteoric rise of BlackRock’s Bitcoin ETF, which achieved the same milestone in a mere four days. This disparity highlights the relatively slower growth trajectory of Ethereum ETFs compared to their Bitcoin counterparts.

Industry experts attribute this difference to several factors. The overall market interest in Bitcoin has historically been more pronounced, driving larger inflows into Bitcoin ETFs. Additionally, Ethereum’s role in the crypto ecosystem, while crucial, differs from Bitcoin’s position as a digital gold.

Despite the slower growth, ETHA is rapidly gaining ground. It’s poised to outpace Grayscale’s Ethereum ETF (ETHE) in terms of AUM, a significant achievement considering ETHE’s earlier market entry and substantial asset base.

The battle for Ethereum ETF dominance is far from over. With Grayscale’s Ethereum Mini Trust and other competitors in the space, the landscape is dynamic and evolving. Investors will be watching closely to see if ETHA can sustain its momentum and solidify its position as the leading Ethereum ETF.

The rapid growth of both Bitcoin and Ethereum ETFs underscores the increasing institutional interest in cryptocurrencies. As these products mature, they are likely to play a pivotal role in shaping the future of the digital asset industry.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!