|

Getting your Trinity Audio player ready...

|

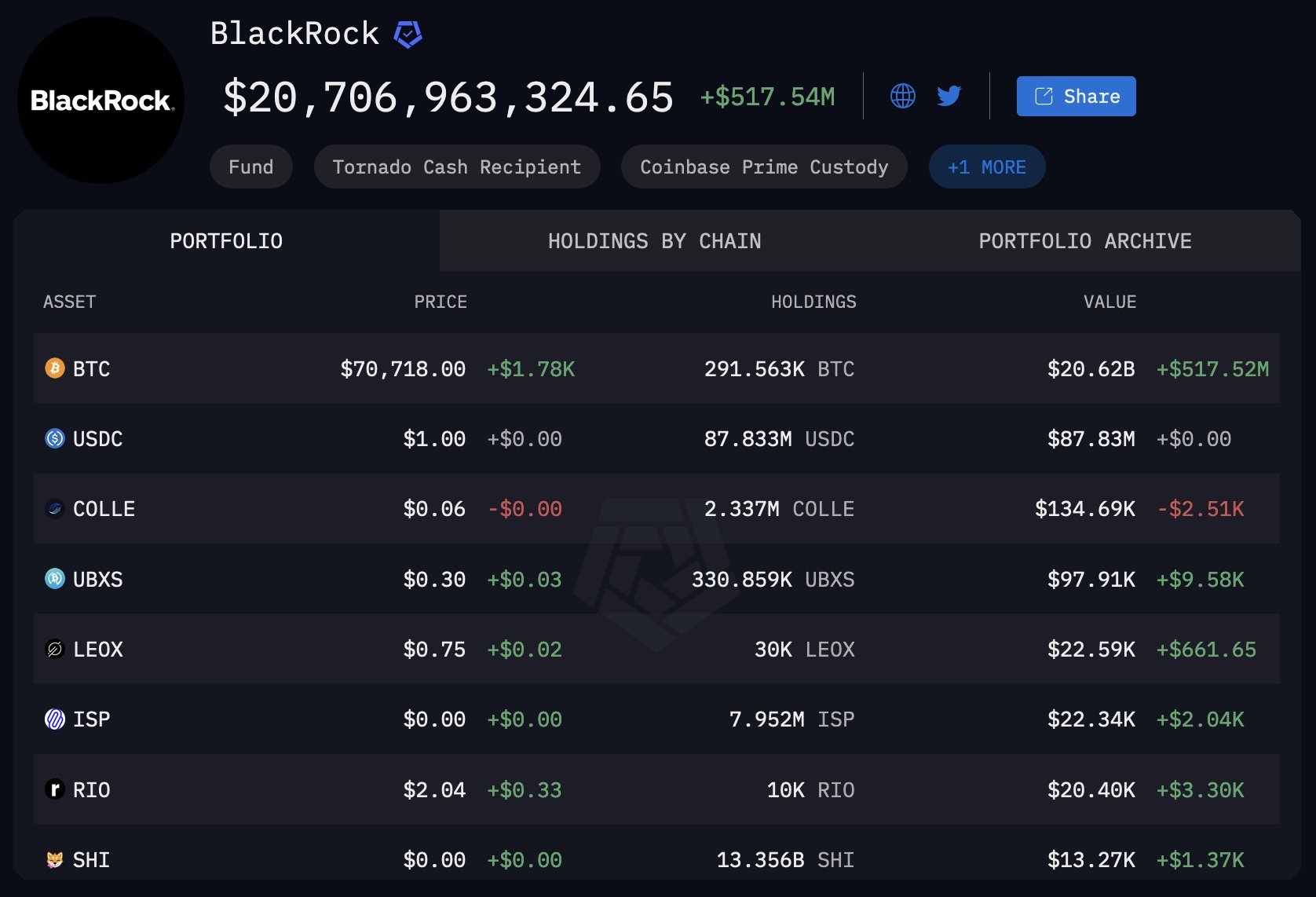

BlackRock, the world’s largest asset manager, has crossed a significant milestone by amassing over $20 billion in on-chain Bitcoin holdings, according to data from Arkham Intelligence. This surge, driven by rising Bitcoin prices, signifies BlackRock’s growing conviction in the cryptocurrency’s potential.

BlackRock’s Crypto Portfolio Flourishes

The total value of BlackRock’s crypto portfolio currently stands at a staggering $20.7 billion, reflecting a net increase of $517.54 million. This growth is primarily fueled by the price appreciation of Bitcoin, its dominant holding. Bitcoin’s price currently sits at $70,718, representing a rise of $1,780.

BlackRock’s Bitcoin holdings translate to a massive 291.563K BTC, valued at $20.62 billion. This substantial holding, coupled with the recent price increase, significantly propels the overall portfolio value.

While Bitcoin dominates BlackRock’s crypto holdings, the firm also ventures into other cryptocurrencies. Their portfolio includes COLLE, UBXS, LEOX, ISP, RIO, and SHI. While these altcoin holdings are significantly smaller compared to Bitcoin, they demonstrate BlackRock’s diversified approach to the crypto market.

Bitcoin ETF Market Sees Influx

The Block’s analysis of on-chain Bitcoin flows for various spot Bitcoin ETFs reveals a dynamic market with periods of significant inflows and outflows. The period between mid-January and early June 2024 witnessed days with substantial inflows exceeding 10,000 BTC, alongside outflows of similar magnitude. However, recent data suggests a trend towards more stable flows since mid-May.

BlackRock’s iShares Bitcoin Trust (IBIT) Takes the Lead

It’s noteworthy that BlackRock’s IBIT recently surpassed Grayscale’s Bitcoin Trust (GBTC) as the leading Bitcoin ETF, following a surge in inflows on May 29th. This achievement, highlighted by Arkham Intelligence, underscores the growing investor interest in the spot Bitcoin ETF market. The U.S. Bitcoin ETF market even witnessed inflows of $45 million on May 28th alone, marking the 11th consecutive day of positive net flows.

Also Read: Bitcoin ETFs Erupt: Over $880 Million Inflows in Second-Biggest Day Ever

BlackRock’s substantial investment in Bitcoin and its foray into altcoins signifies a growing institutional appetite for cryptocurrencies. This trend, combined with the recent success of spot Bitcoin ETFs, paints a promising picture for the future of cryptocurrency adoption within the mainstream financial landscape.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.