|

Getting your Trinity Audio player ready...

|

Bitcoin (BTC), the flagship cryptocurrency, has been grappling with lackluster price action, causing unease among investors. Recent data suggests fear is spreading throughout the market, but some analysts believe this turmoil could pave the way for a trend reversal.

Bitcoin’s Price Dilemma

BTC experienced an 11% correction last week, dragging its price below the $95,000 mark. As of writing, Bitcoin is trading at $94,888, with a market capitalization of $1.86 trillion. Despite the drop, only 1.98 million Bitcoin addresses—less than 4% of all addresses—are “out of the money,” according to data from IntoTheBlock.

Adding to the anxiety, Santiment, a data analytics firm, highlighted increased fear among retail traders, especially those who entered the market in the last 2–3 months. Their tweet pointed out that “massive FUD” (fear, uncertainty, and doubt) is influencing newer investors, creating opportunities for larger players to capitalize.

📉 Crypto markets have opened the week retracing further, instilling panic toward the retail crowd. Particularly Bitcoin and Ethereum are seeing massive FUD from newer traders who joined markets in the past 2-3 months

— Santiment (@santimentfeed) December 23, 2024

These new traders have not seen mid-sized corrections before,… pic.twitter.com/L7yHMPLCNR

Whales and Retail Panic

Historically, retail panic has allowed whales and sharks—investors with significant holdings—to accumulate assets at discounted prices, often leading to price recoveries. However, current metrics show a decline in Bitcoin addresses holding balances exceeding $1 million, suggesting that even large investors are offloading their BTC holdings.

CryptoQuant’s data reinforces the bearish sentiment, with exchange reserves on the rise, indicating increased selling pressure.

Optimism in the Derivatives Market

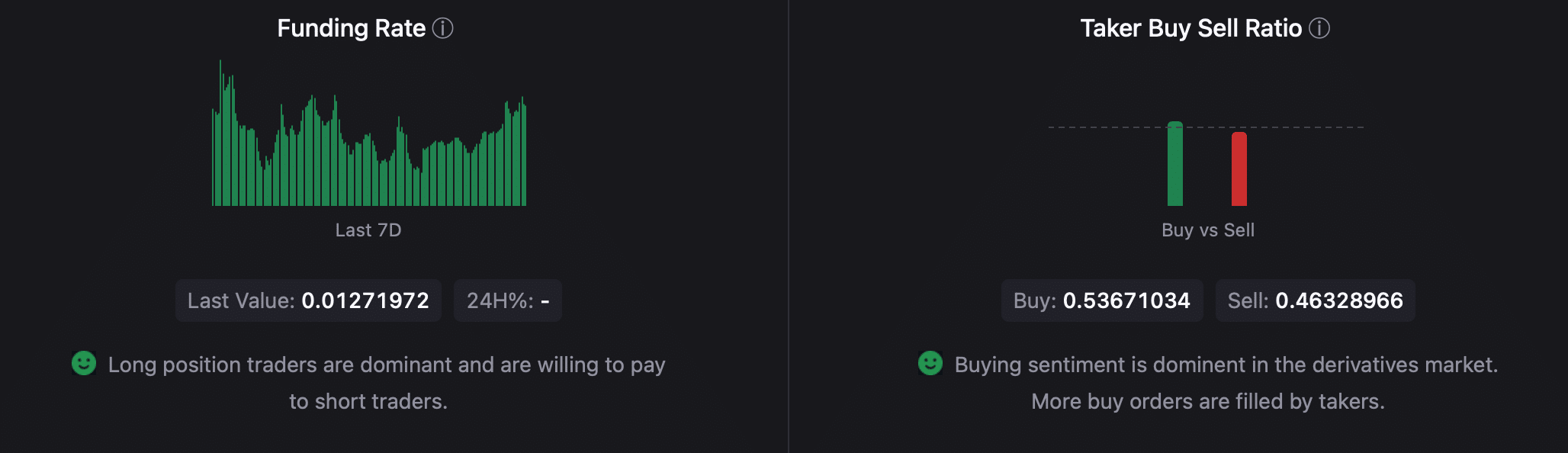

Despite the overarching bearish sentiment, there are signs of hope in the derivatives market. Bitcoin’s funding rate has been increasing, signaling rising bullish sentiment among traders. A higher funding rate means that the cost of holding long positions is growing, often a precursor to upward price momentum.

Also Read: MicroStrategy’s Bold Move: Shareholders to Vote on Raising Capital for More Bitcoin Purchases

Additionally, the taker buy/sell ratio—a measure of buying versus selling sentiment in the derivatives market—remains positive. This indicates a stronger inclination toward buying, which could fuel a recovery.

Can Bitcoin Rebound?

The mixed signals in Bitcoin’s on-chain and market metrics present a complicated picture. While retail panic and whale sell-offs create headwinds, positive signs in the derivatives market hint at the potential for a trend reversal.

As the year-end approaches, the historical Santa Claus rally, a seasonal uptick in the crypto market, may still provide an opportunity for Bitcoin to reclaim its bullish momentum. Investors and traders will need to monitor whale activity and derivative trends closely to gauge whether the king coin is poised for a rebound.

While Bitcoin’s recent struggles have instilled fear in the market, the interplay of retail panic, whale behavior, and derivatives data suggests that a recovery is not out of reach. Whether BTC can capitalize on these dynamics remains to be seen, but the coming weeks will be crucial for its trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!