|

Getting your Trinity Audio player ready...

|

The recent arrival of Bitcoin ETFs has sparked a firestorm of debate, with SEC Chairman Gary Gensler throwing shade at the cryptocurrency’s underlying technology. One of his key concerns? Centralization, specifically within the realm of Bitcoin mining.

Gensler argues that despite Bitcoin’s decentralized aspirations, the actual production of new coins is concentrated in the hands of a “handful of mining companies.” This, he claims, creates a vulnerability to manipulation, as these firms could potentially rewrite transaction history if they collude.

Numbers Don’t Lie:

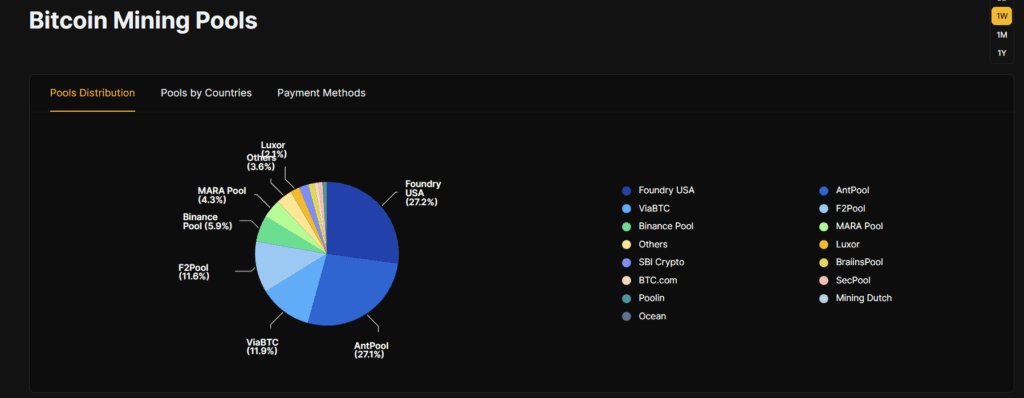

The statistics seem to back Gensler’s claim. According to Hashrate Index, a mere two Bitcoin mining pools currently control over 50% of the network’s hash rate. This hash rate is essentially the computational power dedicated to mining Bitcoin, and a majority control grants significant influence over the network.

Those two dominant pools are not monolithic entities. They represent a constellation of smaller mining firms who choose to pool their resources for efficiency. And here’s the crucial point: these individual firms retain the freedom to switch pools or even mine independently at any time.

This fluidity in the mining landscape injects a dose of complexity into the centralization narrative. While the concentration of hash rate is undeniable, it’s not a static situation. The threat of miners jumping ship or striking out on their own acts as a check against any potential collusion.

Also Read: Bitcoin to the Moon? Cathie Wood Predicts $1.5 Million by 2030 After ETF Approval

Finding the Equilibrium

The challenge lies in finding a balance between the benefits of decentralization and the risks of mining centralization. Several solutions are being explored, such as:

Encouraging individual mining: Initiatives that make mining more accessible to individual users can help distribute the hashing power more evenly.

Developing new consensus mechanisms: Alternative algorithms like Proof of Stake (PoS) are being explored to reduce the reliance on energy-intensive mining.

Promoting transparency and collaboration: Open communication and cooperation between miners, developers, and the wider community can help mitigate the risks of centralization.

Also Read: Bitcoin ETFs: A Golden Dawn or a Modest Glow? Comparing Crypto to Gold’s Historic Move

So, What’s the Bottom Line?

Gensler’s concerns about mining centralization are valid, but the picture is not entirely black and white. While the current distribution of hash rate raises eyebrows, the inherent flexibility of the mining ecosystem offers a countervailing force. The true test will lie in how this tug-of-war between centralization and decentralization plays out in the long run.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.