|

Getting your Trinity Audio player ready...

|

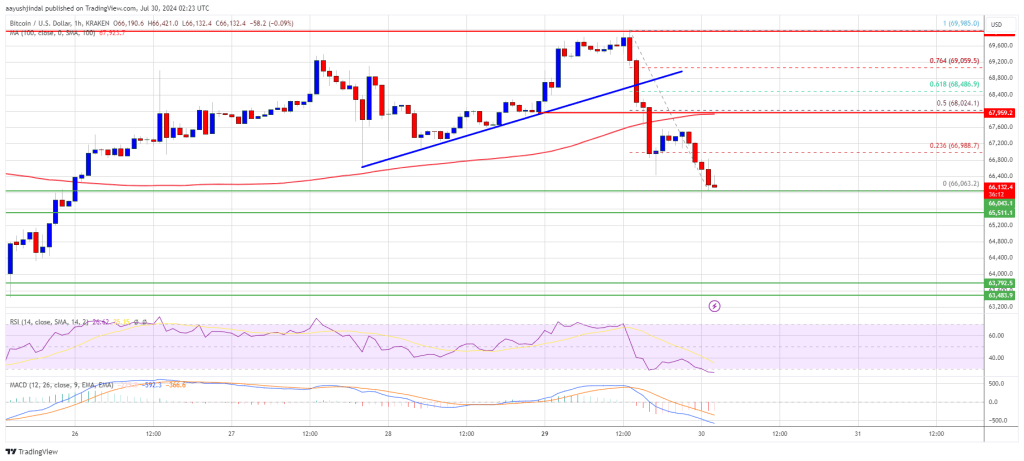

Bitcoin has experienced a setback after a brief rally that pushed prices towards the $70,000 mark. The cryptocurrency has since retreated below the crucial $68,500 support level, sparking concerns among investors.

After breaching the $68,500 resistance, Bitcoin made a determined push towards $70,000, only to be met with selling pressure. This rejection led to a sharp decline, breaking below key support levels at $68,500 and $68,000. The cryptocurrency even dipped below the $66,500 support zone before finding some stability around $66,000.

Technical indicators are currently flashing red signals. The hourly MACD is gaining momentum in the bearish zone, while the RSI has dipped below the 50 level, indicating weakening bullish momentum.

On the upside, Bitcoin faces resistance at the $67,200 level, which coincides with the 23.6% Fibonacci retracement of the recent decline. A successful break above this level could open the door for a retest of $68,000 and potentially $70,000.

However, if Bitcoin fails to reclaim the $67,200 level, it could extend its downward trajectory. Immediate support lies at $66,000, with stronger support levels at $65,500 and $65,000. A breakdown below $65,000 could accelerate the decline towards the $63,500 support zone.

The cryptocurrency market remains highly volatile, and Bitcoin’s price action is closely watched by investors. The ability to reclaim the $67,200 level will be crucial in determining the short-term trend.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.