|

Getting your Trinity Audio player ready...

|

In the latest Bitcoin news, a report from The Kobeissi Letter suggests that Bitcoin (BTC) may be heading for a significant price correction, potentially dropping to $20,000 in the coming weeks. The report emphasizes Bitcoin’s historical correlation with the global money supply, noting that if this trend continues, a major downturn could be imminent.

Bitcoin’s Link to Global Monetary Supply

The analysis points to a close relationship between Bitcoin prices and global monetary supply, with BTC often reacting with a 10-week delay. As the global money supply reached its peak at $108.5 trillion in October, Bitcoin soared to an all-time high of $108,000. However, a subsequent decline in the money supply by $4.1 trillion—down to $104.4 trillion—has raised concerns. If this trend persists, the report suggests Bitcoin could experience a drastic price drop, potentially as low as $20,000.

Market Volatility and the $100K Mark

Bitcoin’s recent slip below the psychological $100K mark has fueled fears of a broader market sell-off, especially in light of increasing global economic uncertainty. The crypto market has been highly volatile, and if the predicted downturn follows historical patterns, Bitcoin’s value could continue its decline, causing even more panic in the market.

What’s Next for Bitcoin?

Despite Bitcoin’s resilience and strong rally this year, the potential for a sharp correction has sparked mixed reactions among investors and traders. Analysts are now closely monitoring macroeconomic factors, including changes in monetary supply, which could significantly affect Bitcoin’s short-term performance.

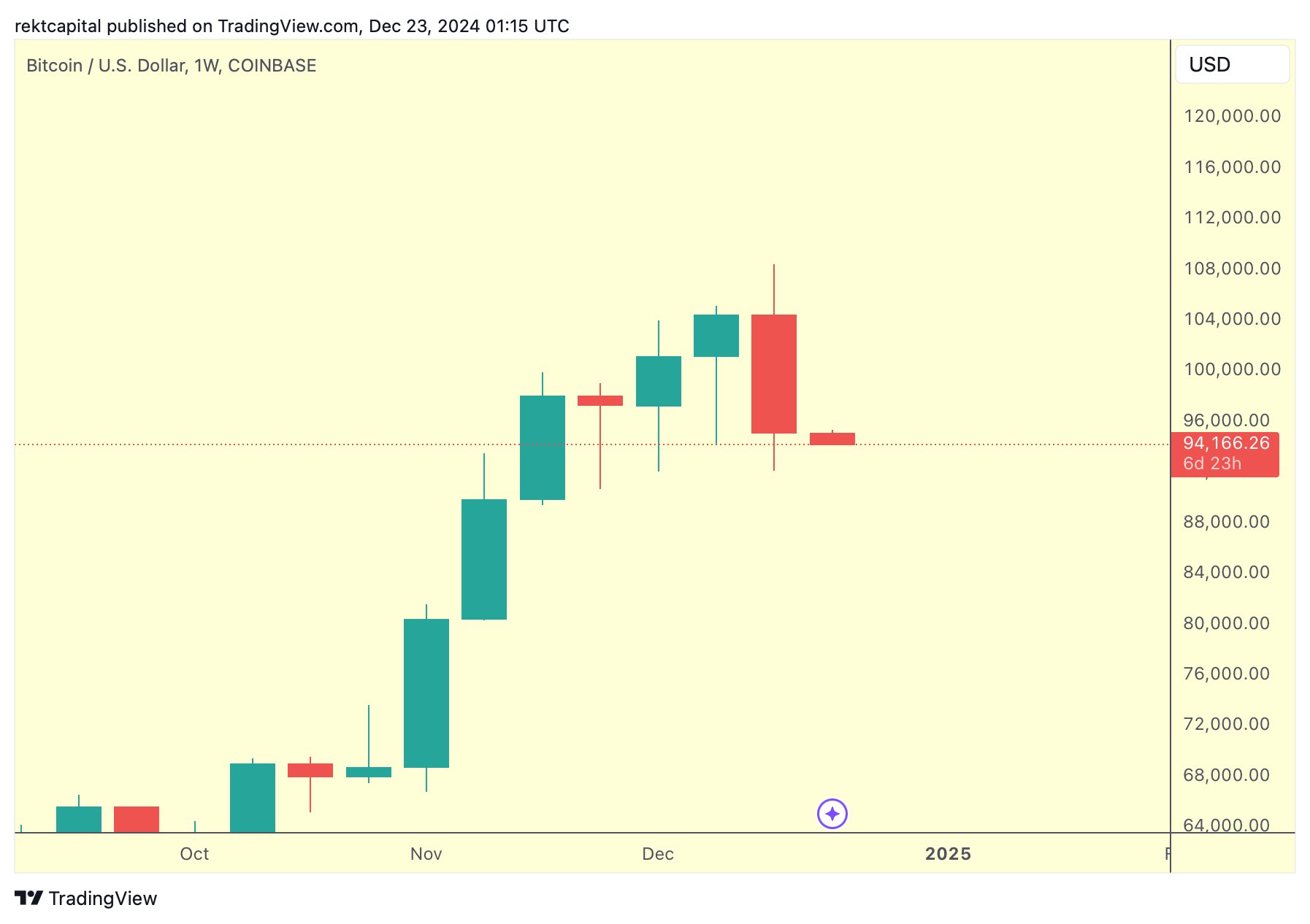

Prominent market experts like Rekt Capital have highlighted bearish signals, including the formation of a Bearish Engulfing Candlestick, suggesting a possible multi-week correction for BTC. Additionally, BTC recently lost its weekly support, marking the end of its 5-week technical uptrend.

Institutional Interest Amid Bearish Sentiment

Despite the bearish outlook, institutional interest in Bitcoin remains strong. Companies like Matador and MicroStrategy are continuing their Bitcoin acquisitions, signaling sustained confidence in the long-term value of BTC. However, the key question remains: Will Bitcoin follow the predicted decline, or will it defy expectations and resume its bullish momentum?

As of today, Bitcoin’s price stands at $94,430, down more than 1%, with a 34% increase in one-day trading volume to $54.39 billion. While the market sentiment remains cautious, there are indications that Bitcoin could recover, depending on future developments.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!