|

Getting your Trinity Audio player ready...

|

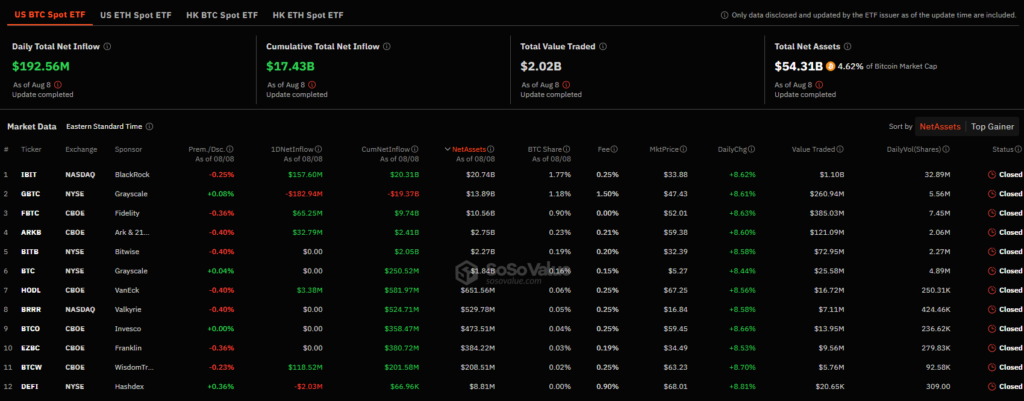

Spot bitcoin exchange-traded funds (ETFs) in the United States experienced a significant influx of capital on Thursday, with a combined $192.56 million in positive flows. This surge in investor interest has propelled the nascent ETF market to new heights.

BlackRock’s iShares Bitcoin Trust (IBIT) led the charge, attracting a substantial $157.6 million. WisdomTree’s Bitcoin Trust (BTCW) was another standout performer, drawing in a record-breaking $118.52 million. This represents a dramatic increase from its previous high and underscores the growing appetite for bitcoin exposure through ETFs.

Other notable inflows included $65.25 million for Fidelity’s Bitcoin ETF (FBTC), $32.79 million for Ark Invest and 21Shares’ Bitcoin ETF (ARKB), and $3.38 million for VanEck’s Bitcoin ETF (HODL).

In contrast, Grayscale’s Bitcoin Trust (GBTC), which is undergoing a conversion to an ETF, experienced significant outflows of $182.94 million. Hashdex’s Bitcoin ETF also saw modest outflows of $2.03 million.

While bitcoin ETFs basked in the limelight, spot ether ETFs exhibited a more muted performance. Total net outflows for these funds amounted to $2.87 million on Thursday. BlackRock’s Ether ETF (ETHA) and Grayscale’s Ethereum Trust saw inflows, but these were offset by outflows from Grayscale’s Ethereum ETF (ETHE) and Fidelity’s Ethereum ETF.

The combined daily trading volume for spot bitcoin ETFs reached $2 billion, surpassing the previous day’s figure of $1.79 billion. Since their launch in January, these funds have collectively amassed $17.43 billion in net inflows. Ether ETFs, on the other hand, have seen a total net outflow of $390.23 million since their inception in July.

Bitcoin’s price surged by 6.93% to $60,837, while ether climbed 9.72% to $2,662. The cryptocurrency market’s overall bullish sentiment appears to have positively impacted investor interest in bitcoin ETFs.

As the ETF landscape continues to evolve, it will be interesting to observe how investor preferences shift between bitcoin and ether, and whether the current trend of strong inflows for bitcoin ETFs will persist.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!