|

Getting your Trinity Audio player ready...

|

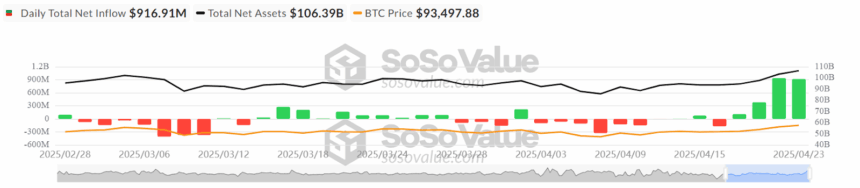

Amidst persistent market volatility, the cryptocurrency market has demonstrated remarkable resilience, hitting a $2.9 trillion valuation with a significant $499.39 billion in intraday trading volume. This positive momentum has propelled Bitcoin (BTC) to retest its $94,000 upper resistance level this week, a mark not seen since March 3rd. Several factors appear to be fueling this resurgence, including increased inflows of digital assets and a reduction in funding rates. Furthermore, on-chain data indicates a strengthening trend, notably with Bitcoin ETFs staging a strong comeback, marked by a four-day streak of positive inflows.

BTC ETF Inflows See Significant Turnaround

After a period characterized by negative outflows, Bitcoin ETFs have experienced a significant shift in investor sentiment. Data from April 23rd reveals that the majority of tracked ETFs recorded positive flows. Leading the pack was BlackRock’s “IBIT” with an impressive inflow of $643.2 million. Ark’s “ARKB” followed with $129.5 million, while Fidelity’s “FBTC” attracted $124.4 million. Grayscale’s “BTC” and VanEck’s “HODL” also saw inflows of $29.8 million and $5.3 million, respectively. Notably, only Bitwise’s “BITB” registered a negative flow of $15.2 million. This collective positive movement resulted in a net inflow of $917 million for the day, marking the fourth consecutive day of positive flows and signaling renewed institutional interest.

Technical Indicators Suggest Continued Bullish Momentum

Bitcoin’s recent price action has been accompanied by encouraging technical signals. The 20-day and 50-day Moving Averages (MA) have displayed a bullish convergence on the daily timeframe, often interpreted as a sign of strengthening upward momentum. Additionally, the 200-day MA continues to act as a robust support level for the BTC price. This confluence of moving average signals points towards a potentially strong bullish outlook for Bitcoin in the near term.

However, the Stoch Relative Strength Index (RSI) on the 1-day timeframe remains in overbought territory. Adding a layer of caution, the average of the Stoch RSI has recorded a negative crossover, suggesting a potential increase in buying and selling pressure and the possibility of a temporary pullback.

Also Read: Metaplanet Hits 5,000 Bitcoin Milestone: On Track for 10,000 BTC by 2025

What the Near Future Holds for Bitcoin

Looking ahead, if the current market momentum persists, Bitcoin could target its immediate resistance trendline around $95,000. Successfully breaching and holding above this level could pave the way for a push towards the highly anticipated $100,000 milestone.

Conversely, should bears regain control of the market, Bitcoin’s price may retest its support level at $91,500. Failure for bulls to find support at this point could lead to a further decline towards the $87,000 level in the short term. Market participants will be closely watching ETF flows and key technical levels to gauge the next direction for the leading cryptocurrency.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.