|

Getting your Trinity Audio player ready...

|

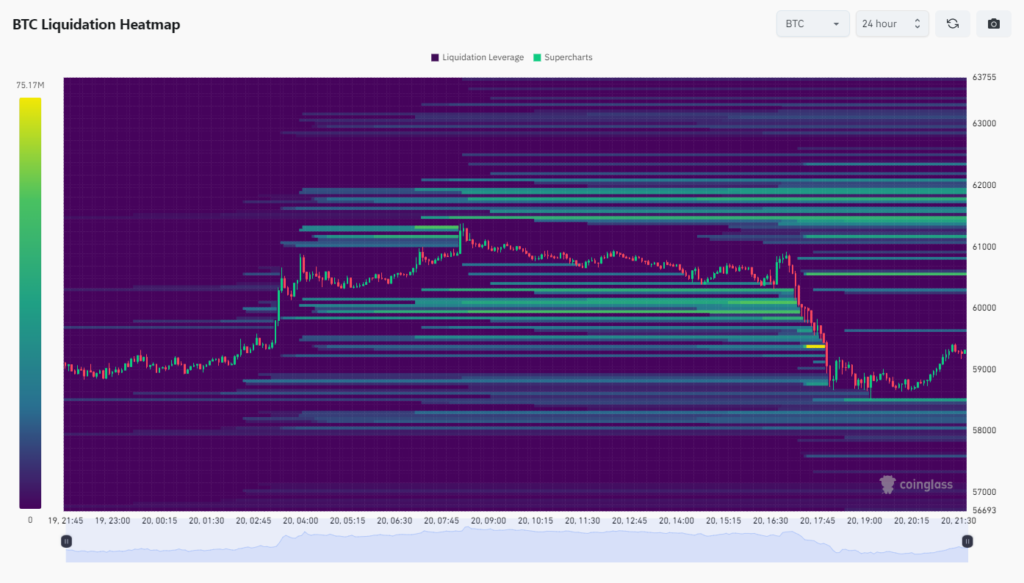

The cryptocurrency market experienced a sudden downturn on August 20, 2024, as Bitcoin plummeted over 3% within an hour, wiping out $50 million in liquidations. The flagship cryptocurrency’s decline below the crucial $59,000 level sent shockwaves through the market, with Ethereum and Solana following suit.

Coinglass data revealed that Bitcoin accounted for the lion’s share of liquidations, totaling $1.84 million in just four hours. Ethereum and Litecoin also suffered significant losses, with $396,130 and $178,470 in liquidations, respectively. Major exchanges like OKX and Binance bore the brunt of the liquidation frenzy, processing a combined $50.9 million in liquidated positions.

The market volatility underscores the risks inherent in leveraged trading. With Bitcoin and other major cryptocurrencies under pressure, traders should exercise caution and be prepared for further price fluctuations.

While Bitcoin, Ethereum, and Solana retreated, other cryptocurrencies demonstrated resilience. Binance Coin (BNB), Dogecoin (DOGE), and XRP managed to hold onto their recent gains, with BNB and DOGE posting impressive increases of 3.81% and 3.37%, respectively. However, Toncoin (TON) bucked the trend, falling 2.03%.

The cryptocurrency market remains highly dynamic, with rapid price swings and significant liquidation events becoming increasingly common. Traders must stay informed and adapt their strategies accordingly to navigate the volatile landscape.

Also Read: Solana Whale Dumps $2.9 Million in SOL as Price Stumbles

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!