|

Getting your Trinity Audio player ready...

|

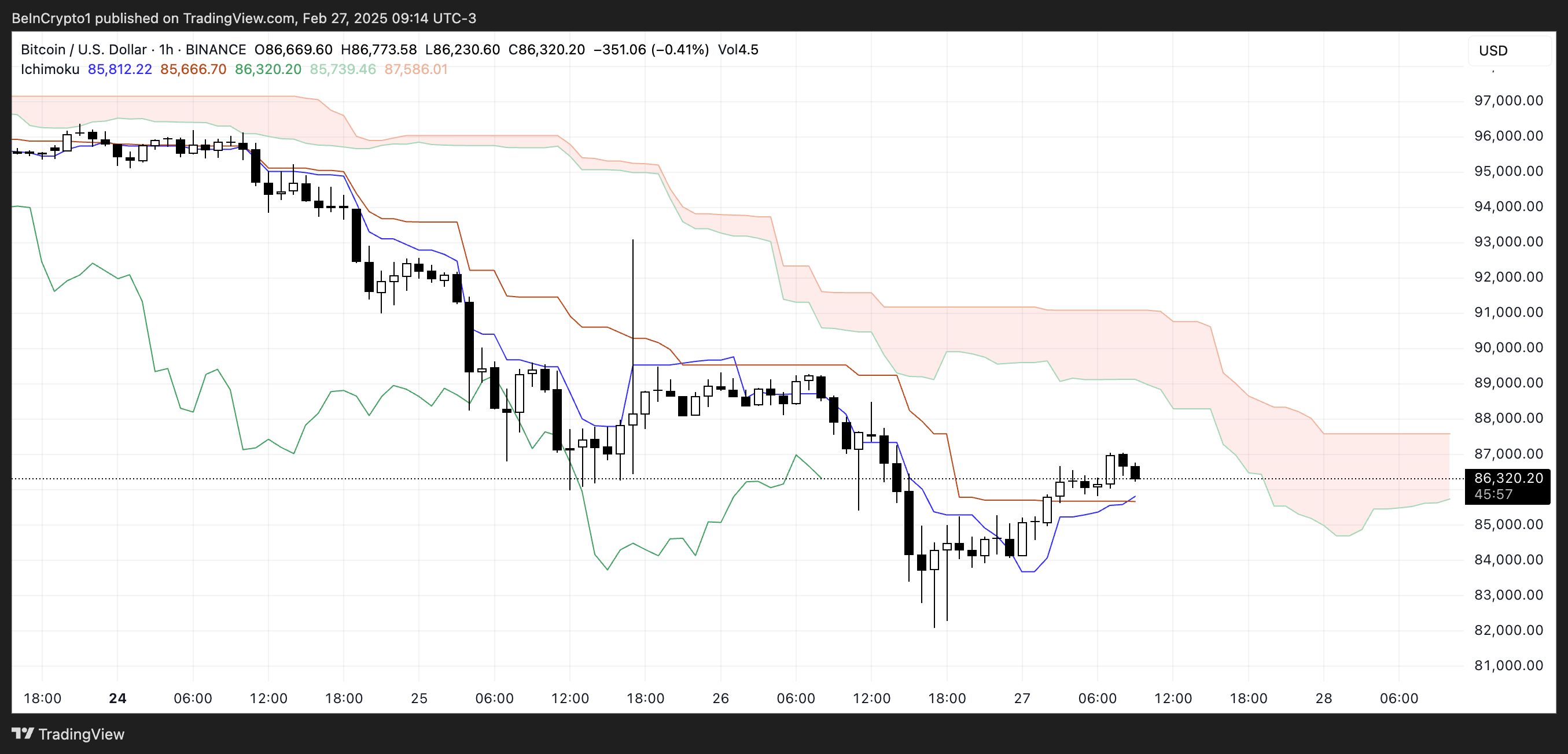

Bitcoin’s price action remains under significant bearish pressure, as technical indicators highlight growing downside momentum. The Ichimoku Cloud, a widely used trend-following indicator, paints a concerning picture for BTC in the short term.

Ichimoku Cloud Indicates Bearish Sentiment

The Ichimoku Cloud for Bitcoin currently signals a bearish outlook, with the red cloud (Kumo) positioned above the price, acting as a strong resistance zone. Additionally, the cloud is widening, suggesting increasing downward momentum. The Leading Span A (green line) remains below the Leading Span B (red line), reinforcing the overall bearish trend.

BTC is also trading below both the blue Tenkan-sen (conversion line) and the red Kijun-sen (baseline), indicating continued downside pressure. The Chikou Span (lagging line) is below both the price action and the cloud, further confirming the negative sentiment. Unless Bitcoin manages to break above the cloud and witness a bullish crossover of the Tenkan-sen and Kijun-sen, the bearish trend is likely to persist.

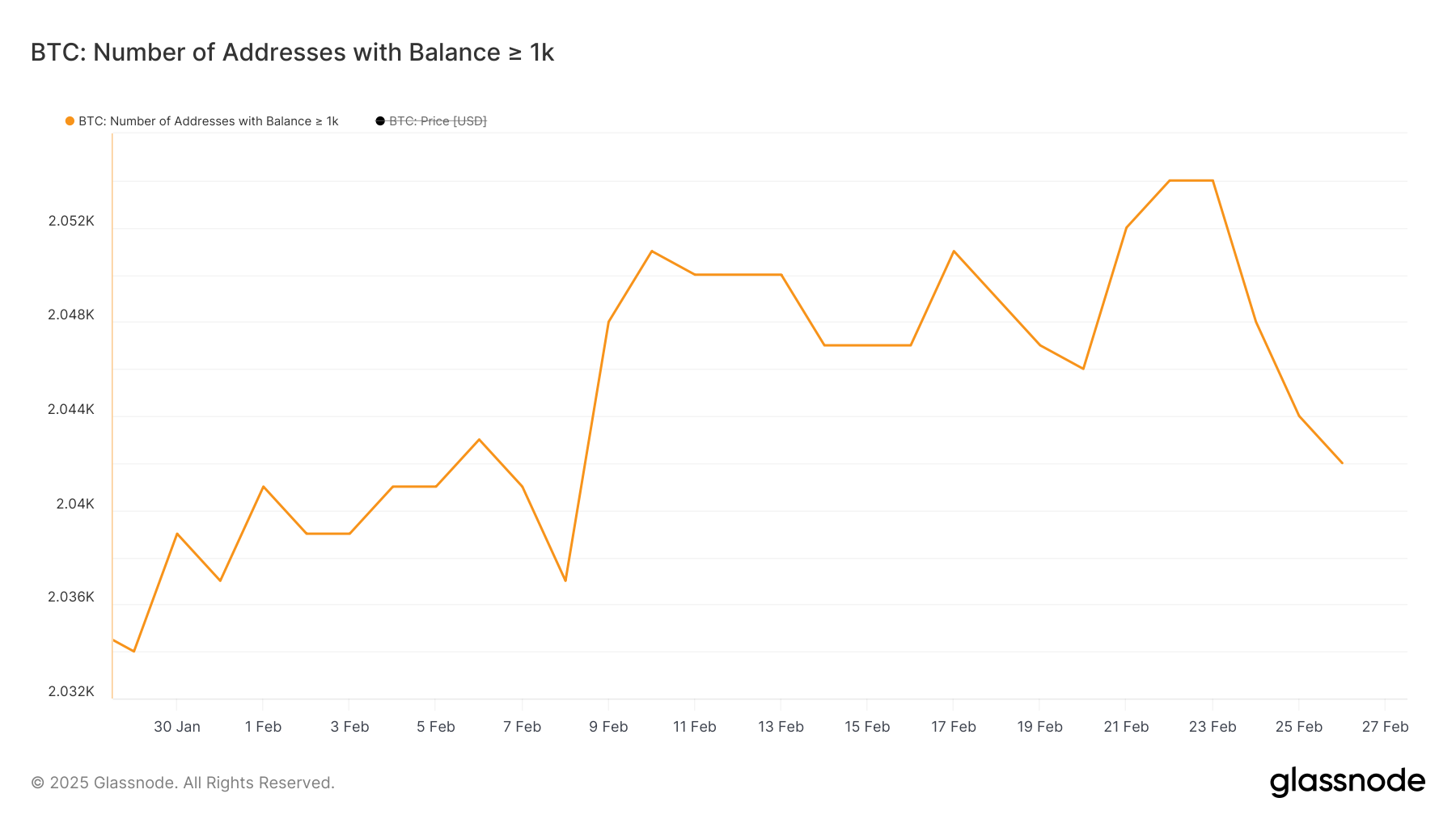

Decline in Bitcoin Whales Adds to Bearish Pressure

Another factor contributing to Bitcoin’s current struggles is the decreasing number of whale addresses. The number of wallets holding at least 1,000 BTC peaked at 2,054 on February 22 but has since declined to 2,042. This drop suggests a potential distribution phase among large holders, which could introduce further volatility and downward pressure on BTC’s price.

Whale activity is closely monitored by traders, as these large holders can significantly influence market trends. While the number of whales remains historically high, the recent decline indicates possible profit-taking or strategic repositioning among institutional investors.

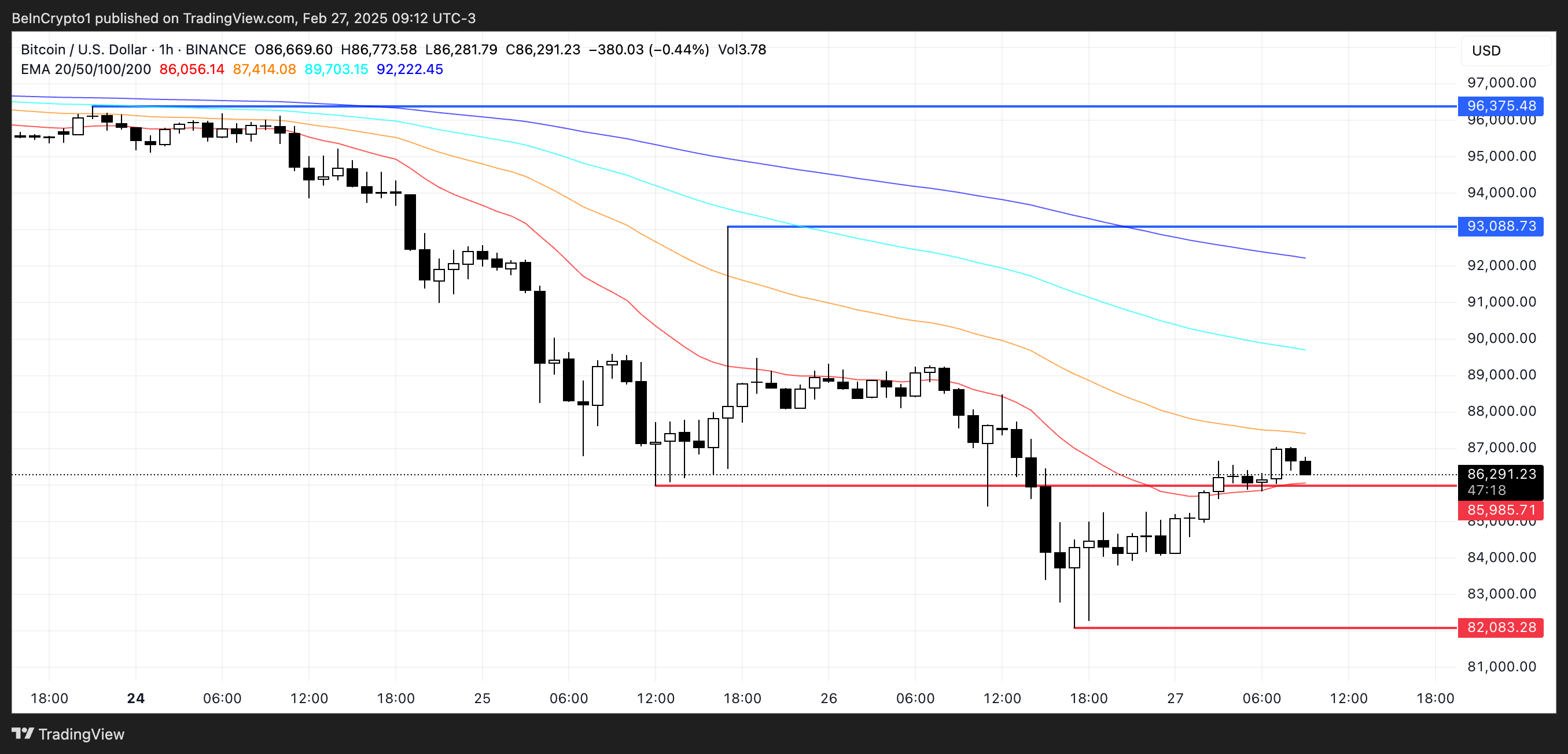

Can Bitcoin Reclaim Higher Price Levels?

Bitcoin faces strong resistance at $85,985, and failing to break above this level could lead to a drop toward $82,000. However, there are emerging signs of potential recovery. Short-term Exponential Moving Averages (EMAs) are beginning to trend upwards, hinting at a possible reversal.

If Bitcoin manages to breach the $93,000 resistance, a rally toward $96,375 could be on the horizon. While bearish momentum dominates in the short term, institutional interest and ongoing infrastructure developments continue to provide a long-term bullish case for BTC.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Binance Denies Dumping Bitcoin, ETH, or SOL Amid Market Manipulation Rumors