|

Getting your Trinity Audio player ready...

|

- Bitcoin’s $80K support is now the market’s most important near-term price zone.

- Macro stress, liquidations, and institutional outflows continue to fuel downside risk.

- Analysts say only a reclaim above $86K would hint at early stabilization.

Bitcoin’s battle to hold above the critical BTC $80k support has become the central focus for traders as the market absorbs one of the harshest Q4 downturns in recent years. Despite small intraday rebounds, the broader crypto landscape remains fragile, with sentiment still weighed down by global macro shocks, institutional risk-off positioning, and unprecedented liquidation waves.

Macro Shocks Trigger a Historic Crypto Repricing

The current selloff began shortly after the U.S. administration escalated its trade conflict with China in October. The announcement ignited a swift chain reaction across markets, erasing billions from crypto positions as investors braced for rising operating costs, supply chain uncertainty, and heightened geopolitical volatility.

While many expected late-October rate cuts to calm the decline, the Federal Reserve’s 0.25 bps reduction failed to deliver relief. Instead, unclear forward guidance amplified anxiety, reinforcing a defensive stance across risk assets. Liquidation data throughout November further highlighted this shift, with long positions dramatically outweighing shorts — a clear signal that traders were forced into capitulation rather than reacting through measured adjustment.

Geopolitical Tensions and Institutional Retreat Intensify Pressure

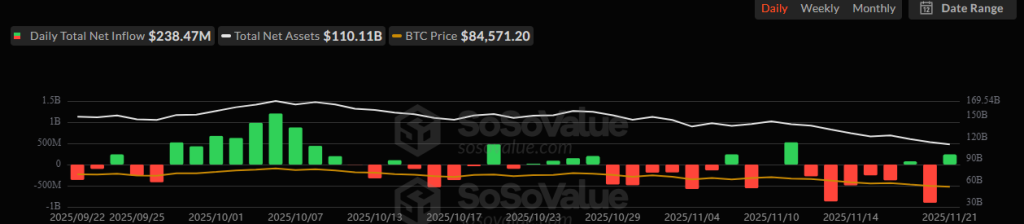

Geopolitical turmoil continued to weigh heavily on crypto markets. Renewed tensions in the Russia-Ukraine conflict sparked consecutive liquidation spikes above $1.7B, accelerating the broader downturn. At the same time, institutional flows reflected sustained caution as billions exited crypto-backed investment products throughout November, pulling liquidity out of major assets including Bitcoin.

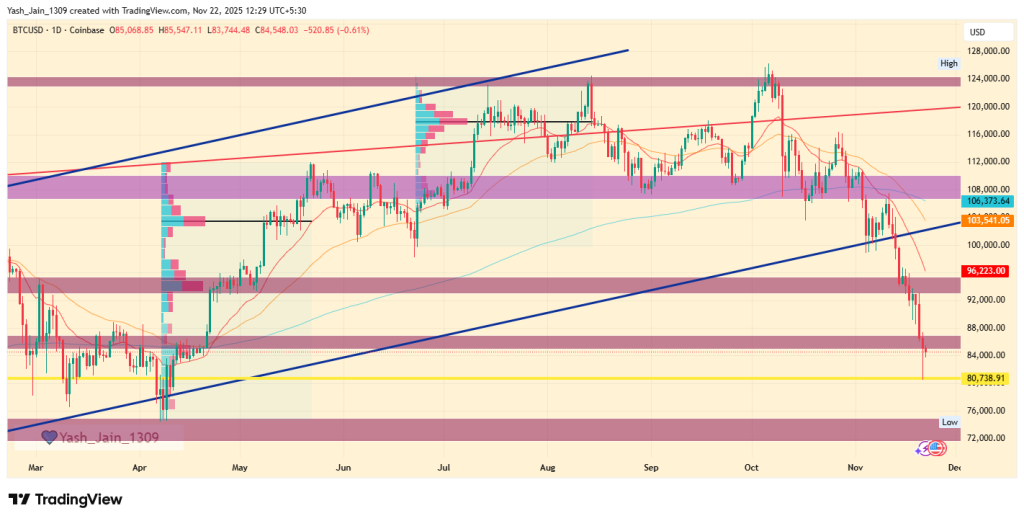

This combination dragged BTC from its all-time high of $126,296 to a weekly low near $80,524, a 35% decline that wiped out months of steady accumulation.

BTC Price Outlook: Support Weakens as Bears Tighten Grip

Technically, analysts warn that Bitcoin’s price structure still leans bearish despite small recoveries toward $84K. The BTC $80k support is now seen as the last significant near-term barrier. A breakdown could expose the market to deeper targets at $73K and potentially the $66K liquidity zone if sellers maintain control. A decisive reclaim above $86,000, however, would be the first early sign of stabilization.

Also Read: Jeff Park Says Sovereign Adoption Could Trigger Bitcoin’s Next $150K Breakout

Market strategists emphasize that this phase is about positioning rather than panic. With total market capitalization down $1.3 trillion since October, analysts recommend disciplined strategies — steady DCA for those with liquidity or maintaining stablecoins to preserve capital. The focus, they say, should shift toward high-quality assets like BTC, ETH, and major high-liquidity chains such as SOL and BNB.

As the market heads into December, Bitcoin’s ability to defend $80K will likely define sentiment — and direction — for the final stretch of 2025.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!