|

Getting your Trinity Audio player ready...

|

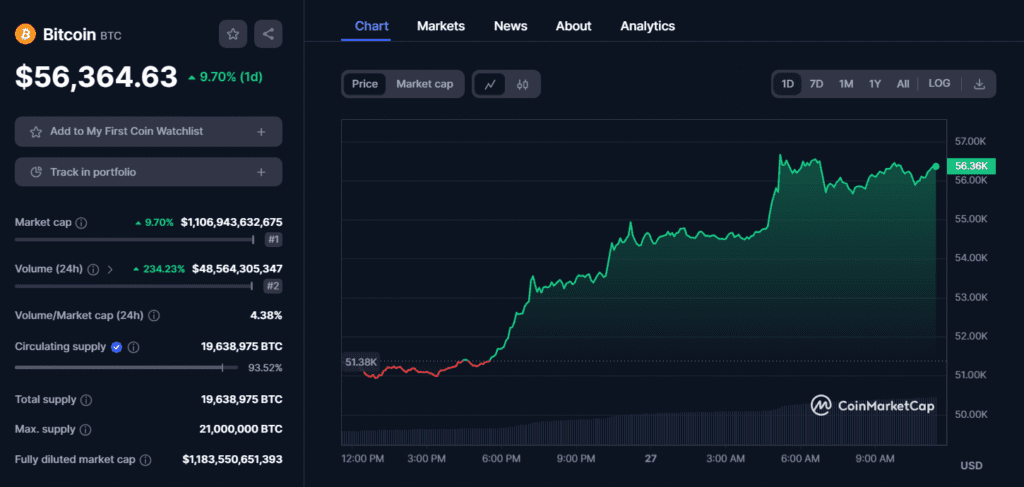

Bitcoin (BTC) surged over 10% in the past 24 hours, reaching its highest price since November 2021 and sparking a wave of bullish sentiment. This price rally triggered over $150 million in liquidations from short sellers betting against Bitcoin, further fueling the upward momentum.

Analysts are now calling for a “new bull market” for Bitcoin, citing factors like rising institutional adoption, increasing spot Bitcoin ETF volumes, and the impending mining reward halving event.

Short Sellers Feeling the Heat

The recent price surge caught short sellers off guard, leading to significant liquidations exceeding $180 million since Sunday. Short sellers borrow Bitcoin, sell it at a higher price, and then aim to repurchase it at a lower price to pocket the difference. However, when the price rises unexpectedly, they are forced to buy back Bitcoin at a loss to cover their positions, further driving the price up in a “short squeeze.”

Analysts Predict “Tremendous Upside”

Market observers are optimistic about Bitcoin’s future, pointing to the upcoming halving event as a key catalyst for further price increases. The halving, scheduled for sometime in April 2024, is a programmed event in Bitcoin’s code that cuts the reward for mining new blocks in half. This event historically reduces the supply of new Bitcoin entering the market, often leading to price appreciation due to increased scarcity.

“Bitcoin’s decisive rally signals the de facto start of a new bull market,” said Alex Adelman, founder at Lolli, in an email to CoinDesk. He further emphasized the role of positive market sentiment and rising institutional investments through Bitcoin ETFs in driving the current rally.

Also Read: Bitcoin Breathes Easy: Mempool Shrinks 61% as Network Clears 139 Million Byte Backlog in February

Broader Market Buoyed by Bitcoin’s Strength

The positive sentiment surrounding Bitcoin spilled over to the broader cryptocurrency market. Major altcoins like Ethereum (ETH), Solana (SOL), and Cardano (ADA) all experienced significant gains in the past 24 hours. This interconnectedness highlights Bitcoin’s continued dominance and its influence on the overall cryptocurrency landscape.

While the future remains uncertain, the recent developments paint a positive picture for Bitcoin and the broader cryptocurrency market. With the halving event approaching and bullish sentiment on the rise, many anticipate “tremendous upside” for Bitcoin in the coming months.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.