|

Getting your Trinity Audio player ready...

|

Arthur Hayes, the co-founder of BitMEX, has shaken the market with a significant move, depositing 7.85 million Ethena (ENA) tokens—valued at $6.46 million—into Binance and Bybit. This action has raised speculation about potential sales or strategic market maneuvers, casting a shadow over ENA’s already fragile price dynamics.

Currently trading at $0.803, Ethena has seen a 9.84% drop in its value, reflecting heightened market volatility. Such whale activity often signals impending shifts in market equilibrium, leaving investors questioning the token’s immediate trajectory.

Technical Indicators Signal Bearish Outlook

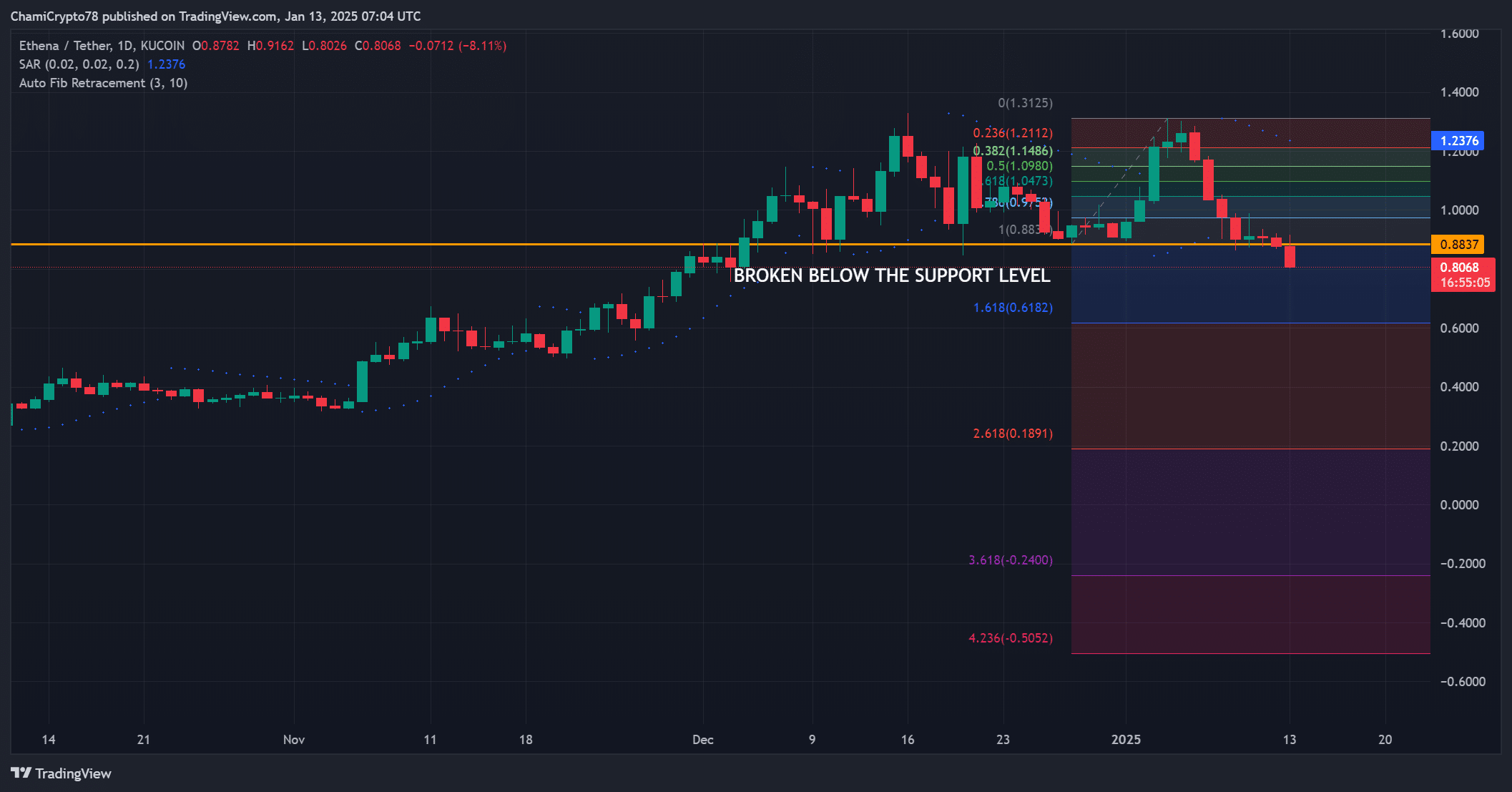

ENA’s recent dip below critical support levels has reinforced bearish sentiment. The Parabolic SAR indicator hovering above price candles points to a sustained downtrend. Fibonacci retracement analysis identifies potential resistance at $0.948, suggesting recovery efforts could face significant hurdles.

In light of these signals, caution remains key for traders navigating the volatile ENA market.

Steady User Engagement as a Silver Lining

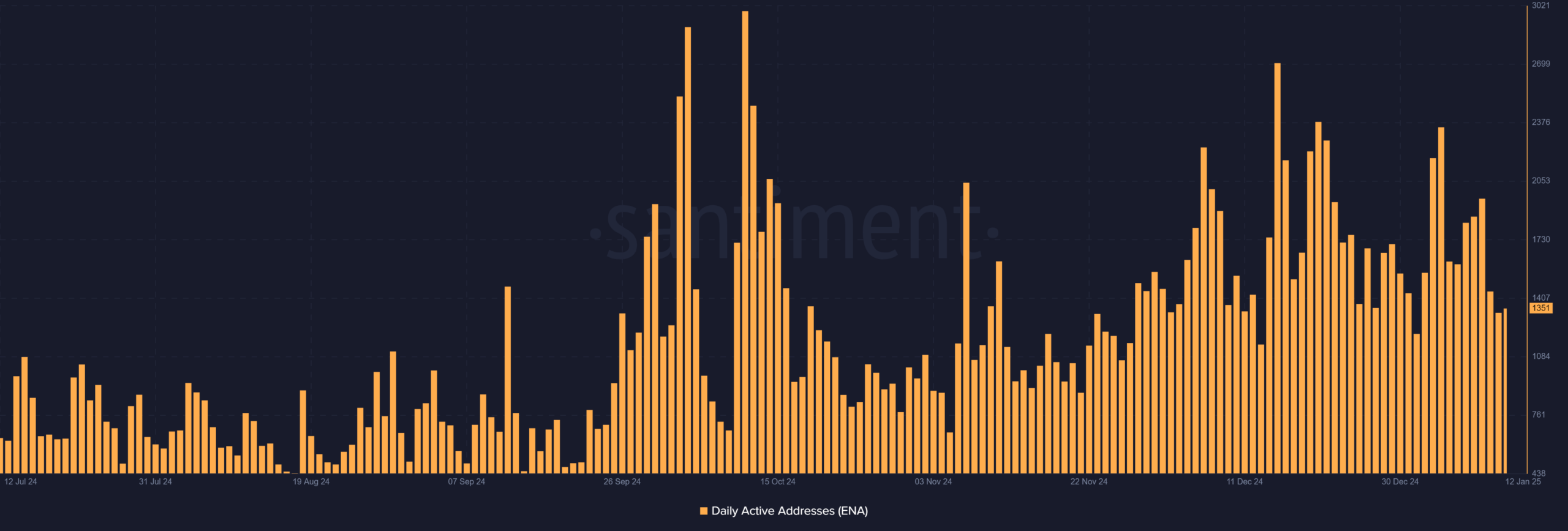

Despite the price downturn, ENA’s blockchain shows consistent activity with 1,351 daily active addresses. This level of engagement highlights a resilient user base, offering a degree of stability amidst market turbulence.

Such robust network activity could mitigate adverse price impacts, potentially cushioning the market from further declines.

Transaction Volumes Reflect Market Sentiment

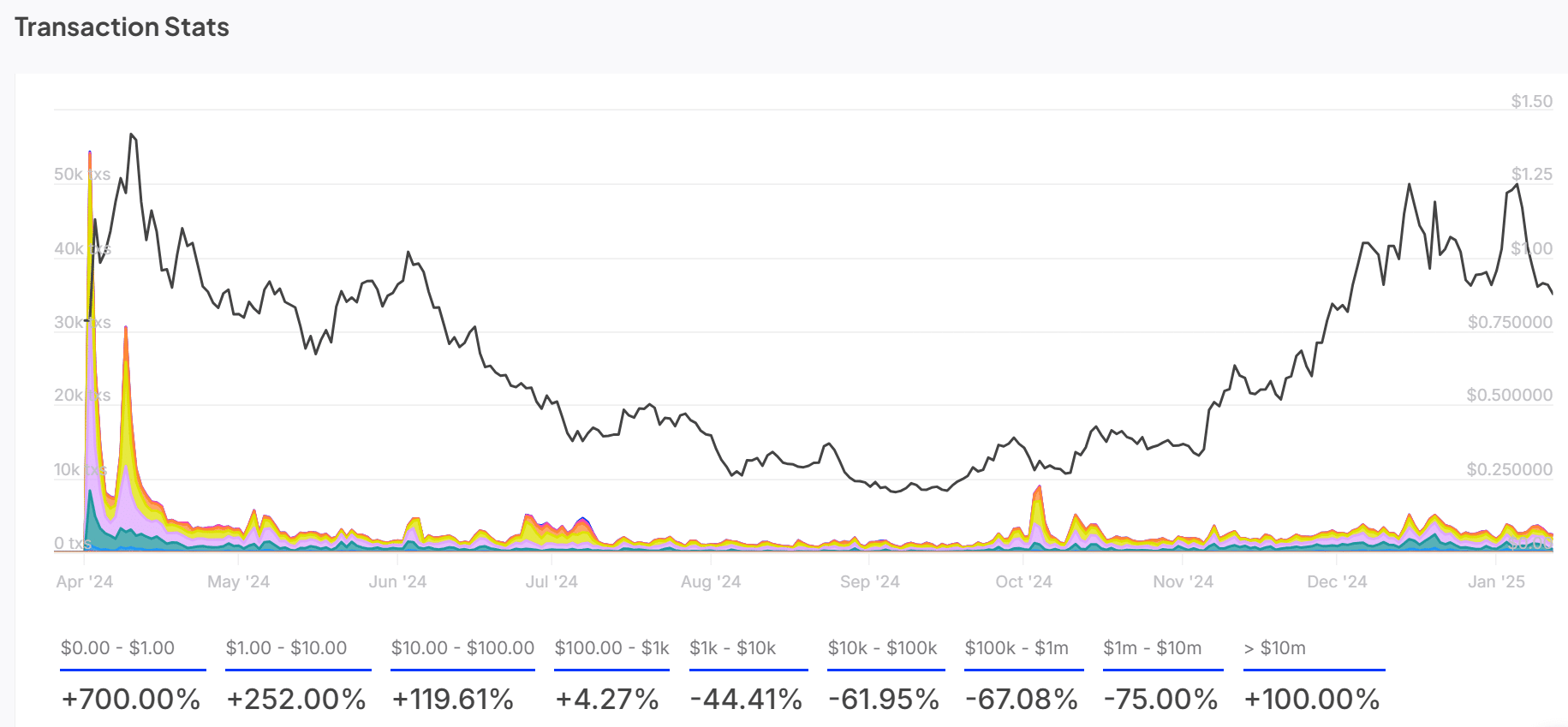

Transaction data reveals fluctuating activity, peaking at 50,000 transactions in early April. Smaller transactions in the $1-$10 range surged by 252%, while those in the $10-$100 range increased by 119.61%. However, a decline in larger transactions later in the year underscores market sensitivity to broader economic conditions and shifting investor sentiment.

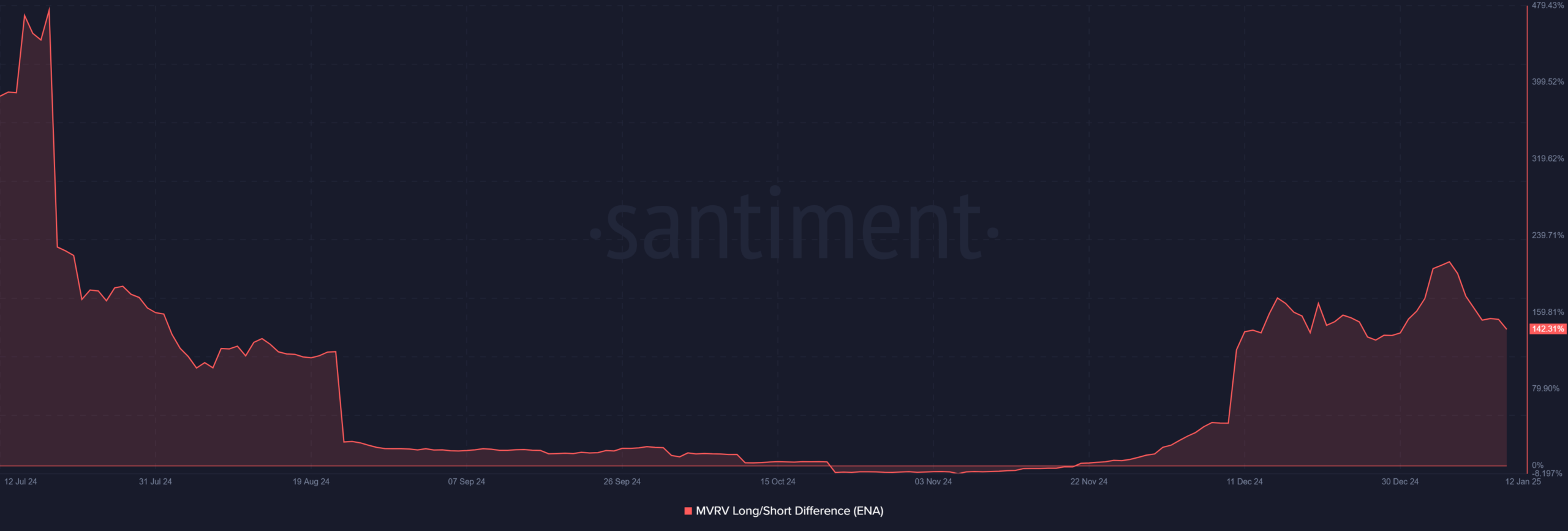

The MVRV Long/Short Difference at 142.31% signals cautious optimism among long-term investors. While slightly lower than earlier highs, this metric suggests enduring confidence in ENA’s long-term potential despite short-term volatility.

As the market reacts to Hayes’ substantial deposit, investors face a delicate balance of risk and opportunity. Staying informed and vigilant will be crucial in navigating Ethena’s uncertain yet intriguing future.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ethena’s Bold 2025 Vision: Bridging DeFi and TradFi with New Neobank Platform and iUSDe Stablecoin

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.