|

Getting your Trinity Audio player ready...

|

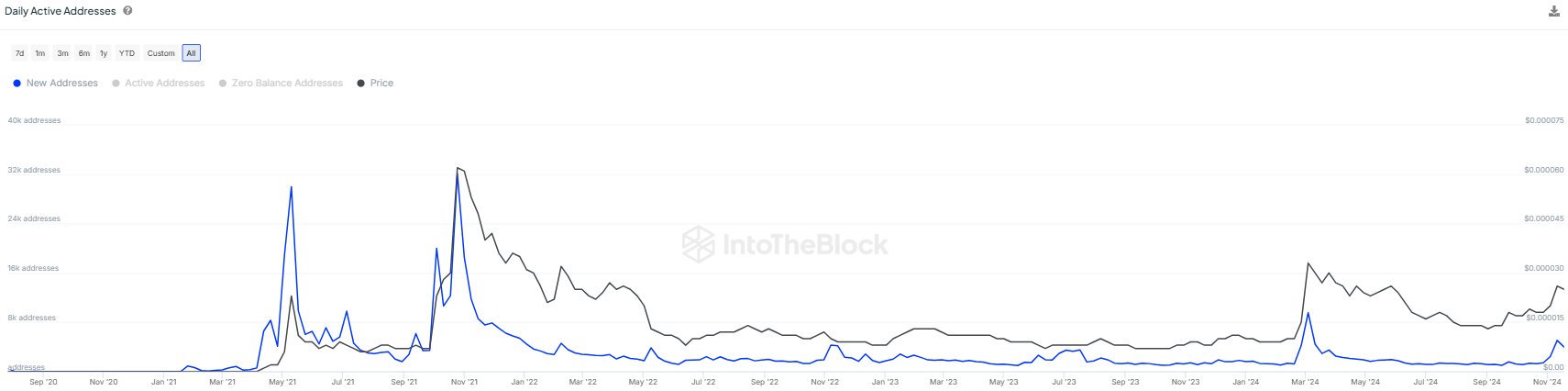

Recent on-chain data suggests that popular meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) are poised for another rally. This bullish sentiment is fueled by a combination of factors, including increased investor interest and positive market trends.

Investor Appetite for Meme Coins Grows

Leading on-chain analytics platform IntoTheBlock has identified a significant trend: retail investors are still underinvested in the meme coin market. Despite recent price surges, the platform notes that meme coin activity remains below previous peaks. This divergence suggests that there is ample room for further growth, as more investors could enter the market and drive prices higher.

Key Factors Driving the Rally:

- Increased Investor Interest: Retail investors are showing renewed interest in meme coins, as evidenced by rising trading volumes and on-chain activity.

- Positive Market Sentiment: The overall positive sentiment in the cryptocurrency market is benefiting meme coins.

- Technical Analysis: Technical indicators suggest that DOGE and SHIB are in a strong uptrend.

- On-Chain Data: On-chain metrics point to a potential surge in demand for these coins.

Potential Risks and Considerations

While the outlook for DOGE and SHIB is bullish, it’s important to remember that the cryptocurrency market is highly volatile. Prices can fluctuate rapidly, and investors should be prepared for potential downside risks. It’s crucial to conduct thorough research and consider consulting with a financial advisor before making any investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!