|

Getting your Trinity Audio player ready...

|

The Arbitrum (ARB) price has taken a beating in recent months, falling nearly 50% from its January peak. However, a recent surge in on-chain activity, coupled with a technical bounce, suggests the correction might be over and a new rally could be brewing.

Layer-2 Boom, But Not All Layers Are Equal

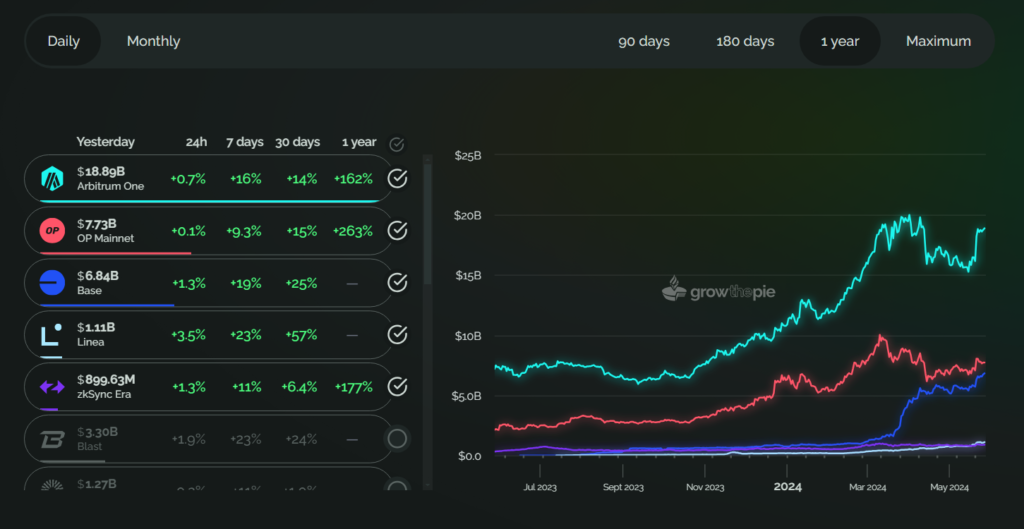

While the overall Ethereum Layer-2 ecosystem is booming, with Total Value Locked (TVL) reaching a record $47.15 billion in May, Arbitrum stands out as the undisputed leader. Boasting over $19 billion in TVL, it outpaces competitors like Optimism and Base by a significant margin. Interestingly, all the top contenders utilize Optimistic Rollups instead of ZK-Rollups, hinting at a potential preference for the former technology.

Despite leading in TVL and decentralized exchange volume, the ARB price hasn’t kept pace with the growth. In May, while Ethereum surged 36%, ARB only managed a 20% increase. This could be attributed to a large token unlock in March, but with that event behind us, the stage might be set for a price correction.

Technical Analysis Hints at Bullish Reversal

A recent price bounce off a crucial long-term support area, combined with bullish divergences on the RSI and MACD indicators, suggests a potential trend reversal. The next hurdle lies in the $1.60-$1.65 resistance zone, where a breakout would solidify the bullish case. Even wave analysis points towards a potential surge, with the completion of a corrective structure and truncation within the sub-waves.

Also Read:

Will ARB Reach New Highs?

If the current momentum continues, a significant price increase for ARB could be on the horizon. Overcoming the $1.60-$1.65 resistance would be a key indicator, paving the way for potential new highs. However, a drop below $0.90 would invalidate the bullish thesis and lead to a potential new all-time low.

The Bottom Line

While the ARB price hasn’t reflected its dominance in on-chain activity, recent technical signals and the completion of a potential corrective structure suggest a bullish reversal could be underway. Investors should keep an eye on the $1.60-$1.65 resistance zone, a breakout above which could confirm the start of a new rally.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.