Arbitrum (ARB), a leading Ethereum scaling solution, has reached a significant milestone with a total value locked (TVL) of $5 billion, marking an all-time high. This achievement reflects growing investor confidence and market interest in the project’s potential.

Technical Analysis Hints at Bullish Breakout

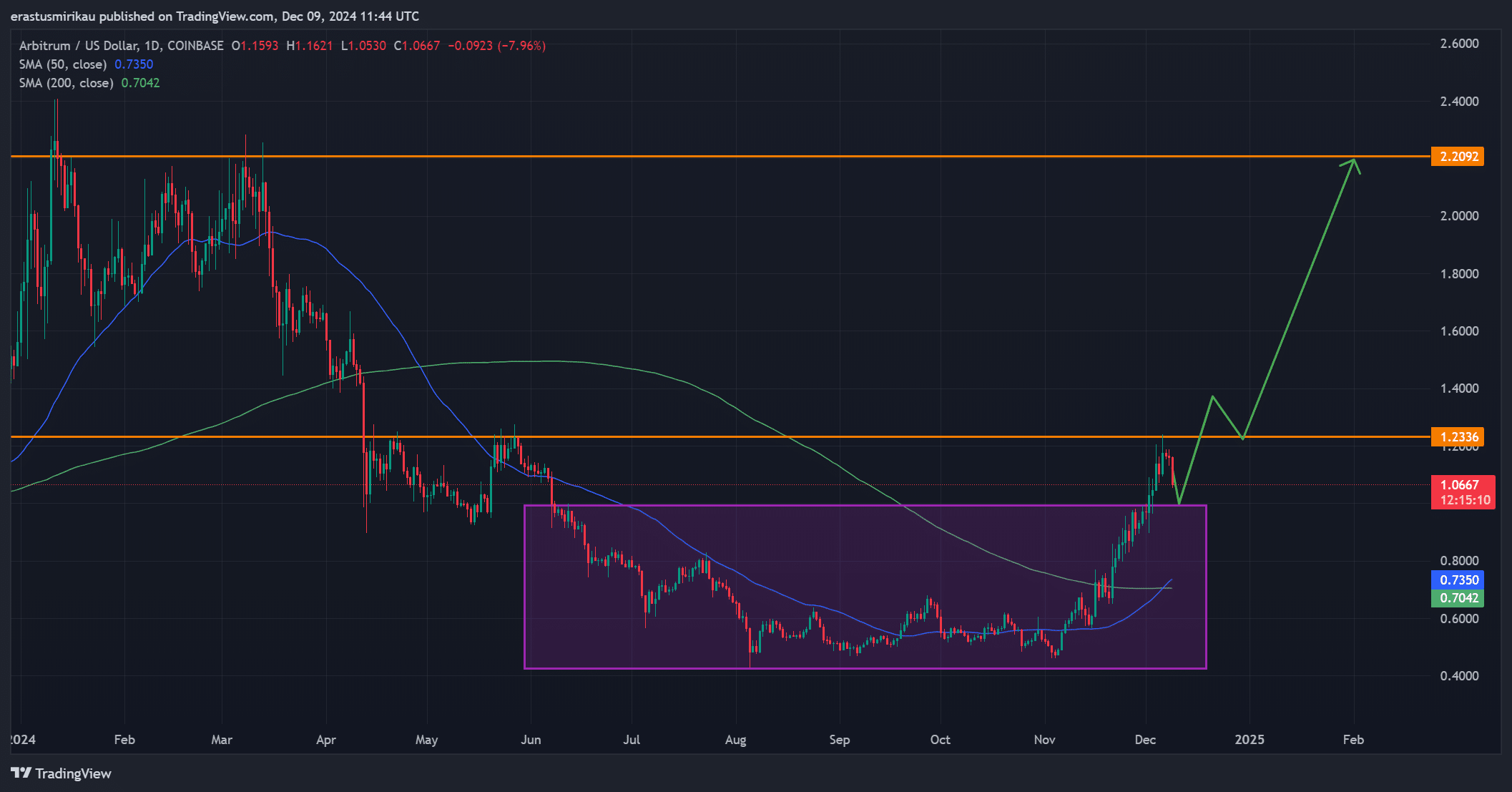

After a prolonged consolidation phase exceeding two years, ARB’s technical charts reveal a bullish breakout. This is further bolstered by the emergence of a golden cross formation, a technical indicator often seen as a precursor to sustained price increases. As ARB approaches a crucial resistance level at $1.2, a critical question emerges: will the bullish momentum propel prices higher, or will resistance stall this upward trend?

Potential Retest Before Definitive Breakout

While the breakout from consolidation is a positive sign, ARB might undergo a retest of this resistance zone before a definitive upward move. A successful push past $1.2 could see ARB prices climb towards $2.2. Traders and investors are keeping a close eye on this level, waiting to see if a sustained breakout confirms the bullish trend signaled by the technical indicators.

Resilient Market Despite Short-Term Fluctuations

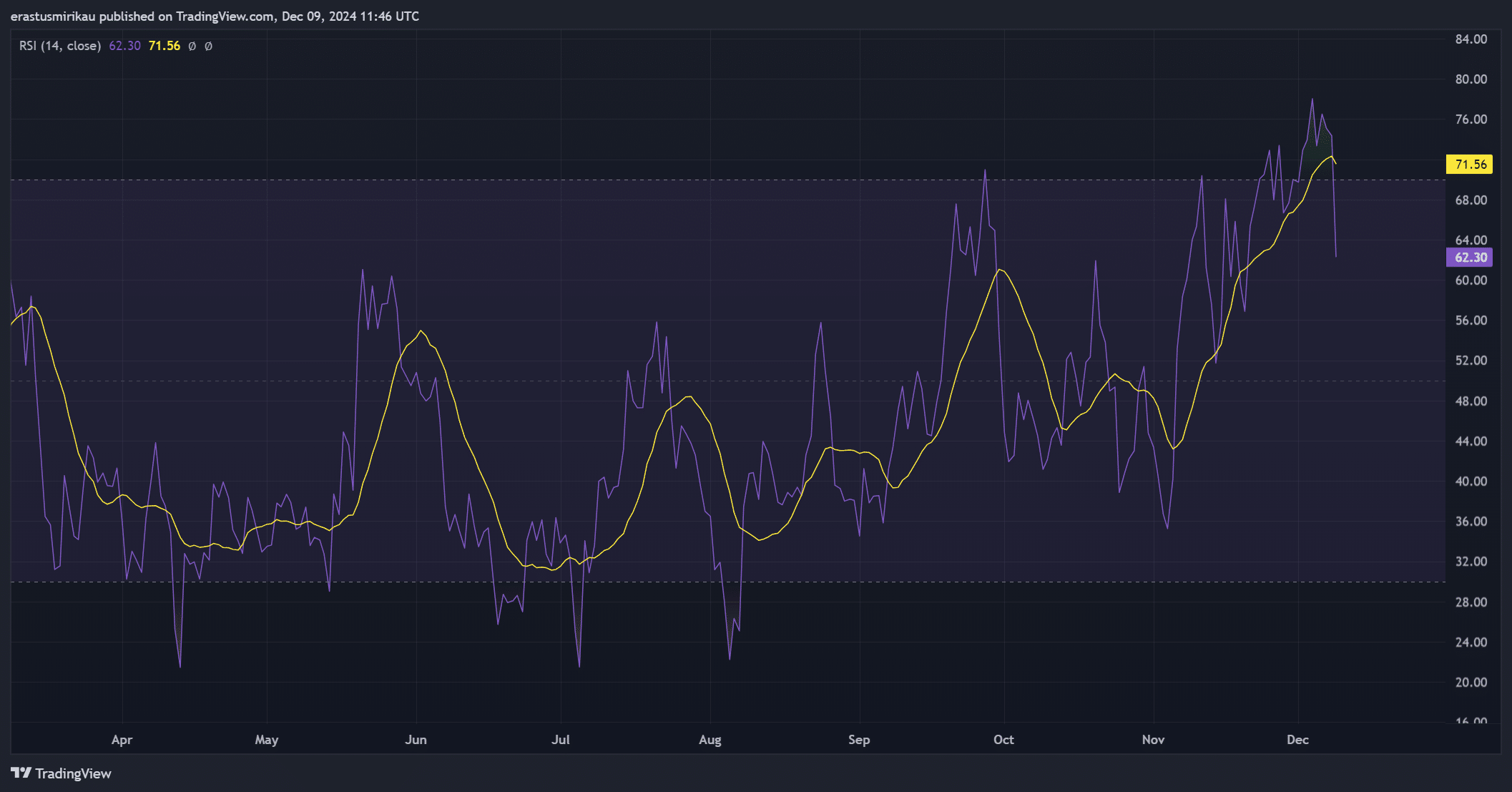

Despite a recent 7.15% price drop, placing ARB at $1.07 at press time, the Relative Strength Index (RSI) remains at a healthy 62.3. This indicates strong underlying bullish momentum, suggesting that buyers are still driving the market despite short-term price adjustments. A high RSI value signifies continued investor support for ARB, maintaining a bullish outlook even amidst recent price corrections.

User Activity and Investor Confidence

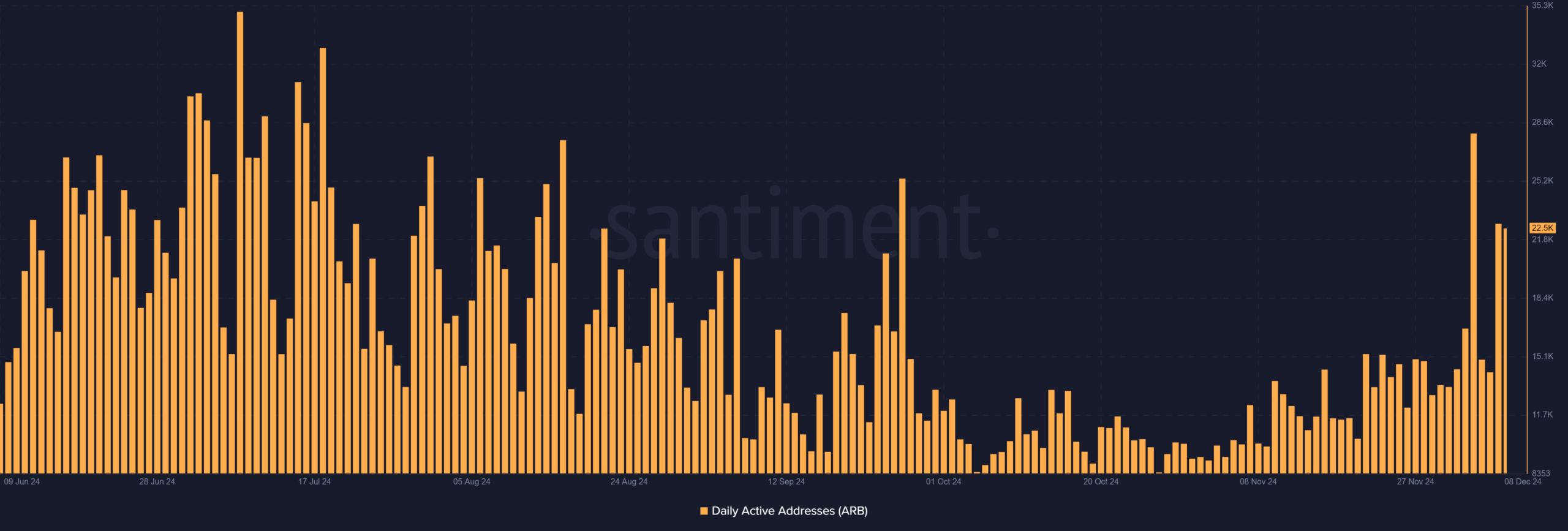

While current daily active addresses for ARB sit at a moderate 22.5K, there’s room for further growth. Increased user engagement could lead to higher trading volume, strengthening market dynamics and overall investor participation. This highlights the potential for a rise in trading momentum in the near future, fueled by greater user interest.

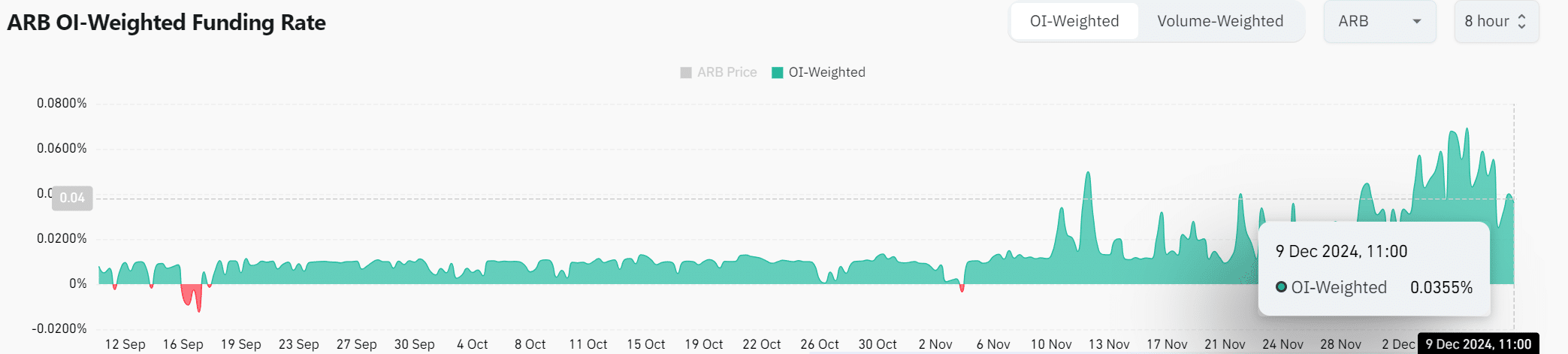

The Open Interest Weighted Funding Rate, currently at 0.0355, signifies positive sentiment among futures traders. This metric underscores investor confidence and interest in ARB contracts, further indicating a willingness to take long positions and contribute to continued bullish momentum.

Overall, Arbitrum‘s performance paints a picture of a strong bullish trend, supported by a record-breaking TVL and a breakout from consolidation. While the resistance at $1.2 presents a significant hurdle, the golden cross formation and other positive indicators suggest a continuation of the upward trajectory. Although short-term pullbacks are a possibility, the overall bullish momentum appears robust. A successful breakout above $1.2 could pave the way for significantly higher ARB prices in the near future.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Solana Soars – 10.7% Development Surge Outpaces Arbitrum And Avalanche!