|

Getting your Trinity Audio player ready...

|

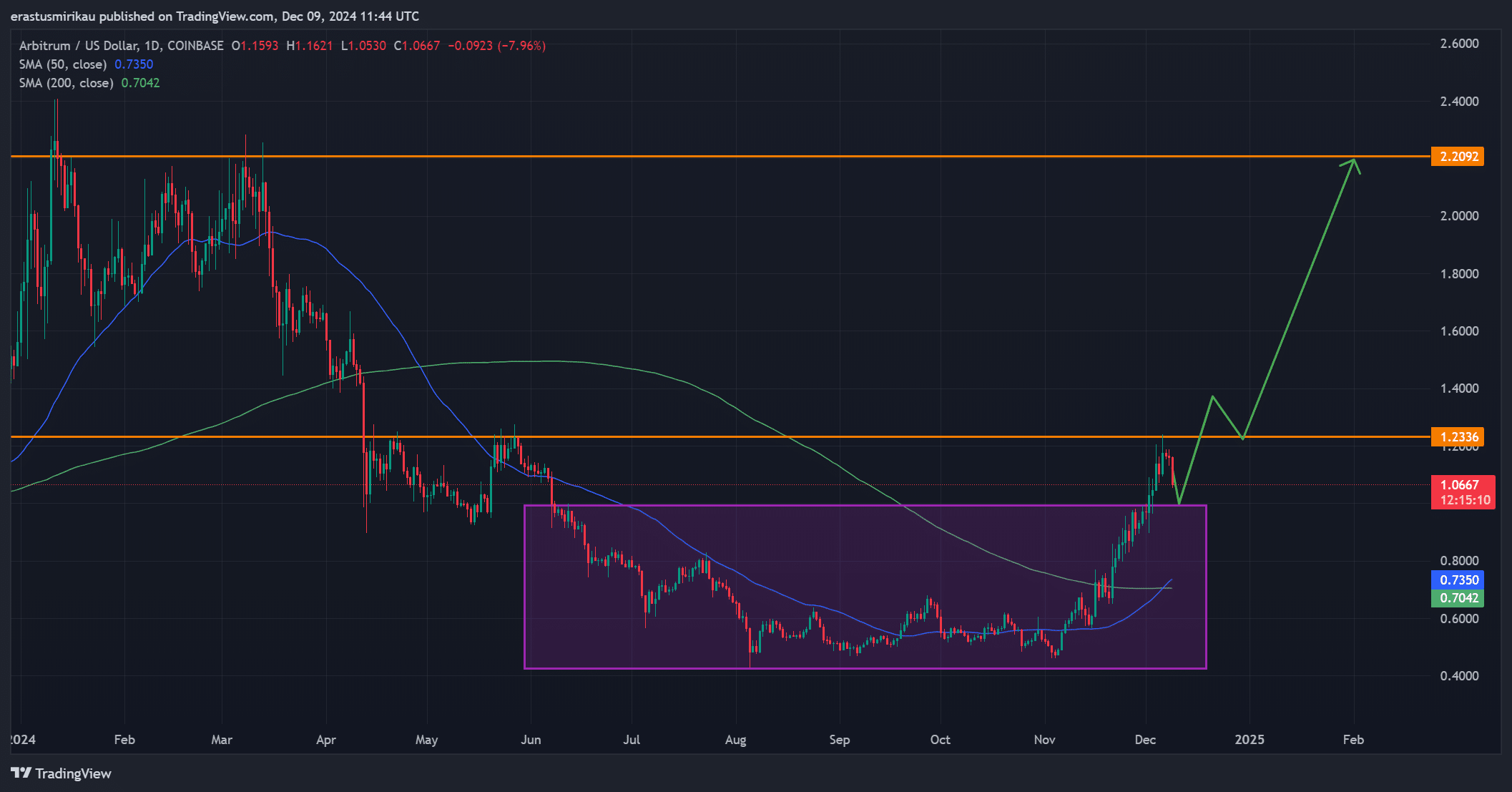

Arbitrum (ARB) has achieved a major milestone with a record-high total value locked (TVL) of $5 billion, signaling growing investor confidence and market interest. As ARB experiences a breakout after a prolonged period of sideways trading, technical indicators such as a golden cross formation are adding to the optimism, suggesting that ARB could potentially rise toward $2.2. However, resistance at $1.2 may test the token’s momentum in the short term.

Arbitrum’s Bullish Breakout: What’s Driving the Momentum?

After two years of consolidation, Arbitrum’s recent price movement points to the possibility of surpassing the $1.2 resistance level. If ARB successfully breaks through this barrier, a climb toward $2.2 could follow. Currently trading at $1.07, ARB has experienced a slight 7.15% dip over the past day, but the Relative Strength Index (RSI) at 62.3 suggests strong bullish momentum. Despite the minor pullback, investor sentiment remains robust.

Key Technical Indicators Supporting ARB’s Upward Trajectory

The golden cross formation, which occurs when the short-term moving average crosses above the long-term moving average, signals a strong upward trend. Additionally, daily engagement from 22,500 active addresses reflects ongoing interest in ARB, with increased trading volume likely to drive momentum.

Also Read: Arbitrum [ARB] Hits $5B TVL Milestone: Will Bullish Momentum Break Resistance at $1.2?

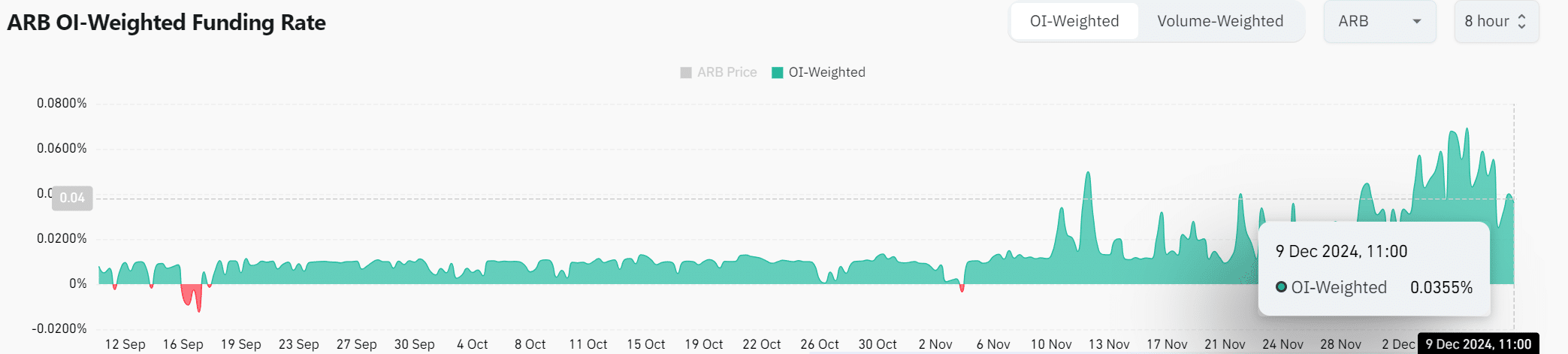

The Open Interest Weighted Funding Rate is currently at 0.0355, indicating that many traders are taking long positions, further supporting the bullish outlook for ARB. This positive market sentiment, combined with technical trends, paints a promising picture for Arbitrum in the coming weeks.

Can ARB Reach $2.2?

With its record-high TVL and strong technical signals, Arbitrum is poised for further growth. Resistance at $1.2 will likely be the next challenge, but if ARB can overcome this hurdle, a push toward $2.2 seems likely. While short-term dips are possible, the overall trend remains positive, driven by technical indicators, investor confidence, and high market engagement.

In conclusion, Arbitrum’s breakout could signal an exciting upward move, with $2.2 on the horizon if the momentum continues. Investors and traders alike will be watching closely to see how ARB navigates the key resistance at $1.2.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.