|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Aptos grew its RWA TVL by 56.28% in just 30 days, led by private credit and institutional adoption.

- With over $1.2 billion in native stablecoins, it’s emerging as a serious player in global DeFi infrastructure.

- A focused, high-impact strategy may help Aptos narrow the gap with Ethereum in the RWA sector.

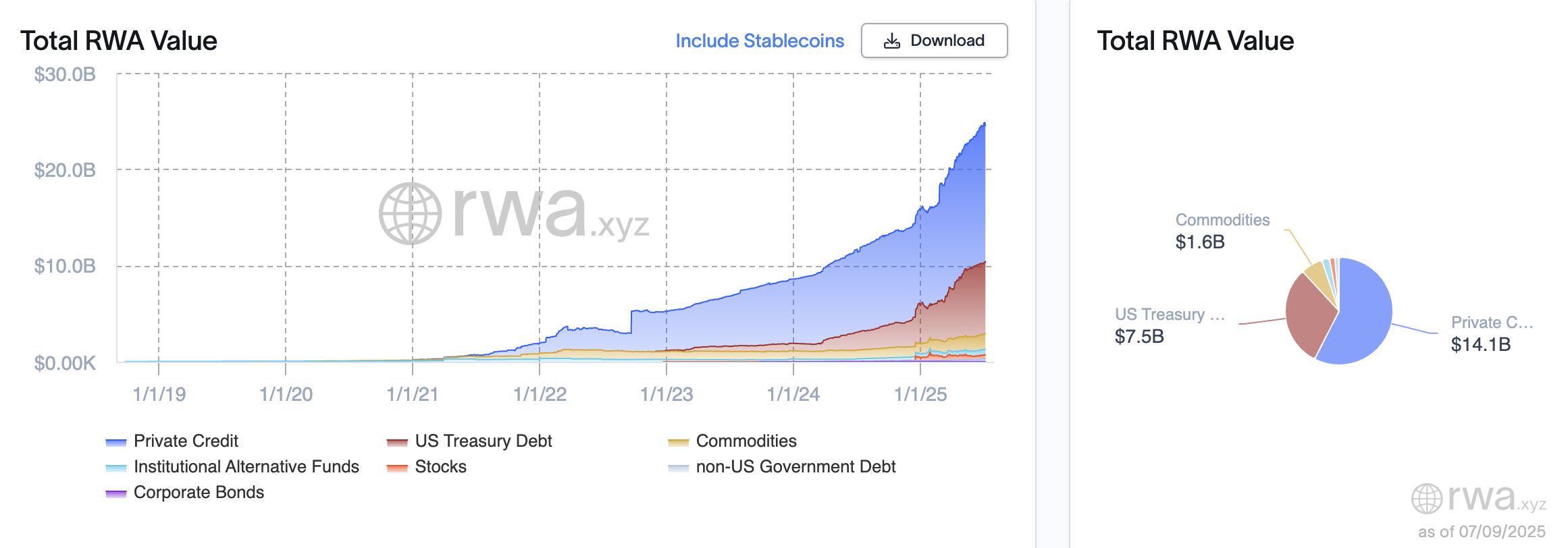

Aptos is rapidly becoming a top contender in the race to tokenize real-world assets (RWAs), achieving a 56.28% increase in total value locked (TVL) in just 30 days, now standing at $538 million. With $420 million tied to private credit and strong institutional involvement, Aptos is showing how focused strategy and high-performance infrastructure can outpace bigger names in the DeFi space.

Private Credit Powers Aptos’ RWA Dominance

According to RWA.xyz, nearly 78% of Aptos’ RWA TVL comes from private credit—far higher than competing chains like Solana, Stellar, and Polygon. This shows clear alignment with institutional lending use cases. Redstone Finance highlights that Aptos’ approach differs by targeting fewer but higher-impact projects, optimizing for depth rather than breadth. This has allowed it to surpass networks with more active RWA projects but less concentrated capital deployment.

Stablecoin Growth Bolsters DeFi Use Cases

Another key driver of Aptos’ DeFi momentum is the rapid expansion of stablecoin usage. Over $1.2 billion in native stablecoins are circulating on the network, supported by ultra-low fees (as low as $0.00055 per transaction) and high throughput. This makes Aptos particularly attractive for use cases such as payroll solutions, cross-border payments, and decentralized commerce—areas traditionally plagued by inefficiencies on legacy and EVM-based chains.

Also Read: Aptos (APT) Set for $50M Token Unlock as Real-World Asset TVL Surges to $538M

Technical Edge Positions Aptos as Ethereum Alternative

Aptos is positioning itself as a next-gen DeFi hub by offering developers and institutional partners a technically advanced alternative to Ethereum. With a modular architecture and sub-second transaction finality, the network provides the scalability and cost efficiency critical for mass RWA adoption. While Ethereum still leads with $7.59 billion in RWA TVL, Aptos’ rapid ascent suggests it could soon challenge the dominance of EVM ecosystems if current momentum continues.

While Aptos has gained significant traction in a short period, sustaining this growth will require continued transparency, innovation, and strategic focus. Competing with Ethereum and other layer-2s remains a long-term challenge. However, with a robust foundation in private credit, stablecoin utility, and high-performance infrastructure, Aptos is well-positioned to scale its impact throughout the second half of 2025.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!