|

Getting your Trinity Audio player ready...

|

3 Key Takeaways:

- Developer activity on Aptos has surged to a six-month high, signaling strong long-term ecosystem growth despite recent price declines.

- APT’s price has dropped nearly 9%, trading near key support levels, even as spot demand and derivatives interest remain high.

- A disconnect between fundamentals and market sentiment is emerging, with rising smart contract deployments but falling TVL and sluggish price action.

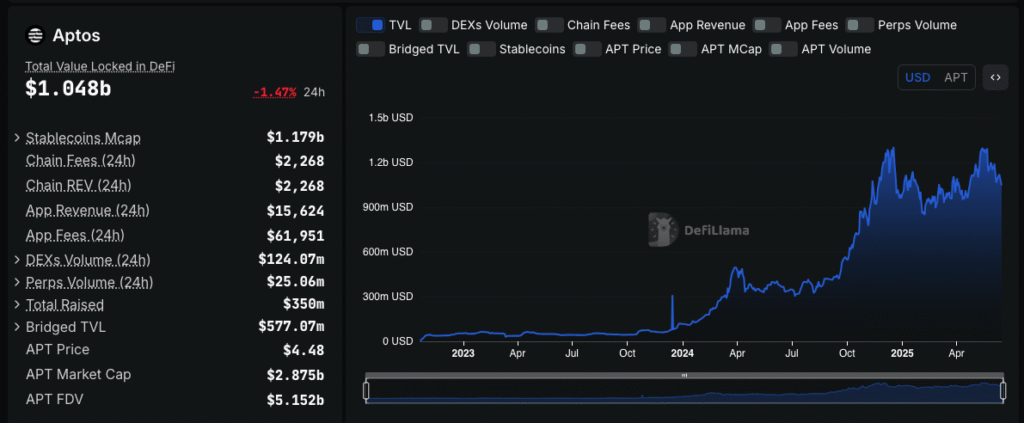

Aptos is witnessing a surge in developer activity, with smart contract deployments reaching a six-month high. Yet, despite this growth, the native token APT has fallen by nearly 9% in the last 24 hours, trading precariously above the $4.48 support level. This mismatch between rising network engagement and declining price raises important questions about what’s really happening under the hood.

Strong Spot Demand, Weak Price Action

Spot market demand for APT remains high, with cumulative volume delta (CVD) showing buyers aggressively accumulating. However, this demand hasn’t translated into price gains. APT continues to hover near the bottom of its multi-month trading range between $4.20 and $7.00.

The daily RSI sits at 38—an oversold signal—suggesting room for a bounce. Yet, repeated tests of the $4.2 support level hint at potential exhaustion among bulls. Without a decisive reversal, Aptos risks another leg down, frustrating spot buyers banking on a breakout.

Derivatives and DEX Activity Heat Up

While the spot market stalls, Aptos’s derivatives data suggests increasing trader interest. Open interest rose by 11.78%, reaching $181.92 million, while trading volume jumped 5.26% to $305.97 million. This spike points to heightened expectations for volatility, though direction remains uncertain.

Decentralized exchange (DEX) volume also climbed, with $165.7 million processed in the last 24 hours—a 26% rise in weekly trading. These indicators suggest a rise in speculative activity, possibly from traders seeking quick returns amid price stagnation.

TVL Drops Despite Developer Optimism

Despite increased short-term trading, Aptos’s total value locked (TVL) declined by nearly 6%, signaling a withdrawal of long-term capital. This trend contrasts sharply with the continued rise in smart contract deployments, which topped 450 daily. Developer interest remains strong, showing confidence in the chain’s long-term potential, even as investors grow cautious.

Conclusion: Price Must Catch Up With Fundamentals

Aptos is at a crossroads. Developer momentum and bullish trading activity suggest underlying strength, but the token’s price hasn’t followed suit. If APT can reclaim the $5–$5.5 zone, it could reignite investor confidence. Until then, Aptos risks losing momentum, despite its on-chain promise.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses