|

Getting your Trinity Audio player ready...

|

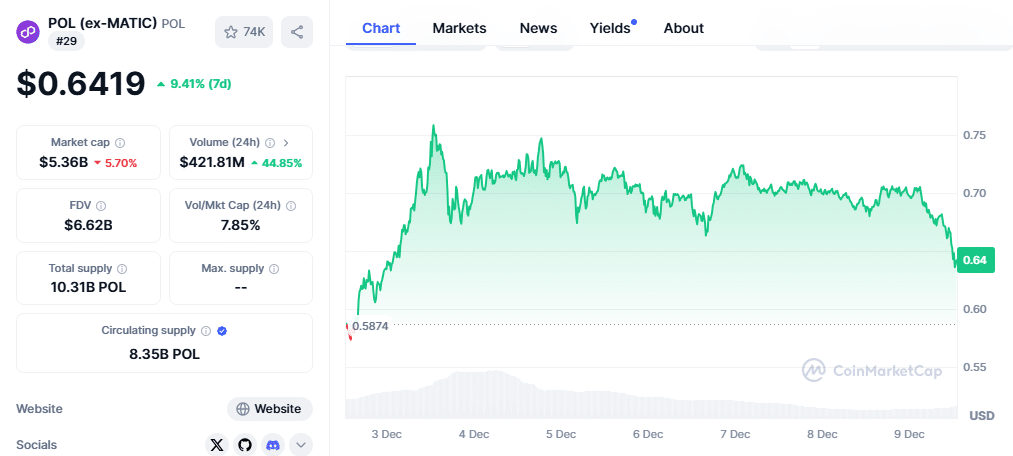

Alameda Research has made waves in the cryptocurrency market following a series of strategic moves involving $POL tokens, recently deposited into multiple trading platforms. The transactions are seen as a strong signal of confidence in Polygon ($POL), which has surged by 106% over the past few weeks, significantly boosting the value of its tokens.

A wallet believed to be linked to Alameda Research deposited a substantial 8.68 million $POL tokens, valued at $6.19 million, into FalconX yesterday. These tokens were originally received from the Polygon Foundation’s “Ecosystem Growth” wallet on November 15, when they were worth $3.2 million. The 106% surge in $POL’s value since then underscores the growing momentum of the Polygon network, a key player in blockchain and decentralized finance (DeFi) ecosystems.

A wallet that received $POL from the #PolygonFoundation deposited all 8.68M $POL ($6.19M) to #FalconX just 4 hours ago.

— Spot On Chain (@spotonchain) December 4, 2024

The wallet initially received these $POL tokens (then worth only $3.2M) from the "Polygon Ecosystem Growth" wallet on Nov 15.

Since then, the price of $POL… pic.twitter.com/DbYAeKWakJ

In a related move, Alameda Research also finalized its $POL deposits to Wintermute Trading earlier today, transferring another 9.14 million tokens, now valued at $6.63 million. This marks the completion of the firm’s move of its entire $POL allocation—over 15 million tokens—worth approximately $12.8 million at current prices.

Alameda Research Completes $POL Deposits to Wintermute Trading

— EyeOnChain 🔶 (@EyeOnChain) December 5, 2024

About 12 hours ago, #Alameda Research deposited the last 9.14M POL ($6.63M) to Wintermute Trading. pic.twitter.com/76TrBFndTS

The tokens, valued at $5.79 million when originally received, have seen a massive increase in value, making Alameda Research’s transactions a key indicator of Polygon’s expanding influence. These actions reflect Alameda’s approach to managing its crypto assets by capitalizing on favorable market conditions.

The surge in $POL’s price is not just a reflection of the token’s growing demand but also highlights Polygon’s broader appeal in the DeFi and blockchain space. The project has garnered attention for its scalability and low-cost transaction capabilities, drawing interest from developers and institutional investors alike.

Alameda’s decision to deposit the entirety of its $POL holdings into trading platforms suggests a strategic move to leverage Polygon’s increasing market momentum. As $POL continues its upward trajectory, these institutional actions highlight the dynamic interplay between major players and the crypto market.

Also Read: Worldcoin Dips 5% Amid Alameda Research’s $2.51M Sell-Off – What’s Next?

With Polygon showing no signs of slowing down, the role of institutional investors like Alameda Research in shaping market trends becomes ever more apparent. This series of moves serves as a reminder of how large-scale investors monitor, adapt to, and capitalize on shifting digital asset trends. As the DeFi ecosystem continues to expand, it’s clear that Polygon’s position as a leading blockchain platform is set to strengthen, providing a wealth of opportunities for investors who can time their moves accordingly.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.