|

Getting your Trinity Audio player ready...

|

The first half of 2026 has been defined by the “Institutional Airdrop.” As industry titans like MetaMask ($MASK) and OpenSea ($SEA) finally distribute equity to their user bases, the market has pivoted from a farming gold rush into a lethal secondary phase. This transition is marked by a brutal reality: approximately 88% of airdropped tokens lose more than 60% of their value within the first 90 days. This isn’t a mere market fluctuation; it is a structural “Liquidity Trap” where multi-billion dollar Fully Diluted Valuations (FDVs) collide with anemic on-chain liquidity.

[Visual Data Block: The 90-Day Decay Curve]

- Day 1–3: +15% (Initial FOMO and Exchange Listing Momentum)

- Day 4–14: -45% (The “Farmer” Mass Exit and Sell-Pressure Peak)

- Day 15–45: -20% (Low-Volume Bleed and Liquidity Exhaustion)

- Day 46–90: Aggressive Mean Reversion to Revenue-Based Valuations.

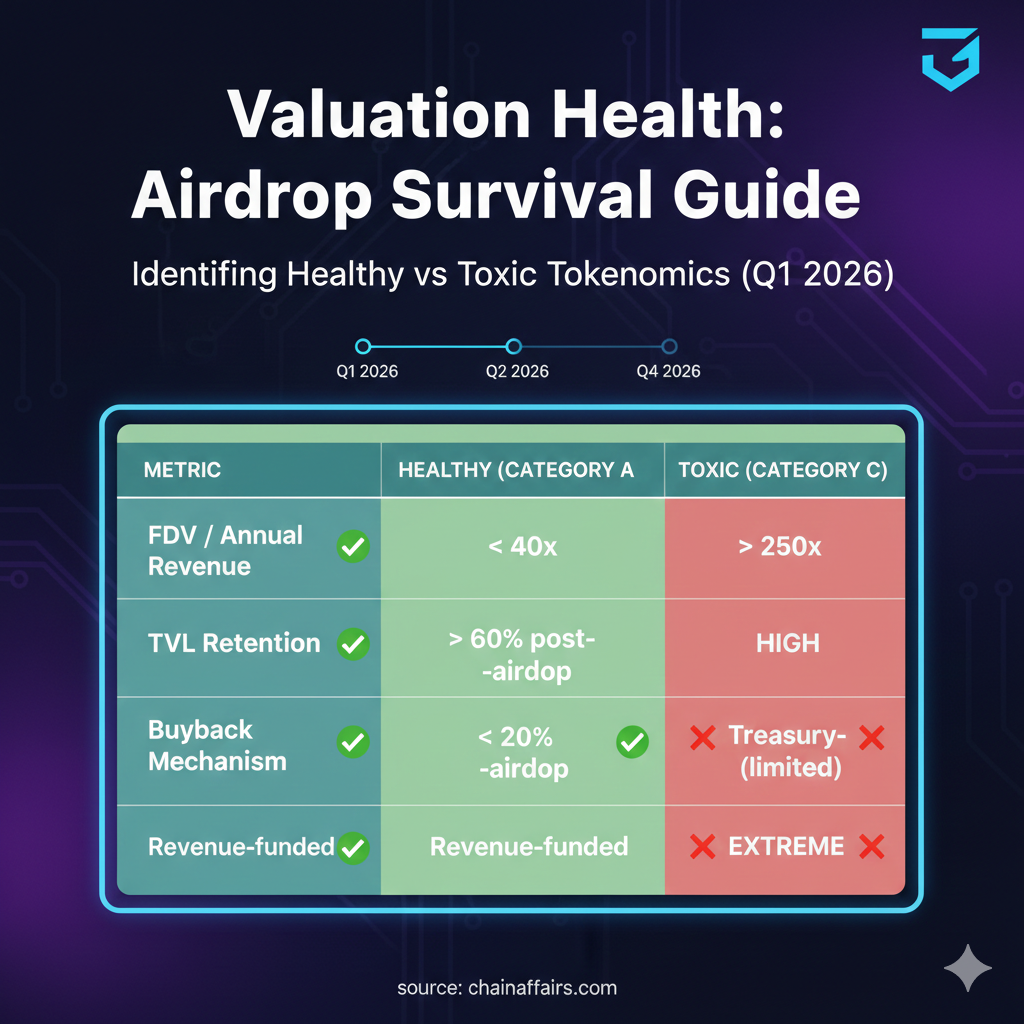

1. The 2026 “FDV-to-Revenue” Framework

In the 2024 cycle, “Low Float, High FDV” was the primary trap. By 2026, the market has matured, shifting the primary danger toward the Revenue Gap. Modern investors are no longer pricing assets based on “potential” or “ecosystem points”; they are valuing them based on sustainable yield and fee capture.

A protocol’s price floor is now mathematically anchored to its Revenue-to-FDV Ratio. The primary trap occurs when protocols launch at a $10B+ FDV while generating less than $50M in annual revenue. Without the buy pressure generated by fee-sharing or utility-driven demand, these tokens are statistically guaranteed to revert toward their fundamental value. Before committing to a long-term hold, savvy participants check the “Supply-Side Fees” versus “Protocol Revenue” on platforms like Token Terminal. If a project spends more on points incentives than it earns in organic fees, it is a Category C: Pure Narrative Trap, and should be exited immediately upon claim.

2. Advanced Execution: The Delta-Neutral Hedge

2026 is the year of “Encumbered Rewards”—tokens that are distributed to users but remain “auto-staked” or locked for 3–6 months. This creates a psychological trap where you are “long” on paper but remain a prisoner to the price action. The solution is the Synthetic Exit.

Rather than waiting for the unlock, sophisticated traders identify pre-market or perpetual listings on DEXs like Hyperliquid to find the asset’s contract. By opening a 1x Short position equal to the size of their airdrop, they achieve a Delta-Neutral state. If the price crashes by 50% during the lock-up period, the profit from the short offsets the loss on the spot allocation, effectively “selling” the airdrop at TGE prices. However, one must remain vigilant regarding Funding Rates. If the market is overly bearish and everyone is shorting the airdrop, the cost to maintain the position can bleed significant capital, making the hedge viable only if a drop of at least 10% is anticipated.

3. Identifying Infrastructure Centrality

Not every token is destined for zero. Assets like Hyperliquid ($HYPE) and Monad ($MON) have established a new “Category A” hold through Infrastructure Centrality. These protocols are distinguished by their Vertical Integration; the token serves as both the gas for the network and the primary collateral for its native DeFi suite.

When evaluating these assets, the most critical indicator is the Organic TVL Test. One should ignore the initial “Incentivized TVL” that floods in during the airdrop snapshot. Instead, look for capital that remains on the chain 30 days after the rewards are distributed. If the Total Value Locked drops by more than 40% post-snapshot, it indicates that the ecosystem was powered by mercenary capital rather than real users. In such ghost towns, even infrastructure tokens will fail to maintain their floor.

4. The “Double Bottom” Buyback Play

Specific “Category B” protocols—notably OpenSea and Uniswap v4—have integrated Programmatic Buybacks into their tokenomics. This creates a distinct 30-day trading cycle. The initial TGE involves a massive dump from airdrop recipients, known as Phase 1. However, around Day 30, the first “Protocol Revenue Distribution” or “Buyback & Burn” cycle usually begins.

This mechanism often triggers a “Double Bottom” on the price chart. For those who missed the initial Day 1 exit, the worst move is a panic sell during the Day 14 bleed. Instead, the strategic play is to wait for the first monthly revenue cycle to trigger an artificial buyback rally, providing the necessary liquidity to exit 50–70% of the position at a much more favorable price.

5. Security: The “Approval Drain” Warning

Security in 2026 has become an arms race. Malicious “Airdrop Checkers” have evolved into “Front-Running Drainers” that monitor the blockchain for the exact moment you claim a high-value drop.

[Visual: The 2026 Security Workflow]

- Claim to a dedicated Burner Wallet (never connect your main vault).

- Bridge to a different chain immediately (e.g., Base to Arbitrum) to break “Drainer Bot” scripts.

- Revoke approvals via

Revoke.cashwithin 60 seconds of claiming. - Transfer to a final Cold Wallet destination.

Furthermore, public RPC nodes are now highly susceptible to MEV (Maximal Extractable Value) bots. During high-traffic events like a MetaMask ($MASK) claim, using a public node can result in your first swap being “sandwiched,” causing a 3–5% loss due to slippage manipulation. Protecting your claim requires using a private RPC like Flashbots or Enclave to ensure your transactions remain invisible to the bots until they are included in a block.

6. Tokenomics of 2026: The “Loyalty Multiplier”

A defining trend of this year is the Anti-Mercenary Clause. Protocols like Jupiter ($JUP) and Berachain ($BERA) have begun tracking the “Sell Ratio” of their participants. If a user sells 100% of their first airdrop, their allocation for the subsequent round is slashed by up to 90%.

The optimal strategy here is the 49% Rule. By selling exactly 49% of your allocation, you de-risk your initial capital and secure a profit while maintaining “Diamond Hand” status in the eyes of the protocol’s tracking algorithms. This ensures you remain eligible for the high-value “Multipliers” reserved for long-term Protocol Partners.

7. The Restaking Pivot

For Category A tokens like $SEA or $MON, the most successful market participants are bypassing the exit to USDC entirely. Instead, they are moving into the Restaking Layer. By depositing airdropped assets into a Liquid Restaking Token (LRT) provider, holders can maintain exposure to the token’s upside while generating a 10–15% APY in ETH or stablecoins. More importantly, restaking your airdrop often serves as a prerequisite for the “Second Wave” of distributions from Actively Validated Services (AVS) scheduled for late 2026.

Also Read: Top Crypto Airdrops to Watch in 2026: The Biggest Free Token Opportunities

The Protocol Partner Shift

The 2026 market offers no mercy for the unprepared. To survive the Liquidity Trap, one must move beyond the “lottery ticket” mindset and treat airdrops like a professional venture portfolio. This requires hedging locked assets with 1x short perps, auditing protocol revenue versus valuation, and monitoring TVL decay with clinical precision.

In this era, the most profitable move isn’t just knowing how to farm—it’s knowing exactly when to exit the trap and move capital into the next high-conviction ecosystem. Don’t be the exit liquidity for institutional VCs; be the capital that moves before the unlock.

Data Disclaimer: Analysis based on February 2026 market conditions. Token performance projections utilize historical FDV/Market Cap divergence data from the 2024-2025 cycle. Trading derivatives involves significant liquidation risk.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!