|

Getting your Trinity Audio player ready...

|

- Whale offloaded 938K LINK, raising short-term sell pressure.

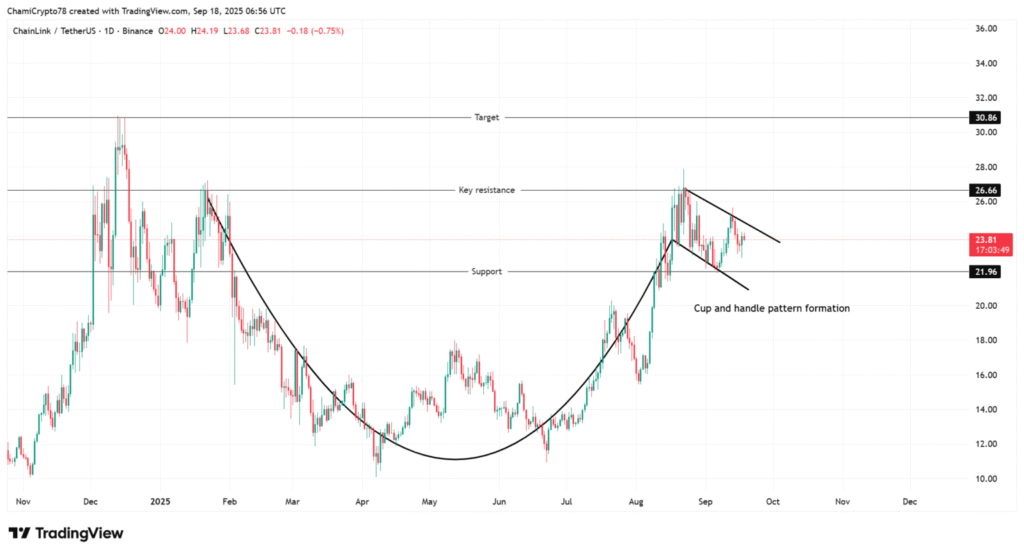

- Chart shows bullish cup and handle pattern forming near $22–$26.

- Rising Open Interest hints at looming breakout toward $30+.

Stay ahead with real-time updates and insights—Join our Telegram channel!

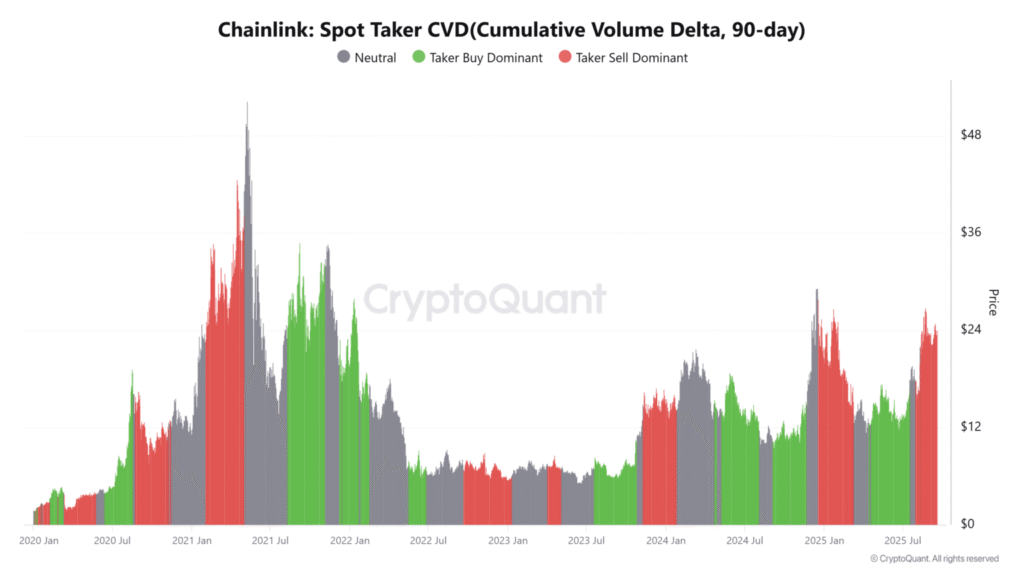

Chainlink (LINK) faced heavy scrutiny this week after a major whale sold 938,489 LINK worth $21.46 million at an average price of $22.87, locking in a $212,000 profit. The sale briefly pressured the market, with LINK hovering near $23.81 as traders debated whether this marked renewed weakness or just profit-taking. Spot Taker CVD data showed aggressive sell orders outpacing buys, reflecting fading bullish conviction at higher levels. This imbalance has weighed on intraday momentum, pushing bids lower and stirring volatility.

A bullish pattern emerges

Despite the near-term sell dominance, LINK’s daily chart is shaping into a classic cup and handle pattern — a structure often preceding bullish continuation. The token is consolidating between support at $21.96 and resistance at $26.66. A clean breakout above this zone could launch a push toward $30.86. This pattern remains valid as long as LINK holds above its current support, giving bulls a clear level to defend as they attempt to flip sentiment back in their favor.

Also Read: Caliber Becomes First Nasdaq Firm to Add Chainlink (LINK) to Treasury

Speculators quietly position for upside

Adding to this backdrop, Open Interest jumped 6.72% to $1.65 billion, signaling growing speculative positioning despite the whale exit. Rising Open Interest often precedes sharp moves as traders load up ahead of major breakouts. The alignment of technical strength with derivatives activity suggests that if LINK breaks past $26.66, sidelined capital could rush back in and drive prices higher.

Conviction meets critical resistance

Chainlink now stands at a pivotal juncture. Sustaining support near $22.00 while breaking above $26.66 could confirm bullish continuation and clear the path toward $30.86. While sellers currently hold the short-term edge, the broader setup hints at a potential momentum shift that could catch the market off guard.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.