|

Getting your Trinity Audio player ready...

|

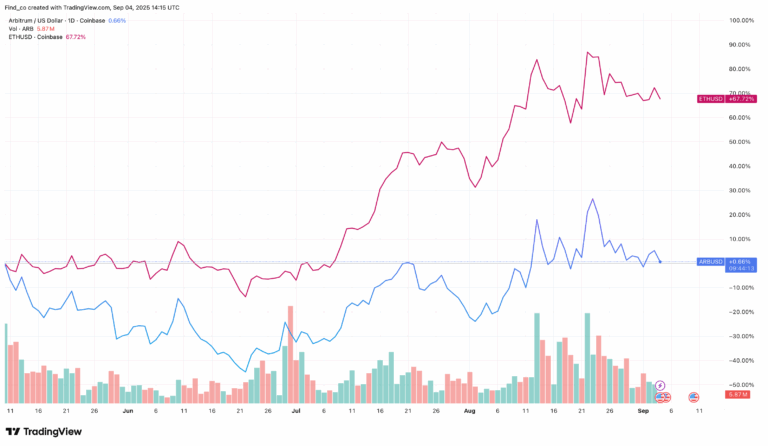

- ARB strongly correlates with Ethereum; ETH weakness can drag ARB lower.

- Open Interest decline signals waning trader momentum and potential price pressure.

- Technical indicators point to possible ARB drop to $0.39–$0.33, with upside only if ETH rebounds.

Arbitrum (ARB) investors are facing a pivotal moment as Ethereum’s (ETH) inability to surpass the $4,500 resistance level puts layer-2 tokens under pressure. Despite ARB posting a 30% gain over the past month, analysts warn that the token’s closely tied performance with ETH could translate into further downside risk.

Why ARB Mirrors Ethereum’s Moves

At press time, ARB trades around $0.49. Historical data shows a strong correlation between ARB and ETH. Over a 90-day window, ARB tends to reflect Ethereum’s price swings, with ETH surging 174% over recent months while ARB followed with an 82% increase.

However, Ethereum’s struggle to reclaim key psychological levels creates uncertainty for Arbitrum. If ETH falters, ARB may follow suit, testing lower support levels and weakening market confidence.

Open Interest Decline Signals Waning Momentum

Another concern is Arbitrum’s derivatives market. Open Interest (OI) for ARB peaked near $500 million two weeks ago but has since dropped to $206 million, indicating traders are pulling out leveraged positions.

Lower OI often signals fading momentum, making it harder for ARB to sustain rallies. Unless speculative interest picks up, ARB could face consolidation or further decline below the $0.45 support. Conversely, a rebound in OI could fuel renewed bullish sentiment and liquidity for upward momentum.

Technical Outlook Points to Bearish Risks

The daily chart indicates a bearish trend for ARB. The MACD has entered negative territory, weakening momentum, while a bearish crossover formed by the 12 EMA crossing below the 26 EMA suggests additional downside.

Also Read: Arbitrum (ARB) Price Eyes $0.60 as Bullish Momentum Holds Despite Pullback

Analysts forecast a potential drop to $0.39, with a highly bearish scenario pushing ARB toward $0.33. On the flip side, renewed demand or Ethereum reclaiming $4,500 could reverse the trend, positioning ARB to rally toward $0.62.

Arbitrum’s price trajectory remains tightly linked to Ethereum’s performance. Traders should monitor ETH’s movement closely, as well as ARB’s Open Interest, to gauge whether the token will consolidate or mount a rebound. Current technical signals favor caution, with downside risk outweighing near-term upside potential.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!