|

Getting your Trinity Audio player ready...

|

- Uniswap proposes new legal structure to enable $90M/month fee switch.

- UNI benefits from 15% share of Ethereum gas usage.

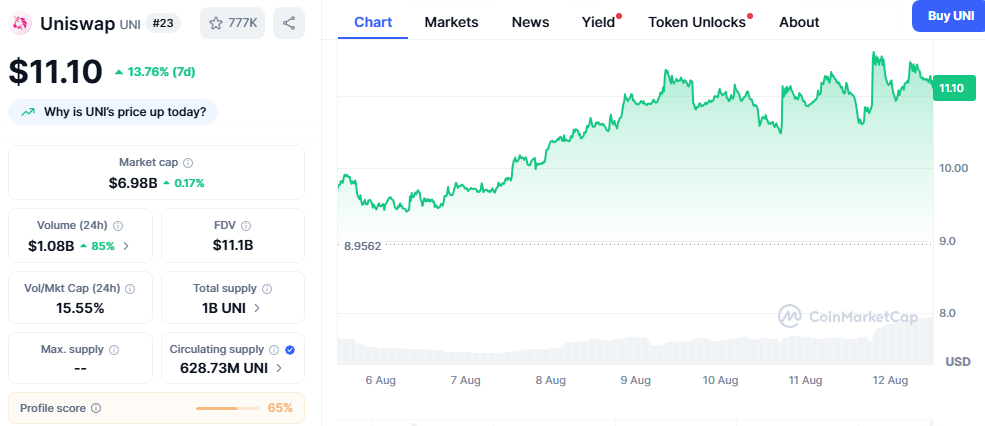

- Technicals point to $12.85 if $11.60 resistance breaks.

The Uniswap Foundation proposed forming a Wyoming Decentralized Unincorporated Nonprofit Association (DUNA), dubbed DUNI. This legal structure would formalize UNI governance decisions and potentially enable the long-discussed fee switch, which could redirect around $90 million per month in protocol fees to the DAO treasury or UNI holders.

The announcement pushed UNI’s price up 6%, with analysts noting that clearer legal standing could significantly reduce regulatory risks. A governance vote is set for August 18, and market watchers are eyeing the outcome closely.

Ethereum Network Effects Support UNI

Uniswap’s trading activity remains a major driver of Ethereum’s on-chain demand. As of August 11, Uniswap swaps made up 15% of Ethereum’s gas usage, helping the protocol generate $3.27 million in daily revenue.

However, Ethereum’s 2.3% price drop on August 12 slightly tempered UNI’s upside, reinforcing the close link between the two assets.

Technical Outlook: Bulls Eye $12.85

On the 4-hour chart, UNI is consolidating near $11.20 after facing resistance at $11.60. Key support sits at $10.95, with stronger demand expected near $10.60. The Relative Strength Index (RSI) at 64.41 leaves room for further upward movement before overbought levels.

Also Read: MultiBank Group’s $MBG Token TGE Is Live on MexC, Gate.io, Uniswap and Multibank.io.

If bulls break $11.60, the next target is $12.14, with a potential run toward $12.85. A drop below $10.95 could shift sentiment bearish, with $9.40 as the next major support.

Uniswap’s price strength amid a market downturn highlights the impact of legal and network fundamentals on crypto valuations. With the governance vote approaching, UNI could see heightened volatility — and potentially a breakout — in the coming days.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!