|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- HBAR long liquidations hit $2.7M, with dominance above 88%, signaling heavy bullish losses.

- Smart Money Index drops to 0.98, showing reduced confidence from experienced investors.

- Key $0.22 support level is under pressure; a break may send HBAR toward $0.18.

The Hedera Hashgraph (HBAR) token has plunged 9% in the past 24 hours, rattling bullish traders amid rising bearish sentiment across the crypto market. According to Coinglass, long liquidations in HBAR futures totaled $2.70 million out of $2.94 million overall, signaling a clear dominance of failed bullish bets.

Glassnode data further confirms this trend, with HBAR’s Futures Long Liquidations Dominance exceeding 88%. This metric reflects the percentage of liquidations originating from long positions and typically spikes during aggressive downward price movements — a situation that’s playing out now for HBAR.

Smart Money Pulls Back from HBAR

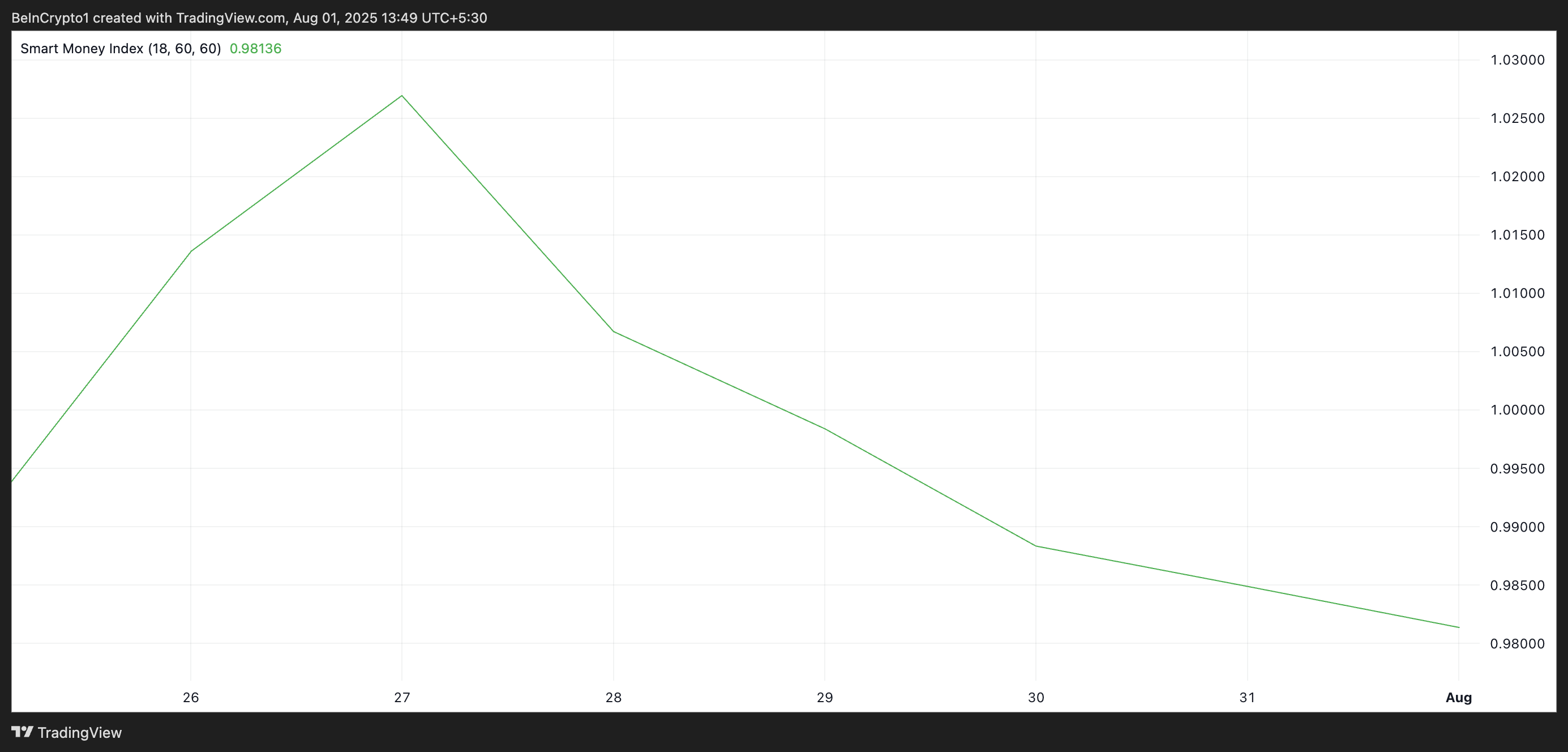

Adding to the bearish outlook, the Smart Money Index (SMI) for HBAR has dropped to 0.98, reflecting reduced buying activity from experienced traders. These “smart holders” often lead market trends, and their exit suggests waning confidence in the token’s short-term prospects.

The SMI analyzes intraday trading patterns, focusing on institutional accumulation in the afternoon versus retail sell-offs in the morning. The current dip in SMI suggests that even seasoned investors are stepping back as HBAR struggles to find support.

Key Support at $0.22 in Focus

At press time, HBAR trades at $0.24, hovering just above a crucial support level at $0.22. A break below this zone could accelerate sell-offs and drag the price toward $0.18. However, if buyers step in, a bounce back to the $0.26 resistance level remains possible — though less likely amid ongoing liquidation pressure and smart money outflows.

Also Read: Hedera (HBAR) Breakout Looms Amid Bullish Momentum

HBAR’s latest price decline reflects broader market weakness, but its vulnerability is amplified by a surge in long liquidations and declining interest from institutional players. Unless the token stabilizes above $0.22, further downside risks loom for traders.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.