|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Dogecoin price rallied 4.84% today after bouncing off the key $0.142–$0.16 demand zone.

- Negative MVRV and oversold RSI point to seller exhaustion and potential bullish reversal.

- A successful breakout could target $0.21 or even $0.34, though downside risk to $0.13 remains.

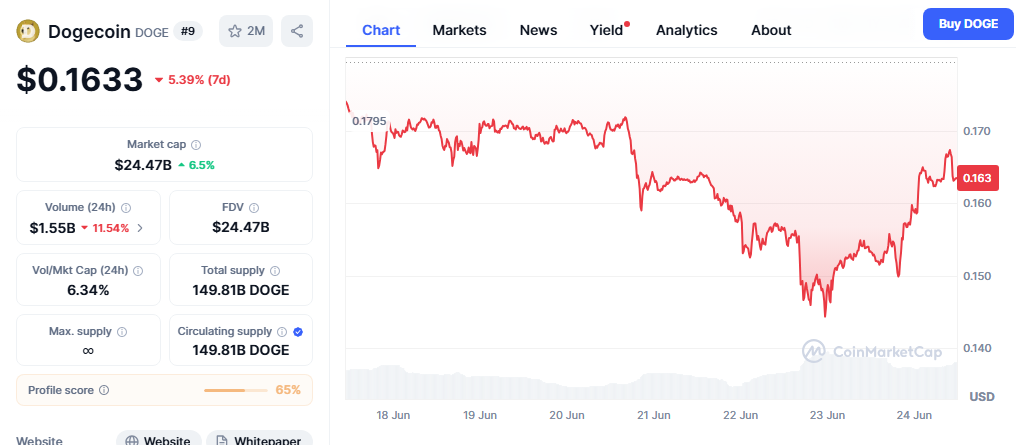

Dogecoin (DOGE) is trading at $0.154 today, June 23, after gaining 4.84% in 24 hours. The meme coin is seeing more than $1.43 billion in daily trading volume as bulls defend a critical demand zone between $0.142 and $0.16. This level, which has held firm since November 2024, once again helped spark a sharp recovery from a two-month low of $0.142 seen over the weekend.

This renewed buying activity has raised hopes that DOGE could be poised for another bullish reversal. But how high can the current rally go?

Historical Support Zone Signals Potential Upside

The $0.142 to $0.16 demand zone has repeatedly served as a launchpad for Dogecoin price rallies. In March and April this year, similar defenses at this zone led to sharp rebounds—first from $0.14 to $0.20 and later from $0.14 to $0.25, with gains of up to 40%.

Technical patterns suggest a repeat of this trend is possible. If history rhymes, DOGE could target the 61.8% Fibonacci retracement level at $0.21. With improving market sentiment, an extended rally could even push prices toward $0.34.

However, a failed defense could trigger a decline to $0.13, especially if broader crypto market sentiment remains in “fear” territory.

MVRV Ratio Indicates DOGE May Have Bottomed

Adding strength to the bullish case, Dogecoin’s 30-day Market Value to Realized Value (MVRV) ratio currently sits at -15.43%, according to Santiment data. This deeply negative reading suggests recent buyers are sitting on sizable losses.

Historically, a negative MVRV often signals seller exhaustion, as investors become unwilling to offload tokens at a loss. Combined with the oversold RSI, this could limit downside and catalyze a new wave of demand, supporting a potential DOGE price recovery.

Also Read: Bloomberg Analysts Raise XRP, Cardano, Dogecoin ETF Approval Odds to 90%

Dogecoin Price Outlook: Signs Point to Rebound

Technical analysis and on-chain metrics both suggest a possible Dogecoin price recovery in the near term. Bulls are once again defending a historically significant demand zone, and MVRV data hints that many sellers may already be exhausted.

While risks remain if market sentiment deteriorates, DOGE’s current technical structure leans toward a rebound—potentially to $0.21 or higher in the coming weeks.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.