|

Getting your Trinity Audio player ready...

|

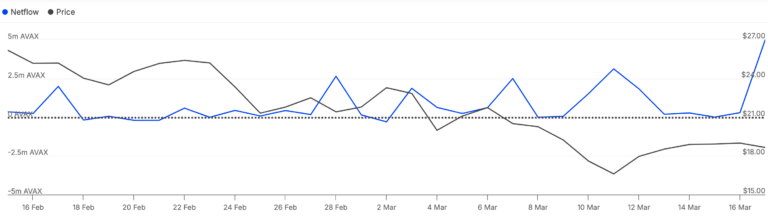

Avalanche (AVAX) whales are making big moves, accumulating nearly $90 million worth of AVAX in just 48 hours. Data from IntoTheBlock reveals that the large holders’ netflow skyrocketed from under 290,000 on March 16 to a staggering 5 million tokens as of today.

Whale Activity Signals Bullish Sentiment

The large holders’ netflow measures the balance of accumulation versus distribution among investors holding between 0.1% to 1% of AVAX’s total circulating supply. A rising netflow indicates increased accumulation, signaling bullish sentiment. Over the past two days, whales have added approximately 4.7 million AVAX tokens to their holdings, reinforcing the notion of potential price growth.

Historically, increased whale activity often precedes price rallies, as strong accumulation reduces available supply and exerts upward pressure on the token’s value. With the current buying spree, AVAX could be primed for a notable price increase in the short term.

Traders Lean Bullish on AVAX’s Future

Market sentiment appears to align with whale activity, as derivatives traders are also betting on further upside. The funding rate—an indicator of market bias in the futures market—has flipped positive after being negative between March 15 and 17. A positive funding rate suggests that long positions (buyers) outweigh short positions (sellers), reinforcing the bullish outlook for AVAX.

AVAX Price Targets $24, Eyes $30

From a technical perspective, AVAX’s price action aligns with bullish indicators. The token recently formed a falling wedge pattern, typically a bullish reversal structure. Additionally, the Moving Average Convergence Divergence (MACD) has moved into positive territory, while the 12-period Exponential Moving Average (EMA) has crossed above the 26 EMA—a strong bullish signal.

Further confirming this trend, the Chaikin Money Flow (CMF) has surged above the zero line, signaling increased buying pressure. If the momentum holds, AVAX could climb towards the $24.06 Fibonacci resistance level, potentially extending towards $30. However, any resurgence of selling pressure could push the price back down to $15.40.

With whale accumulation and technical indicators flashing green, all eyes are on AVAX’s next move. Will the bullish momentum sustain, or is a correction on the horizon?

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Avalanche (AVAX) Faces Strong Resistance: Bearish Trend Targets $14

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.