|

Getting your Trinity Audio player ready...

|

Cardano (ADA) is struggling on multiple fronts, with its price slipping by over 9% in the past week. However, beyond the price decline, deeper issues are emerging—namely, stagnation in network activity and dwindling trader confidence. As other Layer 1 networks see a resurgence, Cardano’s lack of momentum raises questions about its future relevance.

Cardano’s On-Chain Activity Remains Stagnant

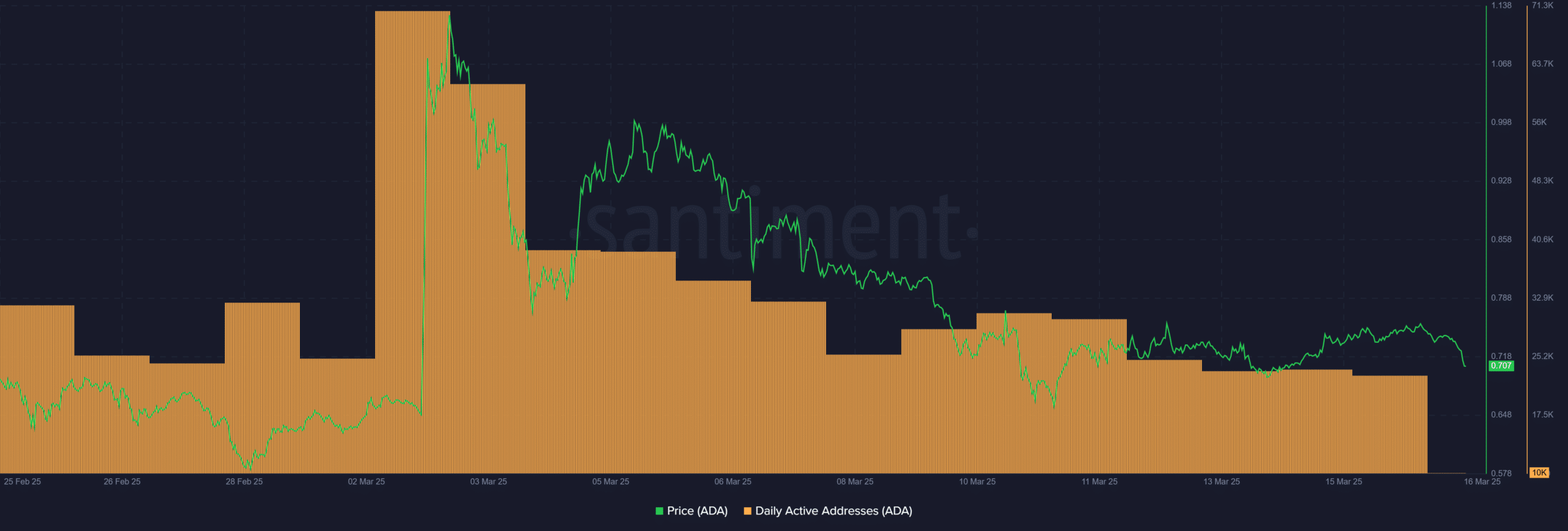

While ADA’s price downturn is concerning, the real red flag lies in its on-chain engagement. Since March 6, daily active addresses have remained flat at around 10,000, showing no meaningful recovery even when the price momentarily rebounded.

This lack of network participation suggests a broader issue: Cardano isn’t just experiencing a temporary slowdown—it’s plateauing. In contrast, rival Layer 1 blockchains are witnessing a return of users and activity, reinforcing concerns that ADA lacks organic demand. Without fresh user engagement or growing real-world adoption, Cardano risks fading into the background amid a rapidly evolving crypto landscape.

Traders Show Little Conviction in ADA’s Future

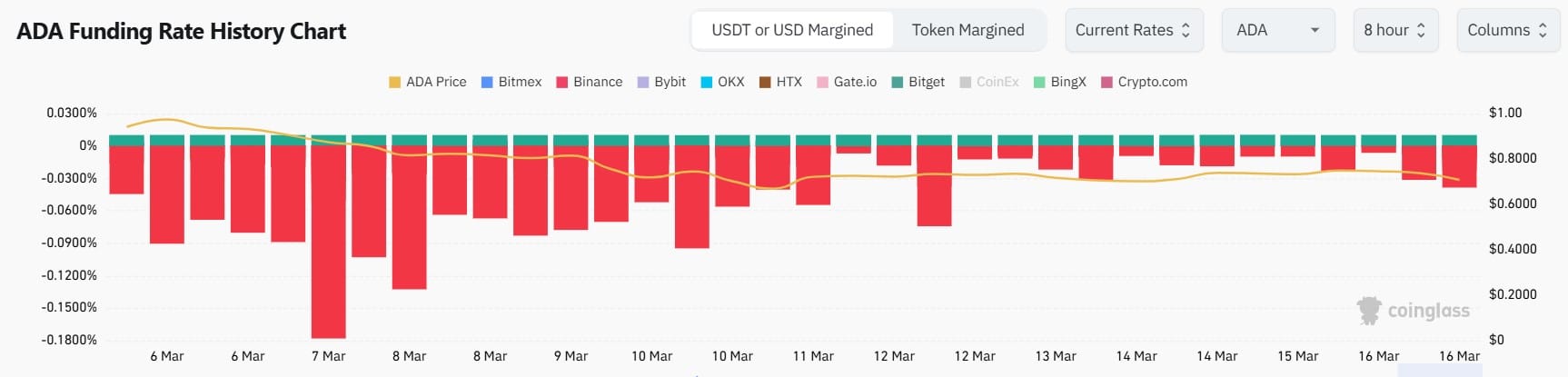

The derivatives market further underscores the bearish sentiment surrounding ADA. Open Interest in Cardano futures has plunged nearly 30% since March 3, declining from over $1.2 billion to under $900 million. This drop indicates that traders are stepping away from leveraged positions, signaling a lack of confidence in ADA’s near-term prospects.

Additionally, Funding Rates across major exchanges like Binance and Bybit have consistently remained negative, often dipping below -0.10%. This suggests that short sellers are paying a premium to maintain bearish positions, reinforcing the notion that market sentiment is heavily skewed toward the downside.

Cardano at a Crossroads

Cardano’s struggles extend beyond market trends. As capital flows into alternative assets like Base, memecoins, and AI-driven tokens, ADA’s stagnation appears systemic. The network has faced similar cycles before—temporary spikes in Total Value Locked (TVL) and user activity that ultimately fade post-hype.

Also Read: Cardano Governance Clash: Budget Cuts Spark Community Backlash Against Foundation

Without a major catalyst beyond its upcoming partner chains initiative and slow DeFi integrations, ADA risks being sidelined in a market increasingly driven by speed and innovation. Once a retail favorite, Cardano now faces the challenge of proving its continued relevance in an ecosystem that is rapidly evolving.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.