Pi Network traders are displaying increasing caution as the market conditions point toward a potential decline rather than a breakout. The latest market data suggests that traders are preparing for a downturn, with a deeply negative funding rate in the Futures market indicating that more investors are betting against PI’s price surge.

Pi Network Traders Turn Bearish

Market sentiment surrounding Pi Network has turned negative, with traders heavily shorting the altcoin. The negative funding rate underscores a bearish outlook, as it shows that short contracts outnumber long positions. This shift in sentiment comes at a crucial time, as today, March 14, marks the deadline for investors to complete their KYC and Mainnet Migration. Failure to meet this requirement could result in losing most of their balances, except for the Pi mined within the last six months before migration.

This looming deadline has added pressure on traders, who are now anticipating further price declines. Many are expected to cash in on short-term gains, further dampening any prospects of a strong recovery for PI.

Technical Indicators Signal Further Decline

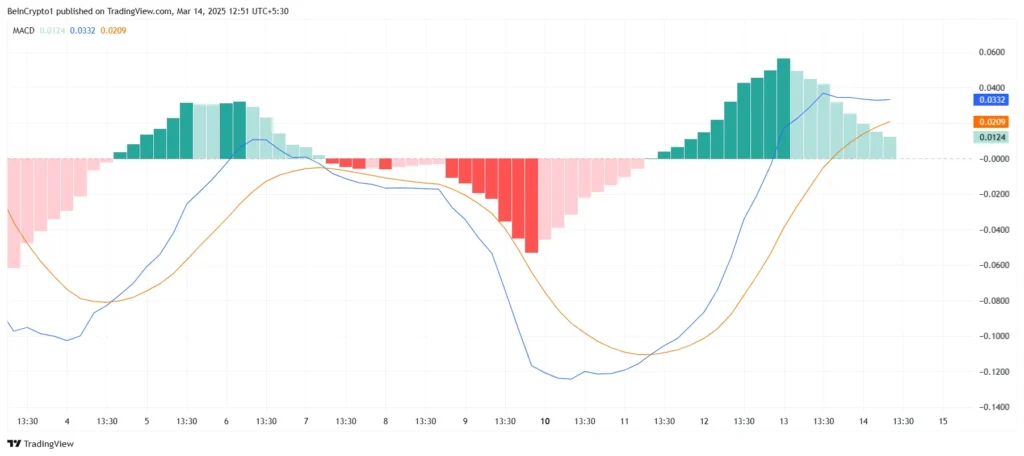

The bearish momentum is reinforced by key technical indicators. The Moving Average Convergence Divergence (MACD) is approaching a bearish crossover, which is often seen as a sign of an impending price drop. If this trend continues, Pi Network could face deeper losses in the near future. The combination of technical indicators and market sentiment suggests that the altcoin may struggle to find any sustainable upward momentum.

PI Price Attempts a Breakout

Currently, Pi Network is trading at $1.67, maintaining a fragile hold above the $1.64 support level. While it is making an attempt to break out of the descending channel, market conditions indicate that such a move may be challenging. However, the hype surrounding Pi Day could provide a temporary boost, potentially pushing PI past its resistance levels.

If Pi Network fails to break out, a drop below the $1.64 support level could lead to further declines, with the price possibly sliding to $1.43 or lower. Conversely, if social media-driven hype enables PI to breach the $1.98 resistance, it could invalidate the bearish outlook and pave the way for future gains.

For now, market sentiment remains cautious, with traders closely watching whether Pi Network can defy the prevailing bearish trend or succumb to further declines.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Pi Day Warning, Major Risks Pi Network Holders Must Watch Out For