Shiba Inu (SHIB) has been on a persistent downtrend in recent weeks, reflecting broader bearish sentiment in the cryptocurrency market. However, a slight relief rally saw SHIB gain 0.3% in the past 24 hours, trading at $0.00001226 at press time. Despite this minor uptick, the memecoin remains in a downward trajectory, losing 9.4% over the past week and a staggering 25.3% in the past month.

Open Interest Decline and Its Impact on SHIB

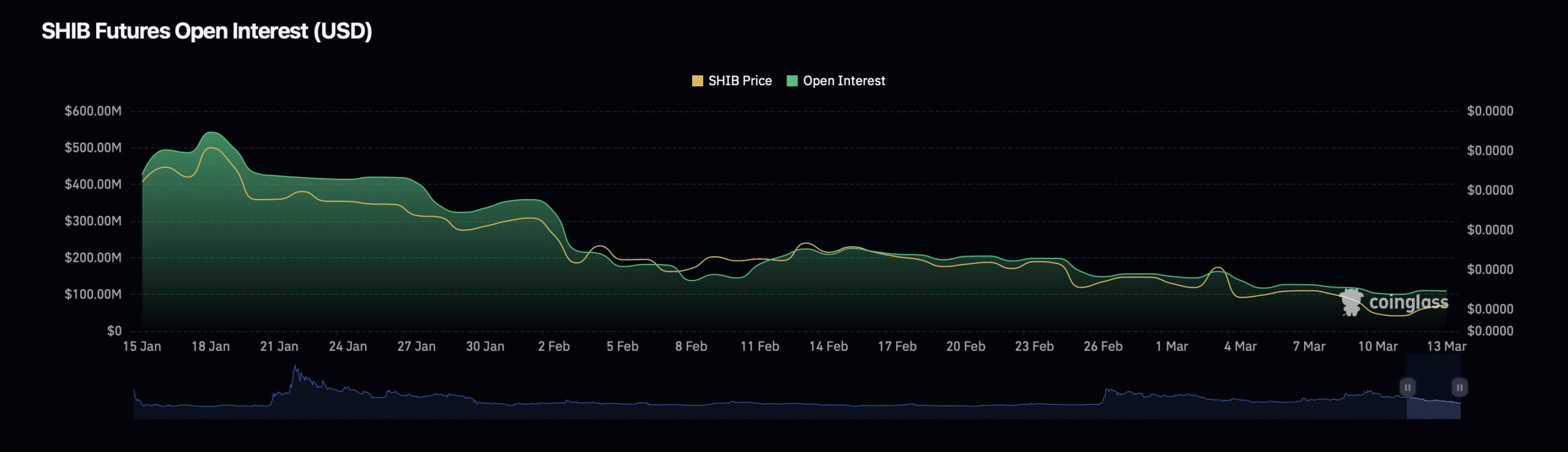

One of the primary factors contributing to SHIB’s decline is the consistent drop in Open Interest (OI). Open Interest represents the total number of unsettled derivative contracts, including futures and options. A decreasing Open Interest typically signals that traders are closing positions, leading to reduced speculation and weakening market momentum.

According to Coinglass data, SHIB’s OI has dropped by nearly 10% in the past day, bringing its valuation down to $105.94 million. Additionally, Open Interest volume has plunged by 12.57% within the same period, standing at $77.41 million. This downward trend suggests that traders are stepping back, reducing SHIB’s price support and contributing to its ongoing decline.

Shiba Inu’s Price Action and Whale Activity

From a technical perspective, SHIB’s price recently dipped below a key trendline, potentially clearing out liquidity. Historically, when liquidity levels are tested, a reversal may follow, indicating a possible bounce-back for SHIB. Moreover, the asset has entered a demand zone on its price chart, hinting at a brewing rally. However, these signals remain speculative, and broader market trends must be considered.

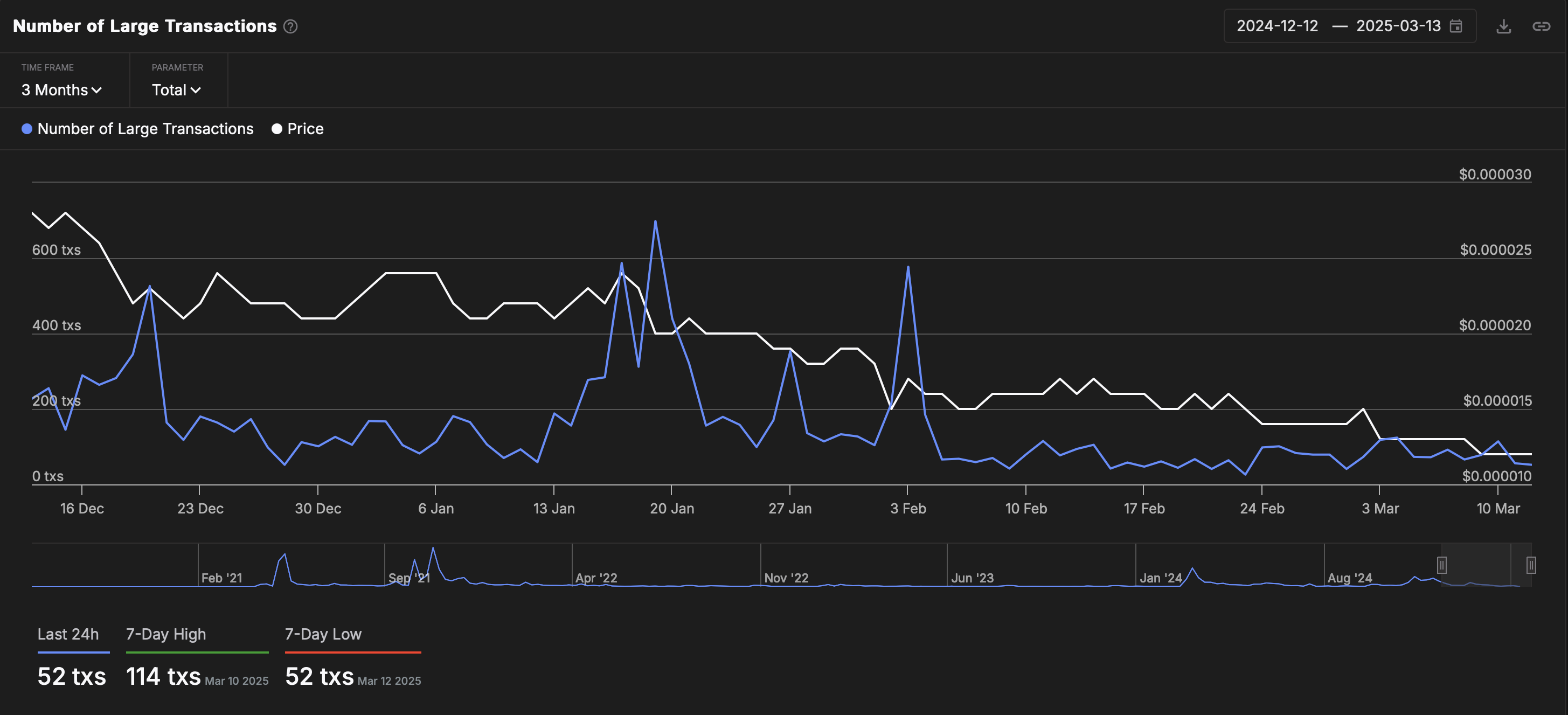

Adding to SHIB’s bearish outlook is the declining activity of whale investors. Data from IntoTheBlock reveals that whale transactions have plummeted from 698 in early January to just 52 at press time—an over 80% drop. This suggests that large investors are reducing exposure to SHIB, limiting its chances of a sustained recovery.

Will SHIB Rebound?

While technical indicators hint at a potential short-term reversal, the lack of whale accumulation and dwindling Open Interest remain significant obstacles. For SHIB to regain momentum, it will require renewed investor confidence and increased market activity. Until then, caution remains key for traders eyeing a turnaround in SHIB’s price trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Shiba Inu (SHIB) Price Prediction: Is a Major Breakout Imminent?