A substantial transfer of 92.9 million TRX, valued at approximately $21.4 million, has been moved from an unknown wallet to Binance. Such significant transactions often foreshadow market volatility, leading to heightened investor caution regarding TRON’s [TRX] next move.

At the time of writing, TRX was trading at $0.2242, reflecting a 3.07% decline over the last 24 hours. With market sentiment hanging in the balance, traders are closely watching whether this transfer will ignite a bullish surge or contribute to further downside pressure.

TRX Holders: Profits vs. Losses

Currently, 48.43% of TRON holders are “in the money,” collectively holding 41.31 billion TRX worth $9.39 billion. This suggests that the price is still favorable for many investors, potentially offering strong support at these levels.

Conversely, 24.61% of addresses remain “out of the money,” holding 20.99 billion TRX valued at $4.77 billion. This imbalance indicates that while many traders are in profit, a considerable number remain at a loss, which could contribute to selling pressure if TRX struggles to maintain its current levels.

Whale Activity and Market Impact

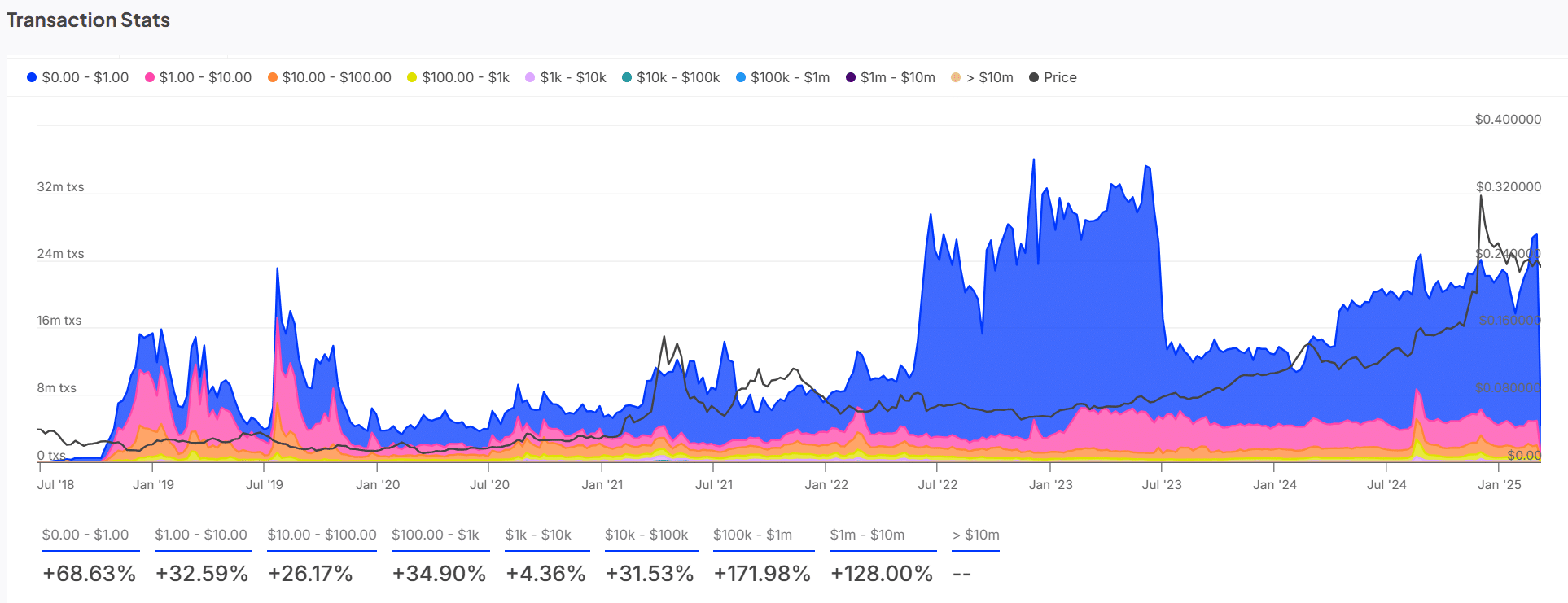

An increase in large transactions, particularly those exceeding $100,000, has been observed. This surge in high-volume trades suggests growing interest from institutional players and crypto whales, signaling an expectation of imminent price fluctuations.

While some investors appear to be positioning for a price increase, others may be offloading their holdings in anticipation of further declines. This dynamic could lead to pronounced market swings in the coming days.

Technical Analysis: Key Support Levels in Focus

TRX has been consolidating within a rectangular range since late December, fluctuating between $0.2185 and $0.25701. Currently, the price is testing its key support at $0.2185—a critical level that could determine its next move.

Should TRX hold above this support, it may sustain its consolidation phase or even break out higher. However, a breakdown below this level could lead to further declines, with the next significant support at $0.2185.

Market sentiment remains divided, with 111 bullish traders against 107 bearish positions. While bulls maintain a slight edge, bearish pressure remains strong, keeping the market in a cautious state. The lack of a decisive breakout suggests TRX remains vulnerable to further downside unless a strong catalyst emerges.

The recent large-scale TRX transfer to Binance has heightened volatility concerns, with the token testing crucial support levels. While there is potential for a bullish reversal, the ongoing struggle between bulls and bears keeps uncertainty high. Unless a strong positive trigger appears, TRX could face additional downside pressure in the near term.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: TRON (TRX) Price Prediction: Analysts See Bullish Surge Toward $1 Amid Network Boom