|

Getting your Trinity Audio player ready...

|

The U.S. Securities and Exchange Commission (SEC) may soon acknowledge Grayscale’s 19b-4 filing for an XRP exchange-traded fund (ETF), according to FOX Business journalist Eleanor Terrett. The filing, submitted on January 30, 2025, seeks to convert Grayscale’s XRP Trust into a spot ETF, similar to its previous transitions for Bitcoin and Ethereum Trusts.

SEC Decision Expected by February 13, 2025

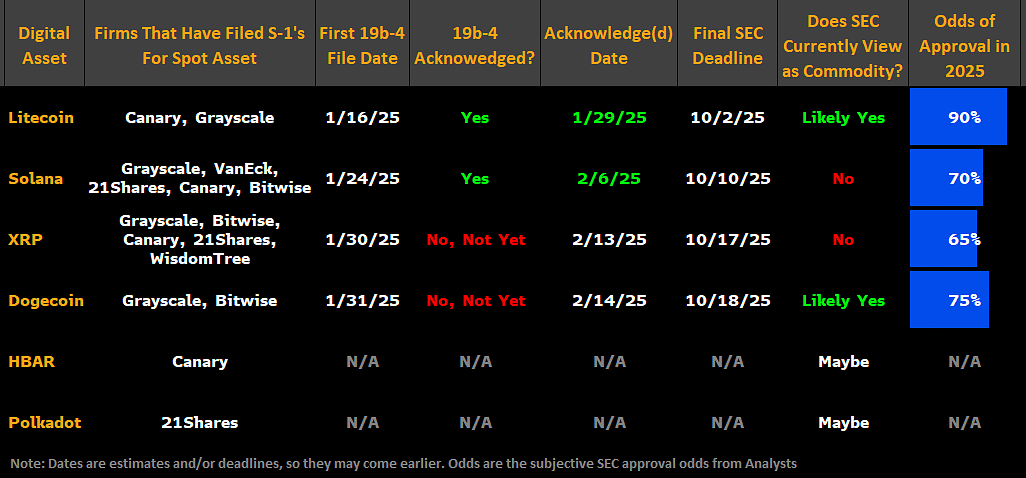

In a recent tweet, Terrett cited a table from Bloomberg analysts James Seyffart and Eric Balchunas, suggesting that the SEC could acknowledge the filing as early as February 13, 2025. Typically, the SEC has 15 days to acknowledge a 19b-4 filing, making this week crucial for XRP investors and enthusiasts.

NYSE Arca submitted the application, seeking approval to list and trade shares of the converted XRP Trust. If approved, this could be a monumental step for XRP, increasing its institutional adoption and market legitimacy.

As per this very helpful table from @JSeyff and @EricBalchunas, we could see the @SECGov acknowledge @Grayscale’s $XRP spot ETF filing as early as Thursday (2/13), if indeed it chooses to acknowledge it. The SEC usually has around 15 days to acknowledge a 19b-4 filing and… https://t.co/cN9skLUSHq

— Eleanor Terrett (@EleanorTerrett) February 11, 2025

Why SEC Acknowledgment Matters

The SEC’s acknowledgment—or lack thereof—will provide a strong indication of how the commission currently views XRP. Historically, the SEC under Gary Gensler’s leadership classified XRP as an unregistered security, a stance challenged by a landmark federal court ruling affirming that XRP is not a security in itself.

However, without clear classification as a commodity, XRP faces a steeper regulatory challenge compared to Bitcoin (BTC) and Ethereum (ETH), which have already secured spot ETF approvals.

XRP ETF Approval Odds in 2025

While an SEC acknowledgment is a positive sign, analysts Seyffart and Balchunas estimate only a 65% chance of an XRP ETF approval this year. This is lower than other altcoins such as Litecoin (90%), Dogecoin (75%), and Solana (70%).

However, XRP’s chances could significantly improve if:

- The SEC formally acknowledges the filing.

- The Ripple lawsuit reaches a resolution.

Ripple Lawsuit Nearing Resolution?

The ongoing Ripple vs. SEC lawsuit is a critical factor in XRP’s regulatory clarity. Recent SEC policy shifts and the launch of its Crypto Task Force suggest a move towards clearer regulations.

Notably, the SEC and Binance recently filed a joint motion to pause legal proceedings for 60 days, indicating that regulatory negotiations may lead to an early settlement. If the SEC adopts a similar approach toward Ripple, an XRP ETF could become a reality sooner than expected.

The SEC’s decision to acknowledge Grayscale’s XRP ETF 19b-4 filing will be a defining moment for XRP’s future in institutional finance. If acknowledged this week, XRP’s ETF approval odds could rise, particularly if the Ripple lawsuit reaches a resolution.

For XRP holders and traders, all eyes are now on February 13, 2025, as the crypto industry awaits the SEC’s next move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!