A previously inactive wallet sprang to life after two years, transferring 6.5 million Dogwifhat (WIF) tokens, valued at $5.21 million, from Binance. This unexpected whale activity has sent ripples through the market, prompting speculation about whether it signals a larger market shift or is merely a short-term fluctuation.

WIF Tests Key Support Levels Amid Downtrend

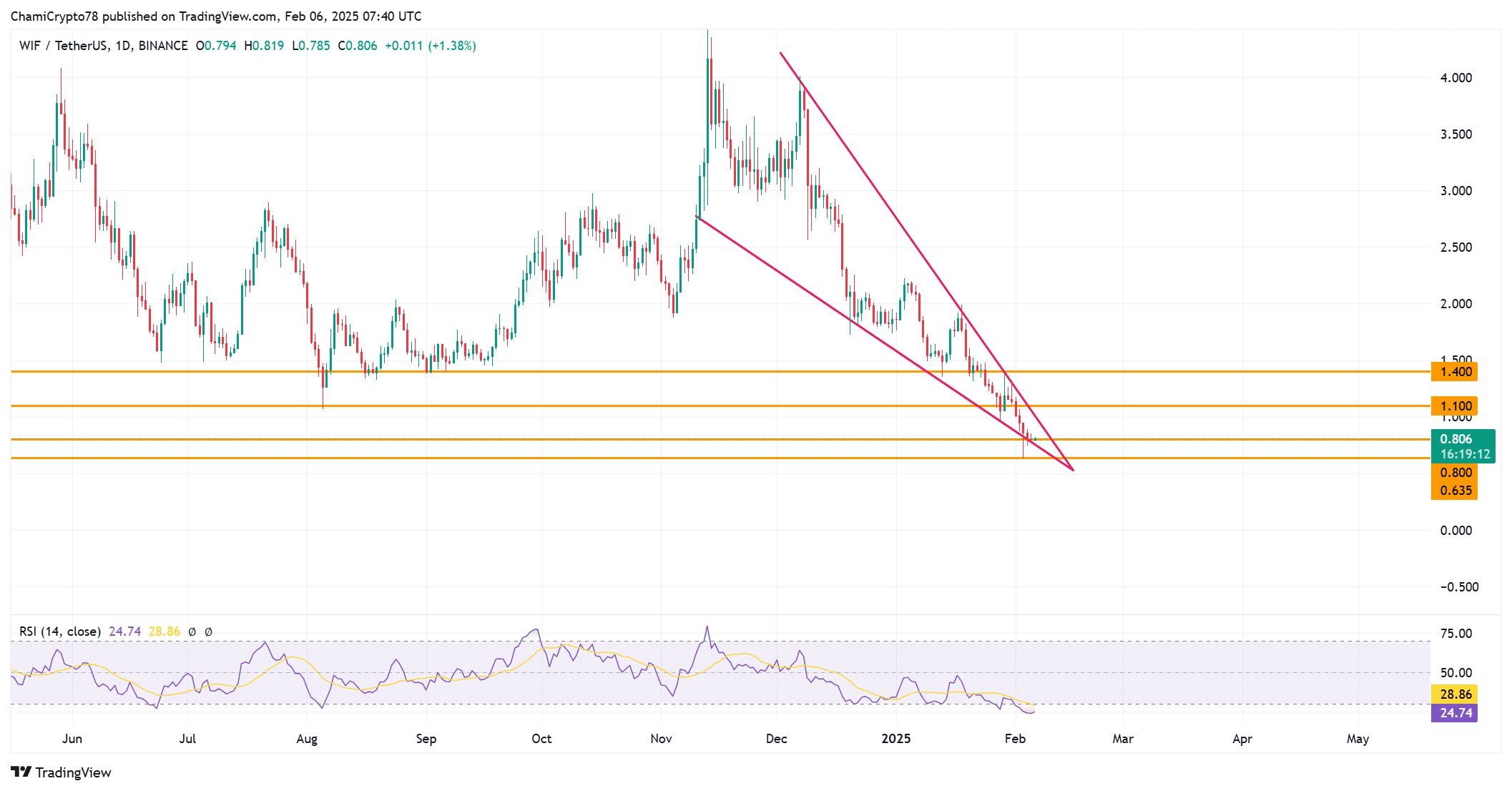

WIF has plunged into oversold territory, currently testing the crucial $0.80 support level. The token’s decline accelerated after losing its $1.40 threshold, falling as low as $0.64. Traders are watching closely to see if WIF can stabilize or if further downside is ahead.

The Relative Strength Index (RSI) remains in the oversold zone, hinting at a possible reversal. However, for a meaningful recovery, WIF must reclaim the $1.10 resistance level. At the time of writing, the token is consolidating within a bullish pennant flag pattern, which often precedes a breakout. Whether this support holds will determine the token’s next major move.

Social Dominance on the Rise

Following a dip, WIF’s social dominance has been steadily increasing, reflecting renewed retail interest. An uptick in mentions across social platforms suggests that investors are paying attention, though it remains uncertain whether this will translate into sustained buying pressure.

Historically, social sentiment plays a role in short-term price fluctuations, but a lasting bullish reversal requires strong market fundamentals and increased volume. Traders will need to assess if this growing attention translates into actual trading momentum.

Bullish Signals Emerge Despite Market Caution

Technical indicators present a mixed picture. The Stochastic RSI shows signs of bullish divergence, often a precursor to a price rebound. Additionally, a Moving Average (MA) cross between the 9-period and 21-period MA suggests a potential recovery, though confirmation is needed.

Meanwhile, liquidations and Open Interest (OI) reflect market caution. Over $1.78 million in liquidations, primarily from short positions, indicate market volatility. Additionally, a 5.79% drop in OI signals declining trader enthusiasm, reinforcing a wait-and-see approach.

Also Read: Can Dogwifhat (WIF) Revisit $5 After Massive Crash? Analyzing Its Price Recovery Potential

WIF Faces a Crucial Test for Recovery

WIF stands at a pivotal juncture. While whale activity and technical indicators hint at a reversal, a successful recovery hinges on reclaiming key resistance levels. With social sentiment improving but market uncertainty persisting, the coming days will be crucial in determining WIF’s next move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.