Dogecoin (DOGE) is currently trading at $0.3542, down 3.33% at press time, but technical analysts are spotting a classic bullish formation. The emergence of a falling wedge pattern on the daily chart has ignited hopes of an imminent price surge.

This pattern, characterized by converging trendlines, often signals a period of consolidation before a sharp price increase. A successful breakout above the critical resistance level of $0.39 could propel DOGE towards a significant target of $0.50.

However, the current price action around $0.3542 reflects indecision among traders. A decisive break above the wedge is crucial to confirm bullish momentum. Failure to do so could lead to further sideways movement or even a price retracement.

On-Chain Metrics Offer Mixed Signals

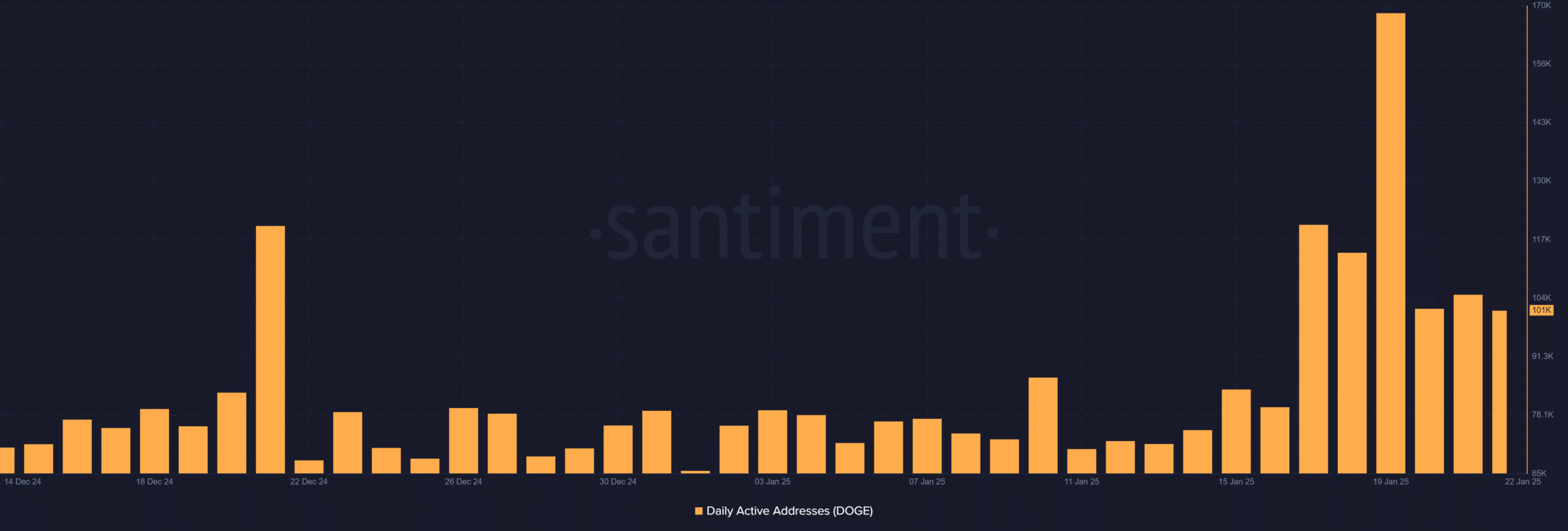

While daily active addresses on the Dogecoin network remain relatively steady at 101,000, this level lacks the sharp growth typically observed during major price rallies. This suggests consistent community interest but may not be sufficient to fuel a significant price surge.

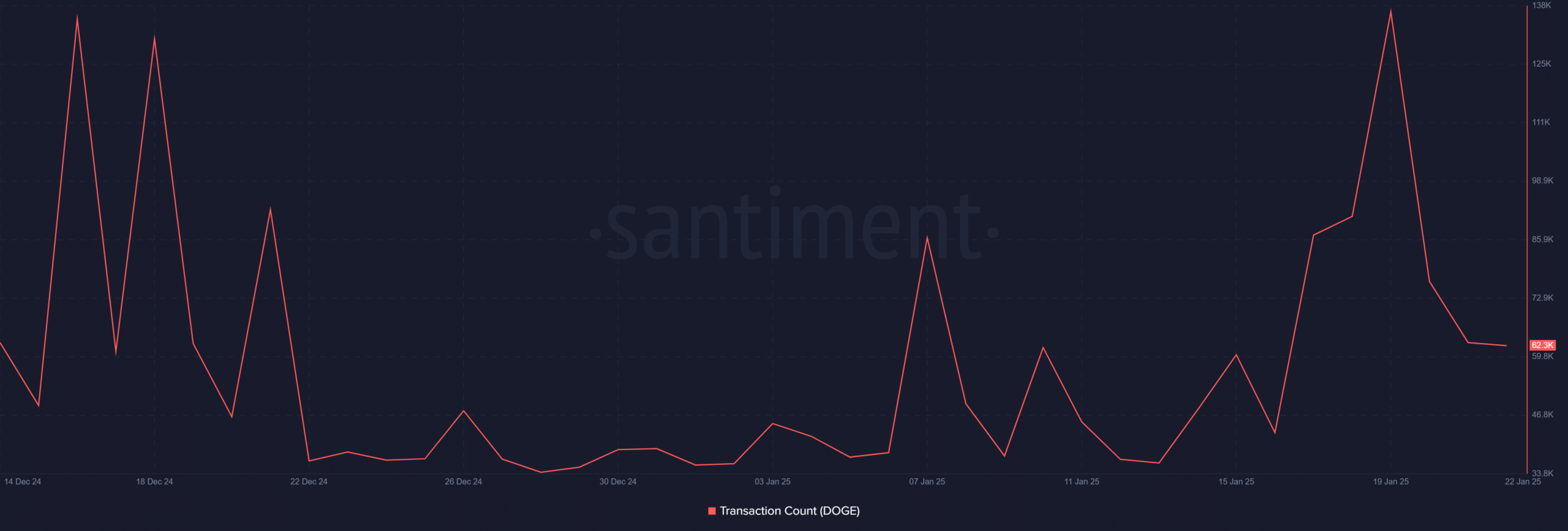

Furthermore, a declining transaction count, dropping to 62,355 on January 23rd, raises concerns. Reduced network activity could indicate waning investor enthusiasm, potentially hindering the anticipated breakout.

MVRV Ratio Points to Bearish Pressure

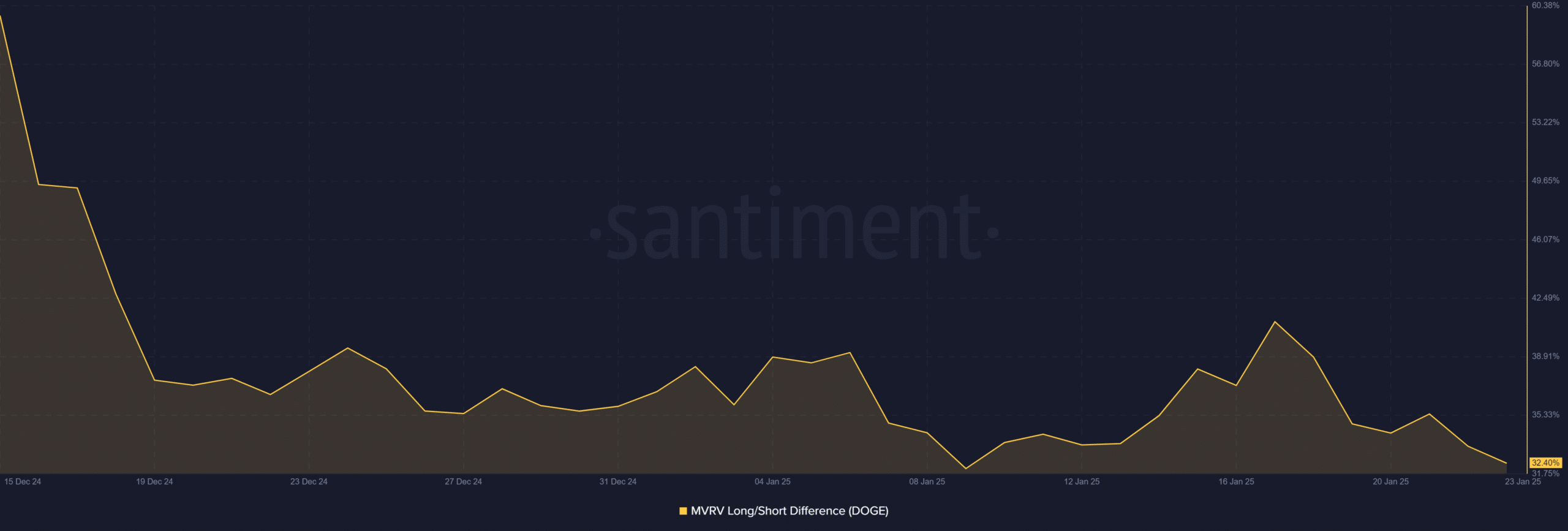

The MVRV Long/Short Difference, a key indicator of market sentiment, has fallen to 32.4%. This decline in profitability for both short- and long-term holders could discourage new investments and potentially increase selling pressure.

Breakout Potential Remains Uncertain

The falling wedge pattern provides a glimmer of hope for Dogecoin bulls, with a potential breakout target of $0.50. However, weak transaction counts and a declining MVRV ratio present significant challenges.

Also Read: Dogecoin ETF Filing Sparks Optimism: Could DOGE Hit $1 by 2025?

While steady daily active addresses suggest continued community support, a substantial increase in on-chain activity is necessary to confirm a bullish reversal and drive DOGE towards its potential upside.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.