|

Getting your Trinity Audio player ready...

|

The stablecoin market is experiencing rapid evolution in 2024, with industry giants like Tether (USDT) and Circle (USDC) adapting to stricter regulations. However, a new player has emerged as a significant contender: Ethena. With its innovative approach and ability to adapt to changing market conditions, Ethena’s USDe stablecoin has quickly gained traction. Since its public launch in February, USDe’s market capitalization has reached $6 billion, surpassing DAI and establishing it as the third-largest stablecoin by market cap.

Growth Driven by Aave Integration and Institutional Interest

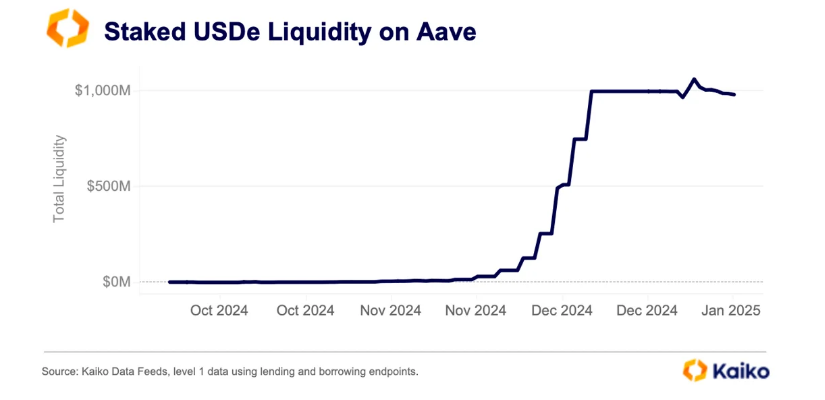

A key factor behind Ethena’s impressive growth is its integration into the Aave lending platform. In Q4 of 2024, the staked version of its stablecoin, sUSDe, was adopted by Aave, allowing users to leverage it as collateral. This move attracted over $1 billion in inflows within a few weeks, signaling strong demand for sUSDe. Interestingly, more than half of these inflows came from just five major addresses, underscoring institutional interest in Ethena’s stablecoin and cementing its place in the DeFi ecosystem.

The success of USDe also had a positive impact on Ethena’s governance token, ENA. As the price of Bitcoin surpassed $100,000, ENA surged back to levels near its initial launch, further boosting investor confidence in Ethena’s offerings.

Expanding Offerings: USDtb and Traditional Asset Backing

Ethena continued its momentum by launching USDtb, a new stablecoin backed by U.S. government bonds through BlackRock’s BUIDL platform. This new stablecoin offers a conventional, low-risk option for investors, contrasting with the delta-neutral hedging strategy of USDe. While USDe focuses on maintaining its dollar peg with hedging strategies, USDtb blends traditional assets with stablecoins to ensure stability and fast redemptions.

Also Read: Ethena (ENA) Price Analysis: Will the Current Pullback Lead to a Breakdown Below $1?

As Ethena navigates a shifting regulatory landscape and industry dynamics, its innovative, on-chain approach positions it for continued success. With growing institutional interest and the launch of new products, Ethena is proving that agility and innovation are key drivers in the evolving stablecoin market. As 2025 approaches, Ethena could play a pivotal role in reshaping the space.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.