|

Getting your Trinity Audio player ready...

|

Toncoin (TON) has been trading sideways, retracing from a high of $6 to the current price of around $5.6. The altcoin’s lack of upward momentum has sparked discussions among analysts, with several factors contributing to its stagnant price action.

Declining Interest for Swaps

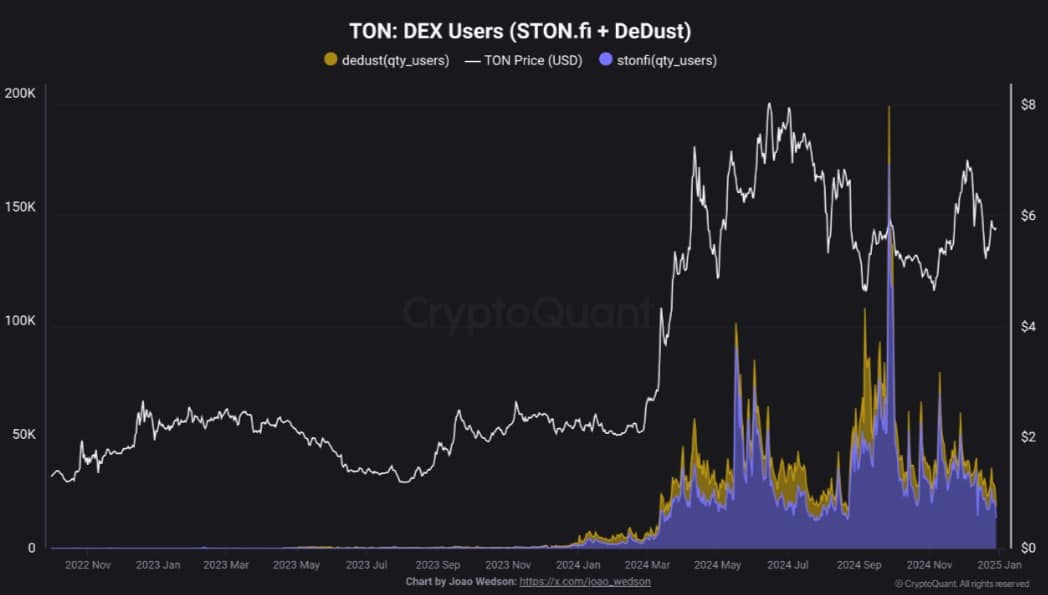

One of the key reasons for Toncoin’s current price stagnation is the sharp decline in interest for swaps on decentralized exchanges (DEXs) within the Toncoin network. According to CryptoQuant analyst Joao Wedson, the number of daily swaps on platforms like STON.fi and DeDust has significantly dropped. STON.fi, for instance, has seen average daily users fall to 13,300, while DeDust now hosts just 5,250 users. This marks a dramatic drop from September, when the combined daily user count on these platforms exceeded 200,000.

Several factors contribute to this decline. First, the reduction in open positions has led to many traders liquidating or reducing their exposure to DEXs. Additionally, uncertainty within the Toncoin community, particularly after the arrest of its founder, has impacted trust and participation in network platforms. Lastly, broader unfavorable market conditions, including reduced trading volumes and lower risk appetite following the Federal Reserve’s rate cuts, have contributed to a general decline in activity.

Shifting Investor Behavior: Staking Over Swaps

As interest in decentralized trading wanes, investors are increasingly shifting their focus toward staking Toncoin. While this shift in interest may seem challenging, it could present a strategic opportunity. Historically, periods of low market activity have often served as attractive entry points for long-term investors looking to capitalize on potential future gains.

What This Means for TON

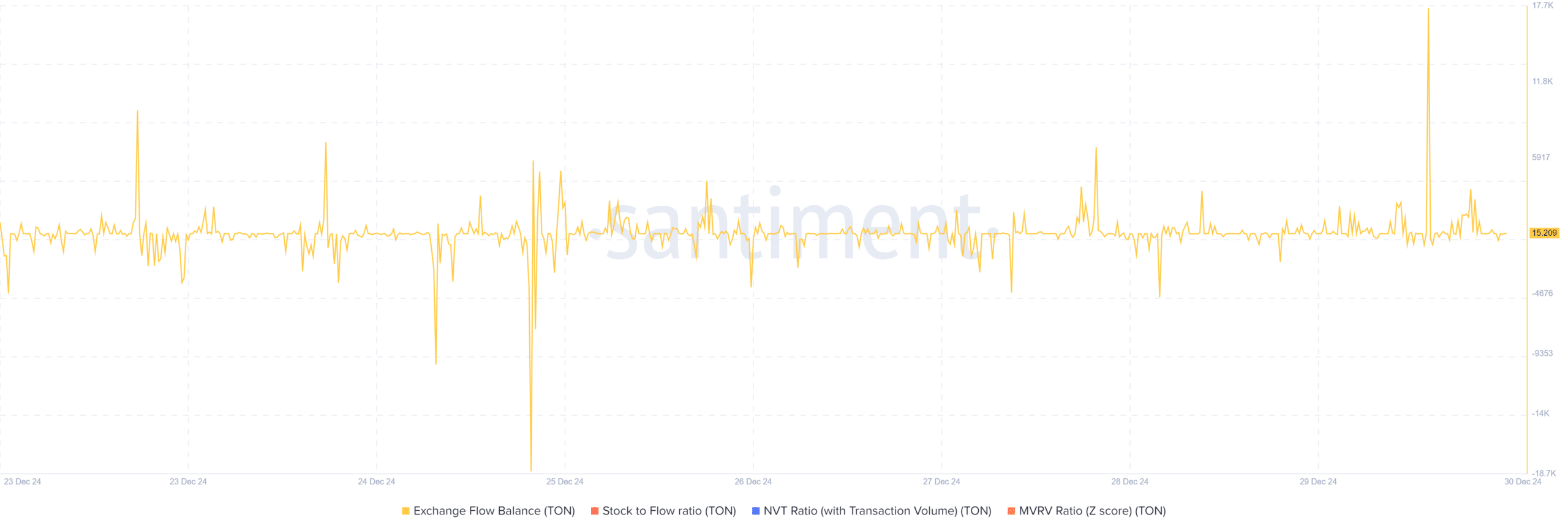

The sharp decline in swaps reflects a broader reduction in buying pressure, as investors adopt a more cautious stance amid market uncertainty. This has led to a drop in demand for Toncoin, visible in the altcoin’s stock-to-flow ratio (SFR), which recently plummeted to zero, signaling oversupply and reduced scarcity. Santiment’s data further highlights an increase in TON’s supply on exchanges, with the exchange flow balance surging to 3,459.

Also Read: Toncoin Price Prediction: Will TON Rebound or Decline as 2025 Approaches?

With these factors in mind, the outlook for Toncoin remains uncertain. If current conditions persist, the altcoin could see further downward pressure, potentially reaching $5.2. However, should investors view the decline as a buying opportunity, Toncoin could break out of its consolidation range, potentially climbing back to $6.1.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!