|

Getting your Trinity Audio player ready...

|

Stellar’s [XLM] price has recently experienced a notable decline, trading at $0.3728, reflecting a 24-hour drop of 8.28% and a 10.36% decrease over the past week. Despite these short-term setbacks, analysts are eyeing a critical support level at $0.3851, which has historically attracted buyer interest and could signal a potential rebound for the cryptocurrency.

#Stellar ( $XLM/USDT) is trading within a corrective downtrend, maintaining strong support at $0.3851. Indicators suggest a strong rebound from this level, with upside targets at $0.6396 and $0.8278. Holding this support represents an ideal entry point for a long position." pic.twitter.com/21IjgS7cH9

— Rose Premium Signals 🌹 (@VipRoseTr) December 19, 2024

Support Level at $0.3851: A Key Turning Point

The $0.3851 support zone is of significant importance for Stellar, as it aligns with the 0.786 Fibonacci retracement level, often indicating oversold conditions. This level has historically been a point of buyer activity, and if XLM can hold above it, the cryptocurrency could be poised for a strong recovery. Analysts suggest upside targets of $0.6396 and $0.8278, which represent substantial growth potential if the price reverses from its current downtrend.

Technical Indicators: A Mixed Picture

Technical indicators are showing mixed signals for XLM. The recent price decline follows a broader corrective trend after a significant rally in late November. The MACD (12, 26) indicator, a commonly used momentum tool, has formed a bearish crossover, with the MACD line dropping below the signal line and the histogram turning negative. This suggests that bearish momentum remains in the short term.

However, the Fibonacci retracement level at $0.3851 may provide the foundation for a bullish reversal if momentum indicators shift in a positive direction. If XLM can stabilize at this support level, it could lay the groundwork for a price surge in the coming weeks.

Derivatives Data and Market Sentiment

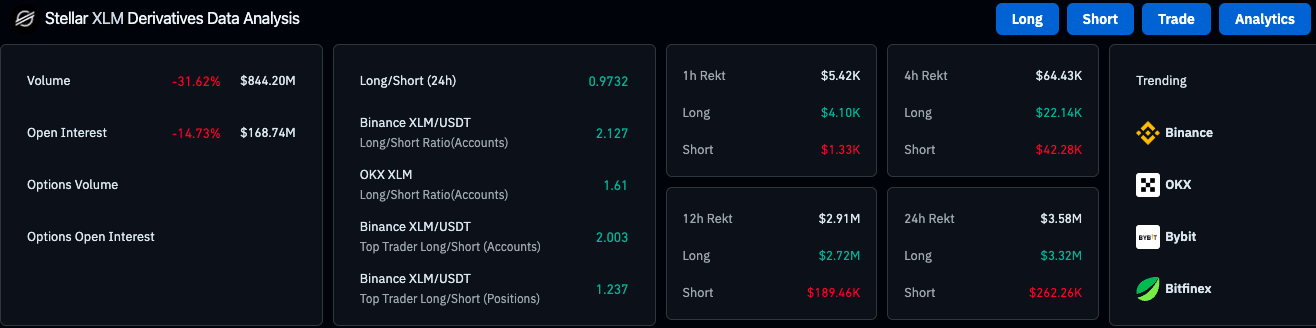

Despite the recent drop in trading volume (down 31.62% to $844.20M) and open interest (down 14.73% to $168.74M), derivatives data indicates a bullish bias among traders. Binance’s Long/Short Ratios above 2.0 show that traders are favoring long positions over short ones, suggesting confidence in a potential recovery. However, with $3.58M in 24-hour liquidations, primarily affecting long positions, caution is advised as market volatility remains high.

On-Chain Data and Ecosystem Metrics

On-chain data from DeFiLlama highlights a 4.21% drop in Stellar’s Total Value Locked (TVL) over 24 hours, currently standing at $46.53M. Additionally, Stellar’s stablecoin market cap is at $143.09M, and the network has raised $3M, emphasizing its growing utility in decentralized finance. With a circulating supply of 30 billion XLM and a market cap of over $11.53 billion, Stellar remains a cryptocurrency with substantial growth potential if the rebound materializes.

As Stellar approaches this critical support level, all eyes will be on its ability to hold the $0.3851 mark, which will likely determine the next phase of its market journey.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.