|

Getting your Trinity Audio player ready...

|

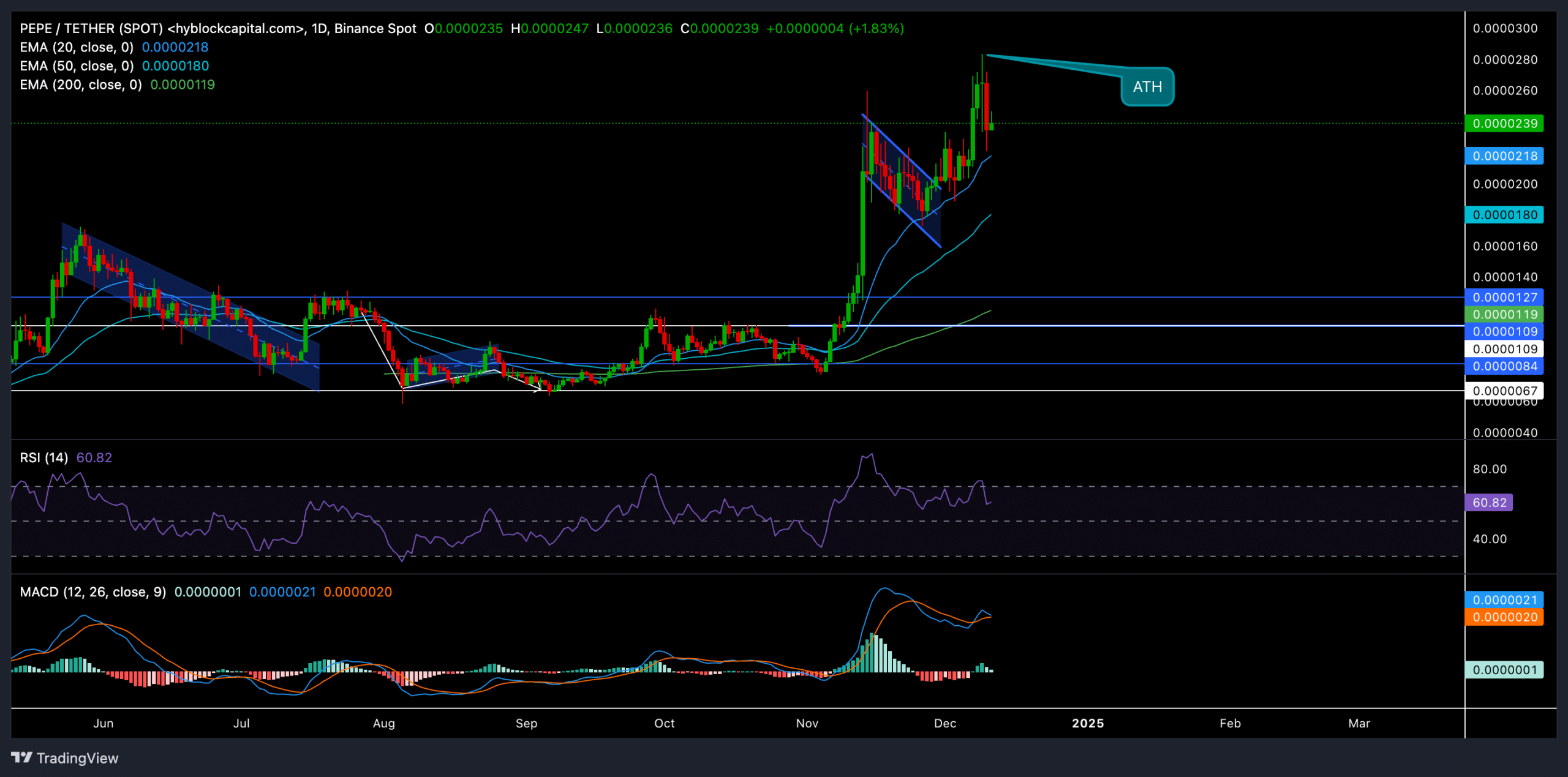

The cryptocurrency market has once again witnessed a captivating surge, this time led by the memecoin PEPE. In a stunning display of volatility, PEPE rallied over 250% to reach an all-time high (ATH) of $0.0000284 on December 9th. This explosive growth coincided with a broader memecoin supercycle and Bitcoin’s sustained bullish sentiment.

A Pause for Breath?

While the recent rally has been impressive, PEPE has since retreated slightly, currently trading at $0.0000239. The 20-day Exponential Moving Average (EMA) has provided crucial support during this correction. A sustained rebound from this level could potentially propel the price into a new discovery phase, targeting even higher highs.

Key Levels to Watch

As PEPE consolidates its gains, traders should keep an eye on the following key levels:

- Support: The $0.000018 to $0.00002 range, aligned with the 20-day EMA, serves as a critical support zone for buyers. A breach below this level could invalidate the bullish trend and potentially lead to a decline towards $0.000015.

- Resistance: A decisive move above the $0.000025 resistance level could pave the way for a further rally towards the ATH of $0.0000284. Breaking this level could open doors to an extended uptrend, potentially targeting $0.00003.

Technical Analysis: A Cautious Outlook

Technical indicators offer a somewhat mixed picture. The Relative Strength Index (RSI) is currently hovering near 61, indicating moderate bullish momentum. While it’s not yet in overbought territory, the possibility of a consolidation phase cannot be ruled out.

The Moving Average Convergence Divergence (MACD) has not yet formed a full bearish crossover, suggesting that selling pressure may be limited in the near term. However, traders should wait for the Signal line to stabilize before confirming a trend reversal.

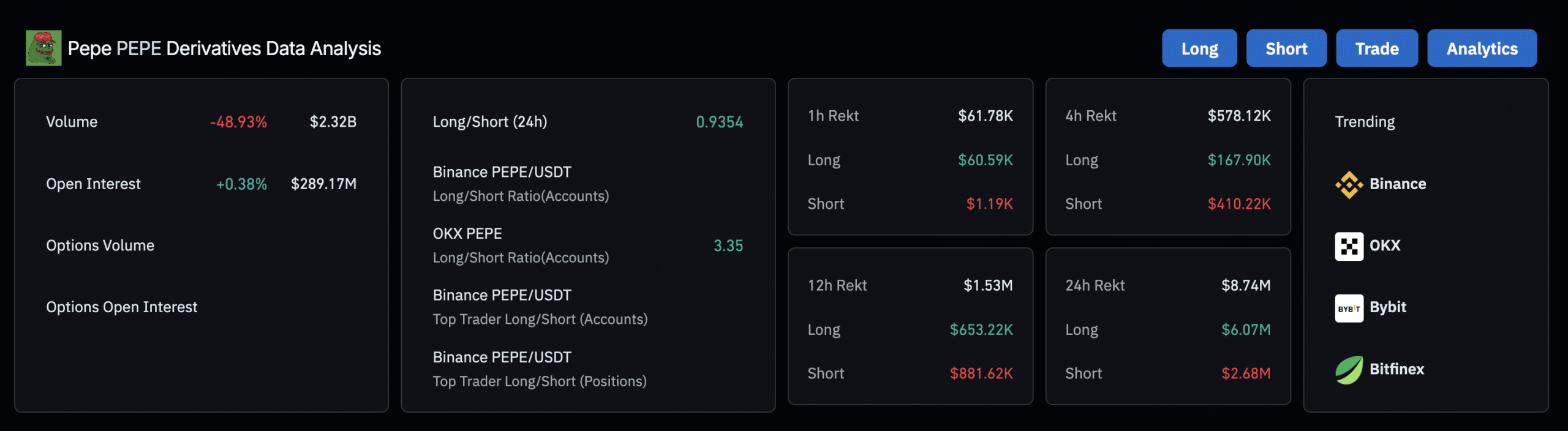

Derivatives markets offer valuable insights into trader sentiment and positioning. Over the past day, trading volume has decreased by nearly 49%, indicating reduced market activity following the recent rally. Open Interest has seen a slight uptick, suggesting cautious participation from traders.

The long/short ratio is currently slightly below 1, indicating a neutral sentiment. However, the ratio on OKX is well above 3, suggesting a strong bullish bias among traders on that platform.

Liquidation data reveals that the recent price correction caught over-leveraged long positions off guard, with long liquidations significantly exceeding short liquidations.

Also Read: PEPE’s Rollercoaster Ride: Frog Meme Coin Faces Year-End Volatility Amid Market Buzz

While PEPE’s recent rally has been impressive, traders should approach the market with caution. The high volatility of memecoins can lead to sharp reversals. Bitcoin’s continued bullish momentum could provide additional support for PEPE, but it’s crucial to monitor technical indicators and derivatives data for early signs of a potential trend change.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.