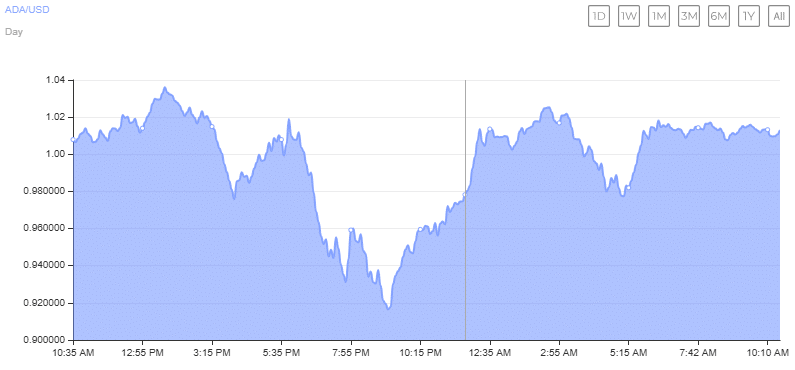

Cardano (ADA) recently achieved a yearly high of $1.3, breaking through key resistance levels. However, this upward momentum has quickly reversed, with ADA now experiencing a significant 20% decline on the weekly price chart. In the past 24 hours alone, ADA has dropped by 8.5%, currently trading at $1.016. So, what’s behind this sudden dip, and is there a possibility of a rebound?

Broader Market Pullback

The cryptocurrency market as a whole has endured its fastest flush-out since September, with traders opting to take profits following recent gains. According to Coinglass data, crypto liquidations reached a staggering $1.76 billion in just 24 hours, with $1.58 billion of that coming from long liquidations. This mass liquidation affected 583,647 traders, the largest event of which took place on Binance, with the ETH/USDT pair seeing $19.69 million in liquidations. Analyst Michael van de Poppe noted that some cryptocurrencies lost as much as 30% of their value during this downturn, which may have contributed to ADA’s sharp price decline.

Analyst Predictions for ADA’s Future

Despite the recent downturn, some analysts remain optimistic about Cardano’s long-term prospects. Crypto analyst Ali Martinez, who previously predicted ADA could reach $4, continues to accumulate the asset even amid its current bearish trend. Martinez referenced a historical pattern from 2020, where ADA exhibited a similar price movement before ultimately rebounding. This aligns with a recent report suggesting ADA could hit $2 in the near term.

On-Chain Data and Market Sentiment

Examining Cardano’s on-chain data reveals some interesting insights. The Futures Open Interest (OI) for ADA has fallen by 25%, signaling reduced market speculation on ADA’s price movements. The Relative Strength Index (RSI) currently sits at 53, indicating neutral market sentiment. However, Martinez believes the $1.2 mark is a critical support level, where 93,000 addresses hold 2.54 billion ADA. He views $1 as the next major accumulation zone for ADA, providing a potential entry point for long-term investors.

Technical Analysis: Could ADA Reach a New All-Time High?

Another analyst, Dan Gambardello, has a more bullish outlook for ADA. Gambardello predicts that ADA could hit a new all-time high within the next 30 to 60 days, based on historical market patterns and the recent growth in Cardano’s network activity, which now handles over a million transactions per second. He also highlights the ongoing political developments in the U.S., particularly the potential re-election of Donald Trump and the appointment of former SEC commissioner Paul Atkins as SEC Chairman. According to Gambardello, these factors could contribute to a favorable environment for ADA’s growth.

Cardano All Time High In 30-60 Days (ADA Linked To Trump SEC Pick)

— Dan Gambardello (@cryptorecruitr) December 4, 2024

Intro 00:00

1,000,000 TPS! 1:35

Trump SEC pick tied to cardano 3:25

Crypto/com 5:00

Important monthly cardano chart 6:05

Potential ADA dip makes sense 7:30

The path to all time high 9:30 pic.twitter.com/lCKKpe8NUa

Technically, ADA is currently testing a critical resistance level that Gambardello refers to as the “bull market doors.” If the cryptocurrency follows a similar pattern to its previous cycles, ADA could breach this level by December 31, potentially setting the stage for a significant price rally.

Also Read: Cardano’s Struggle: Will ADA Bounce Back from Recent 12% Drop or Face Further Decline?

While Cardano (ADA) faces short-term volatility, multiple analysts predict that the asset has the potential to rebound and hit new highs in the coming months. Whether ADA can capitalize on its network growth and favorable market conditions remains to be seen. As always, investors should stay cautious and watch key support levels, including the $1.2 mark, for signs of a potential recovery.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.