BlackRock’s iShares Bitcoin Trust (IBIT) has shown remarkable resilience, defying the recent crypto market volatility. Despite Bitcoin’s recent price drop to the $94,000 level, IBIT has continued to attract significant inflows. On Monday, December 9th, the ETF saw a massive influx of $358 million, equating to over 4,000 Bitcoin. This surge in demand from institutional investors has propelled IBIT’s daily trading volume to $3 billion.

A Historic Milestone

IBIT has achieved a historic milestone, surpassing $50 billion in assets under management (AUM) in just 228 days. This unprecedented growth rate is more than five times faster than any other ETF in history, including the gold ETF GLD, which took 5.5 years to reach the same milestone.

Outpacing Satoshi Nakamoto

The collective holdings of Bitcoin ETFs have now surpassed those of Bitcoin’s enigmatic creator, Satoshi Nakamoto. With over 1.1 million BTC under management, these ETFs have become a significant force in the crypto market.

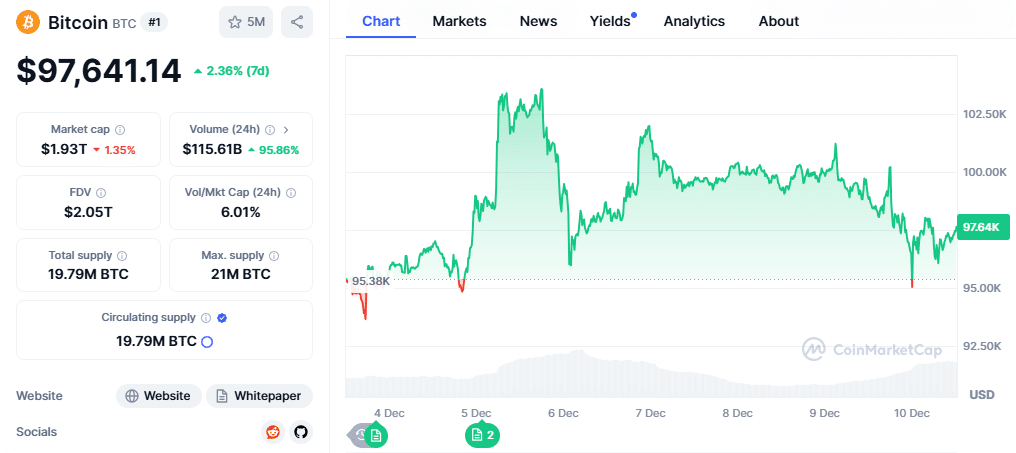

Bitcoin’s Price Correction

After multiple rejections at the $100,000 level, Bitcoin has experienced a significant price correction, falling below $95,000. This downward trend has triggered a broader market sell-off, impacting altcoins like XRP and DOGE, which have seen double-digit declines.

Institutional Demand and Market Sentiment

While institutional demand for Bitcoin remains strong, as evidenced by the continued inflows into IBIT, the market is awaiting additional catalysts to sustain a rally above $100,000. The upcoming US Federal Reserve interest rate decision and the release of key economic indicators, such as the US CPI, will play a crucial role in shaping market sentiment.

As the crypto market continues to evolve, the growing influence of institutional investors and the increasing adoption of Bitcoin ETFs are likely to shape the future of digital assets.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.