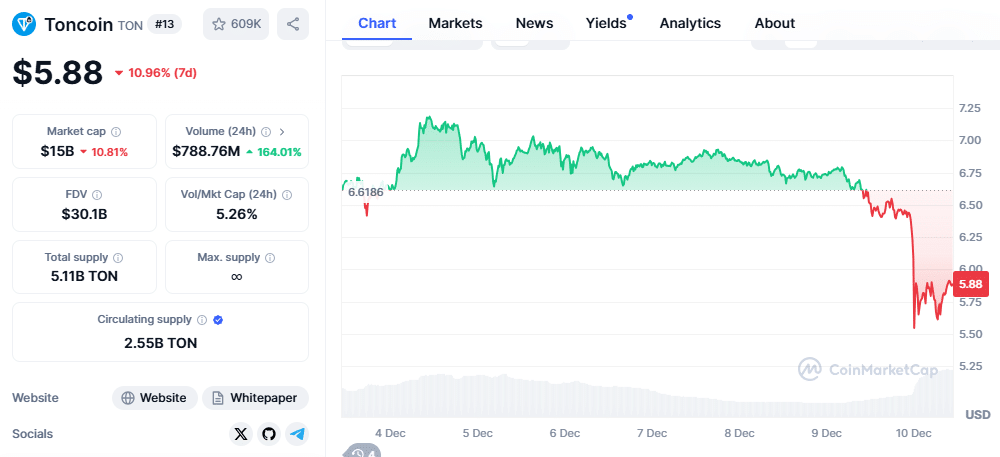

Toncoin (TON) has been trading sideways recently, with a slight bearish bias. As we approach 2025, the cryptocurrency market is eager to understand the potential trajectory of this promising blockchain project.

Technical Analysis

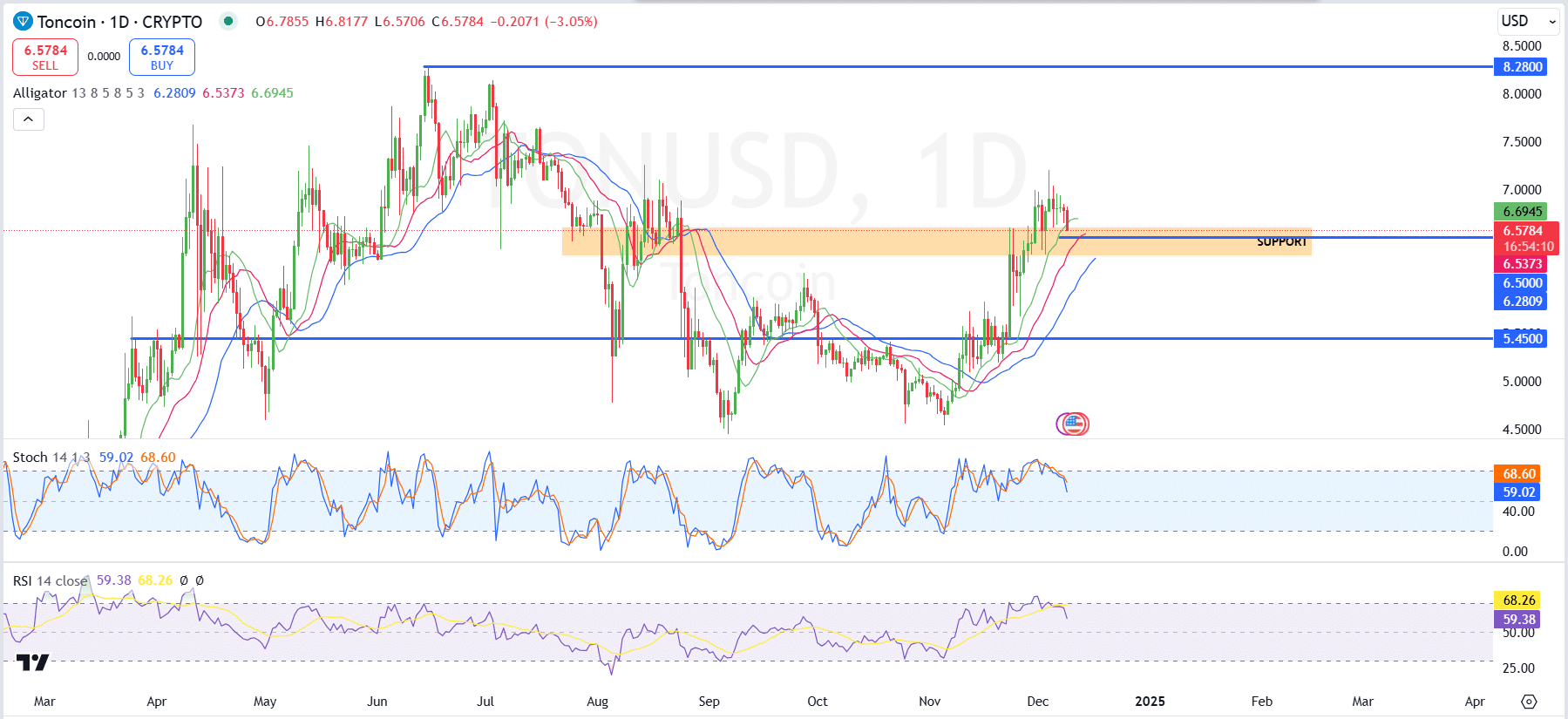

At the time of writing, TON was trading at $6.58, down 3.54% daily. The key support level of $6.50 is crucial, as it has previously acted as resistance and could provide a foundation for a potential recovery.

Technical indicators suggest a mixed outlook:

- Alligator Indicator: The indicator shows consolidation, with the fast moving average flattening near the current price.

- Momentum Indicators: The Stochastic RSI at 59.02 and the 14-day RSI at 59.38 indicate weakening bullish momentum.

For a bullish continuation, TON needs to break above $7.2 and target $7.5, which could pave the way for a potential retest of its all-time high of $8.24. However, a breach below $6.50 could lead to a decline toward $6.28 and deeper support at $5.45.

Network Activity and Market Sentiment

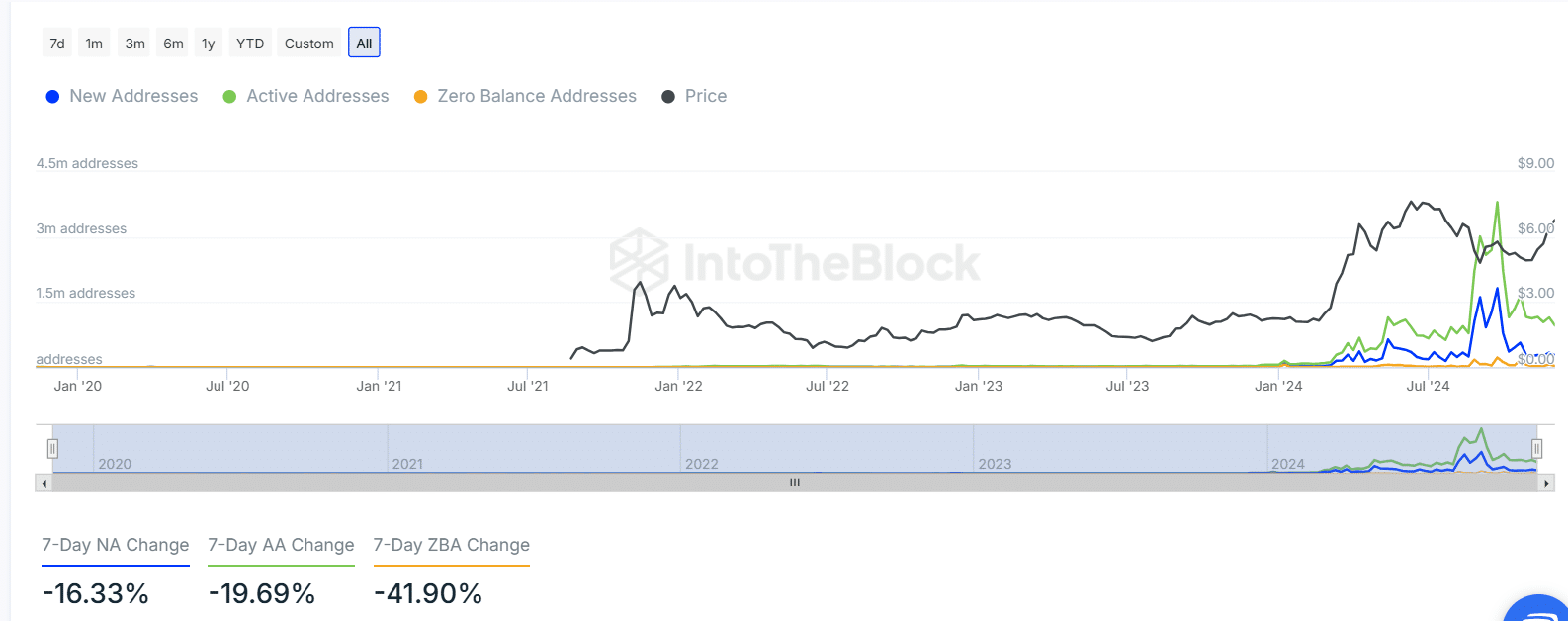

Network activity for TON has been declining, with new addresses down 16.33% and active addresses dropping 19.69%. The decrease in zero-balance addresses indicates reduced engagement across the blockchain. This correlation between network activity and price movements highlights the importance of increased participation for a potential rebound.

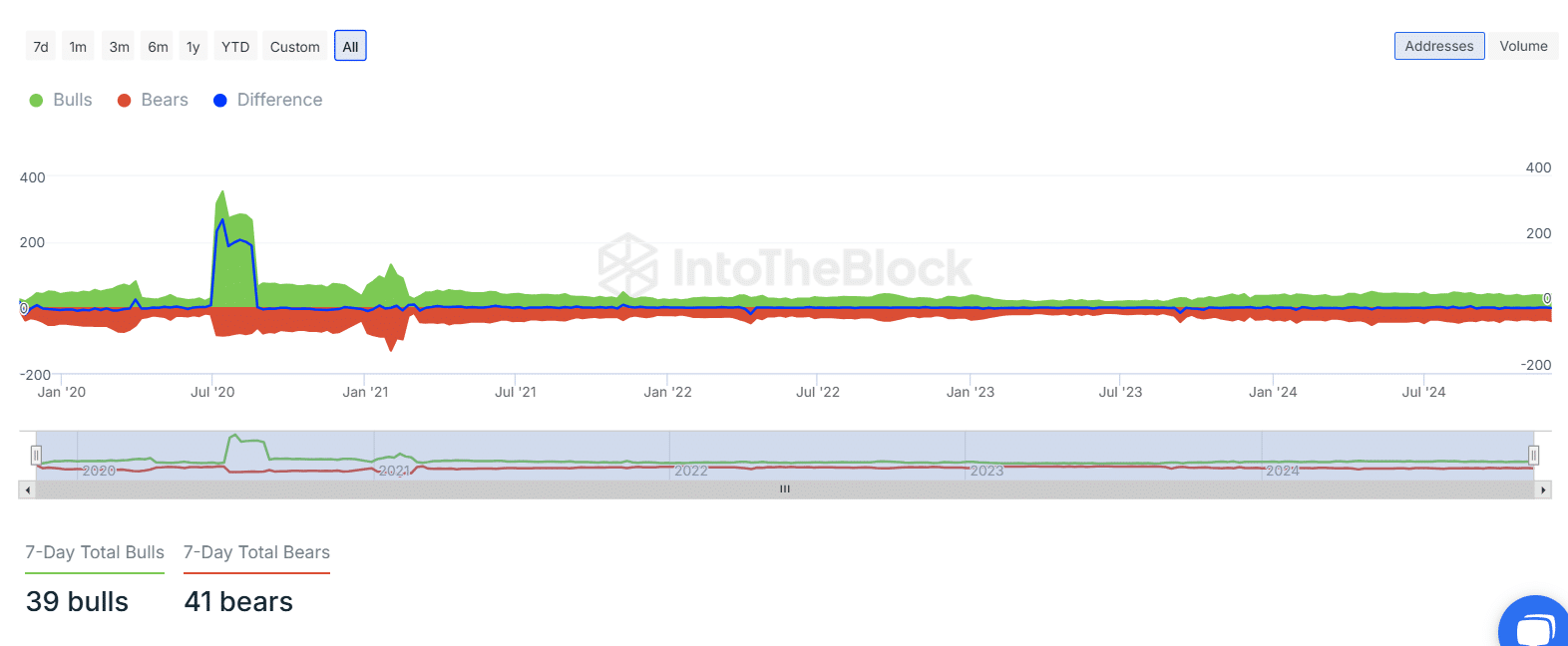

Market sentiment for TON has been slightly bearish in the past week. The difference between bulls and bears is hovering near neutral levels, suggesting a consolidating market. Historical data shows cyclical shifts in sentiment, with periods of strong bullish dominance followed by bearish trends.

As we approach 2025, TON‘s price prediction remains uncertain. While the project holds significant potential, the current market sentiment and network activity suggest a cautious outlook. A renewed focus on network growth and increased user engagement could fuel a bullish resurgence. However, investors should closely monitor technical indicators and market trends to make informed decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Toncoin Surges to $6.7 – Can the Rally Continue? Key Levels and Strategies for Traders