Over the past 24 hours, Render (RNDR) has captured the spotlight with a staggering 40.16% rally, propelling its price to a nine-month high of $11.853. This surge in value has been accompanied by an exponential increase in trading activity, with volumes soaring 244.93% to $4.23 billion. Render’s market capitalization also crossed the $5 billion mark, solidifying its position as a top-performing altcoin.

RNDR Outperforms Major Cryptos

Render’s rally comes amidst a mixed performance across the cryptocurrency market. Despite Bitcoin (BTC) surpassing the $100,000 milestone, Render outshined the leading cryptocurrency in terms of percentage gains. Other notable AI-focused cryptocurrencies like Internet Computer Protocol (ICP) and Bittensor (TAO) recorded losses of 2.08% and 5.23%, respectively. In contrast, NEAR Protocol (NEAR) edged up by 2.7%.

Major players like Ripple (XRP) and Solana (SOL) faced declines of 9.71% and 0.70%, respectively, while Ethereum (ETH) registered a modest gain of 4.6%. Render’s explosive performance, therefore, stands out as a testament to its growing market interest and adoption.

Key Drivers of Render’s Momentum

1. Rising Open Interest (OI)

Render’s Open Interest has hit an all-time high of $173.08 million, according to Coinglass. This metric highlights an influx of new investors opening positions, with existing ones maintaining their trades. The surge in OI suggests heightened speculative activity and optimism among market participants.

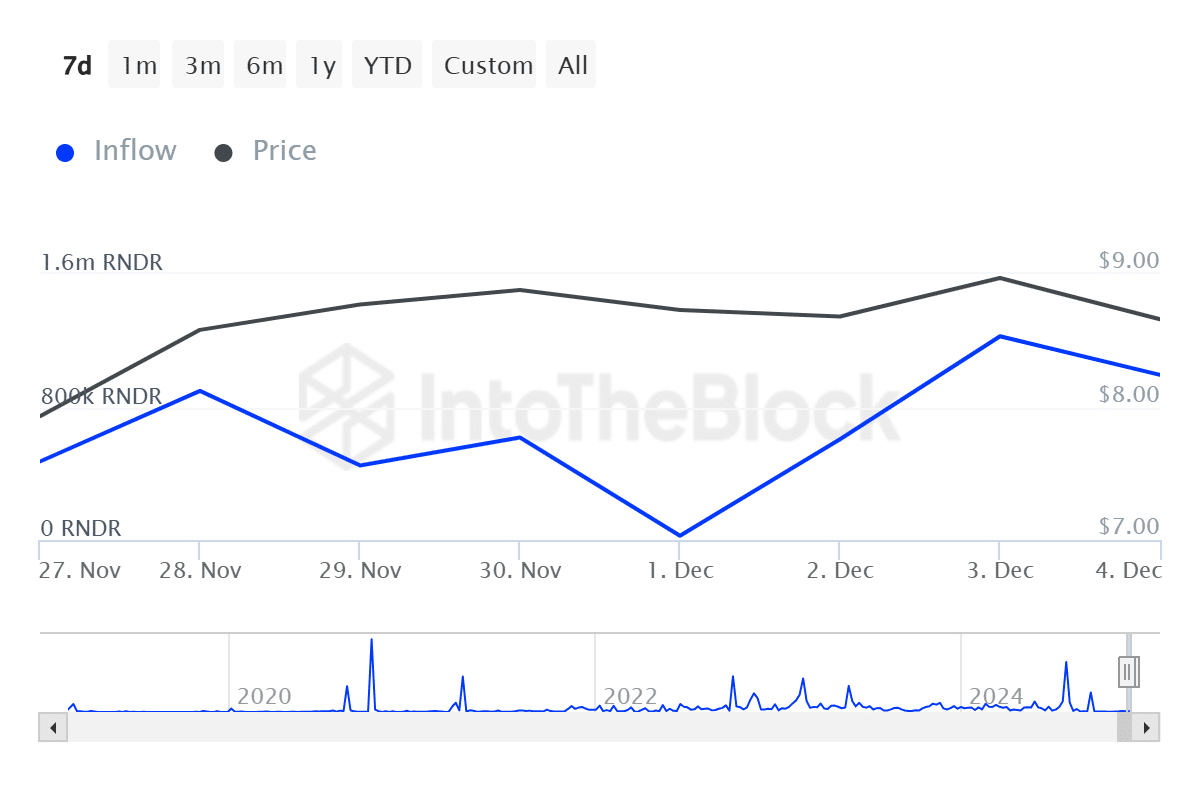

2. Whale Accumulation

Large holders’ inflow has skyrocketed by 4627% since December 1, indicating that whales are actively accumulating RNDR. This significant increase in whale activity often signals long-term confidence in the asset and can fuel further price gains.

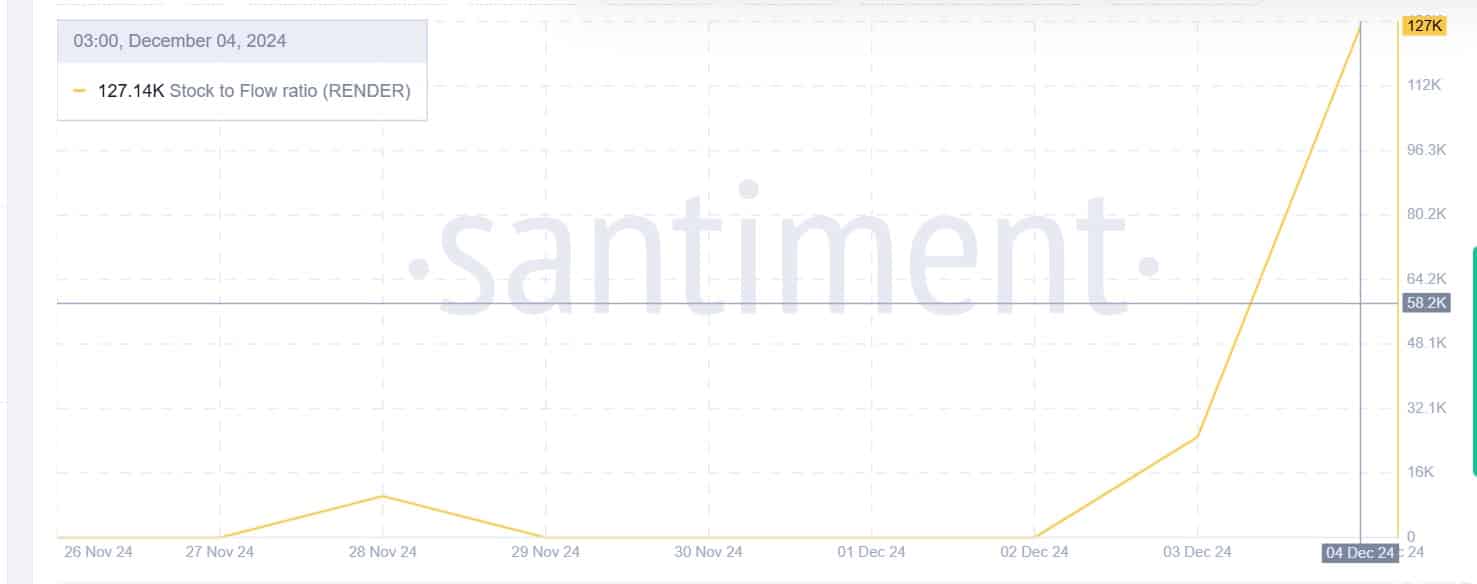

3. Scarcity Effect

Render’s Stock-to-Flow ratio surged from zero to 127.14k over the past week, reflecting a shift from oversupply to scarcity. This reduced availability in the market typically heightens demand, driving prices upward.

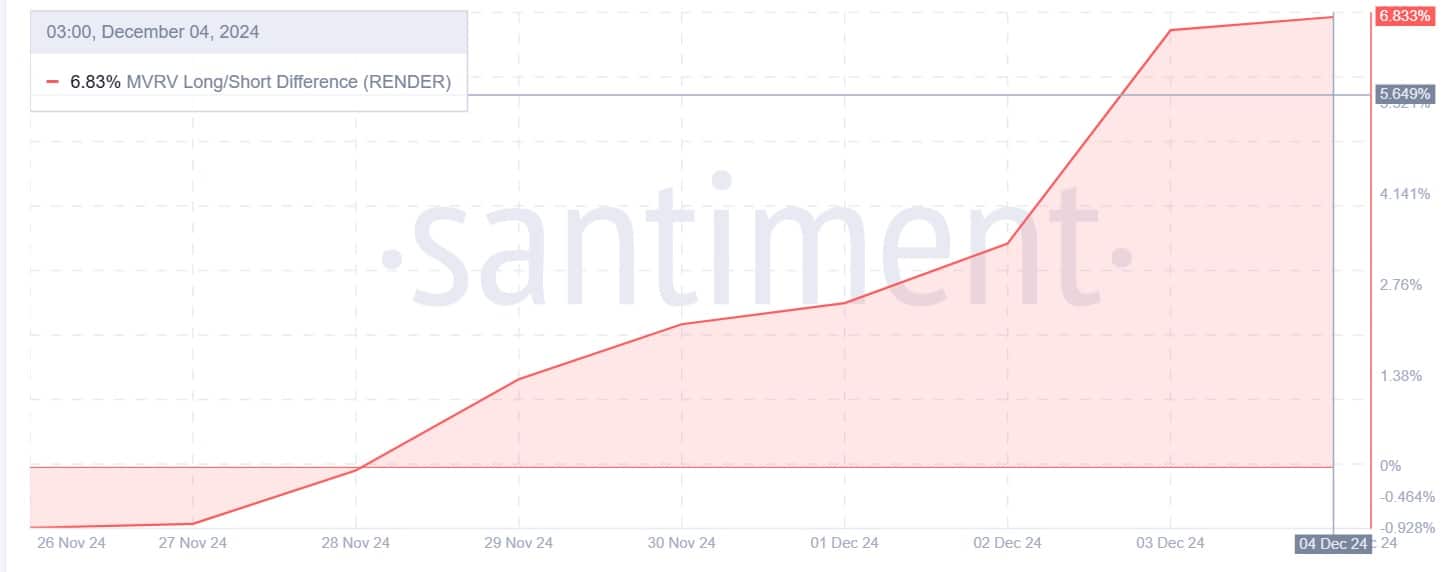

4. Improved Profitability for Holders

The MVRV Long/Short Difference has climbed from 0.04% to 6.83%, signifying higher profit margins for long-term holders. This trend indicates sustained confidence among investors in Render’s future potential.

Can RNDR Maintain Its Momentum?

While the current bullish sentiment positions Render for further gains, the altcoin faces resistance at $12.095. If it breaks through this level, minimal resistance lies ahead, potentially paving the way for a new all-time high.

However, the sustainability of this rally hinges on market sentiment, continued whale accumulation, and broader crypto market trends. For now, Render appears poised to capitalize on its momentum, making it one to watch in the days ahead.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.