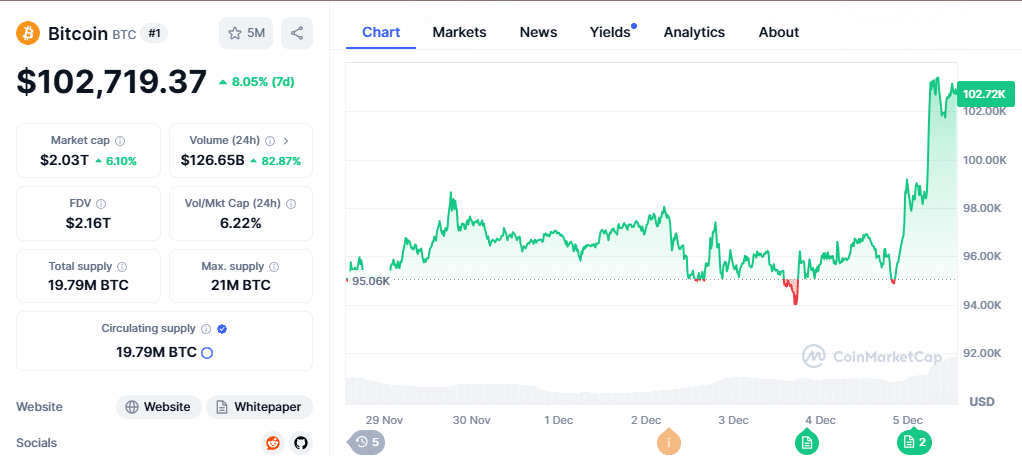

Bitcoin (BTC) has achieved a historic feat, surpassing the $100,000 mark for the first time ever. As of December 5th, the leading cryptocurrency’s price sits above $103,000, reflecting a remarkable 7% surge within the last 24 hours. This momentous occasion coincides with a significant transfer of 24,000 BTC from the once-dominant exchange, Mt. Gox.

Mt. Gox on the Move: $2.4 Billion in Bitcoin Transferred

On December 5th, at approximately 2:45 AM UTC, Mt. Gox executed a substantial transfer of 24,051 BTC, valued at nearly $2.47 billion. The Bitcoin was sent to a new address starting with “1N7j,” marking the first movement of funds from the exchange since November 12th. The precise reason behind this transfer remains shrouded in mystery.

Mt. Gox transferred 24,052 $BTC ($2.43B) to a new wallet, “1N7jW,” an hour ago, right after the $BTC price broke through the $100K milestone.

— Spot On Chain (@spotonchain) December 5, 2024

However, the new wallet is likely just an internal address.

Currently, Mt. Gox still holds 15,826 $BTC ($1.63B) across 31 known wallet… pic.twitter.com/W1kyoSDEHc

Blockchain analytics platform Spot On Chain speculates that the new address could be an internal wallet controlled by Mt. Gox. Their analysis suggests the exchange still holds a significant amount of Bitcoin, with an estimated 15,826 BTC (valued at roughly $1.63 billion) spread across 31 known wallets.

A History of Mt. Gox Fund Movements

Mt. Gox has a history of transferring large quantities of Bitcoin, particularly when preparing to settle with creditors. The exchange’s recent activity aligns with this pattern. In the days leading up to the $100,000 milestone, Mt. Gox executed a series of transfers, including:

- November 12th: 262.782 BTC (valued at $27 million) and 2.3K BTC (worth approximately $238 million) to undisclosed wallets.

- November 3rd: Substantial amounts moved to internal wallets, totaling 2.5K BTC ($255 million) and 27.87K BTC ($2.84 billion).

- Early November: Over $2 billion in Bitcoin transferred to three wallets within a two-hour window, coinciding with the final stages of the U.S. presidential election campaign.

- November 4th: 32,371 BTC (valued at roughly $2.19 billion) sent to various wallets, with the majority directed to an unknown address.

Unanswered Questions and Market Speculation

The timing and nature of Mt. Gox’s recent transfers have sparked speculation within the cryptocurrency community. Some believe the exchange might be preparing for a larger distribution to creditors, while others suspect these actions could be related to internal restructuring or investment strategies.

As the investigation into Mt. Gox’s motives continues, one thing is certain: the exchange’s activity coincides with Bitcoin’s historic price surge. Whether this is a mere coincidence or a contributing factor remains to be seen. Only time will tell how these developments will impact the future trajectory of Bitcoin and the broader cryptocurrency market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Bitcoin Hits New All-Time High of $103K: 3 Key Catalysts Driving the Surge to $2 Trillion Market Cap