|

Getting your Trinity Audio player ready...

|

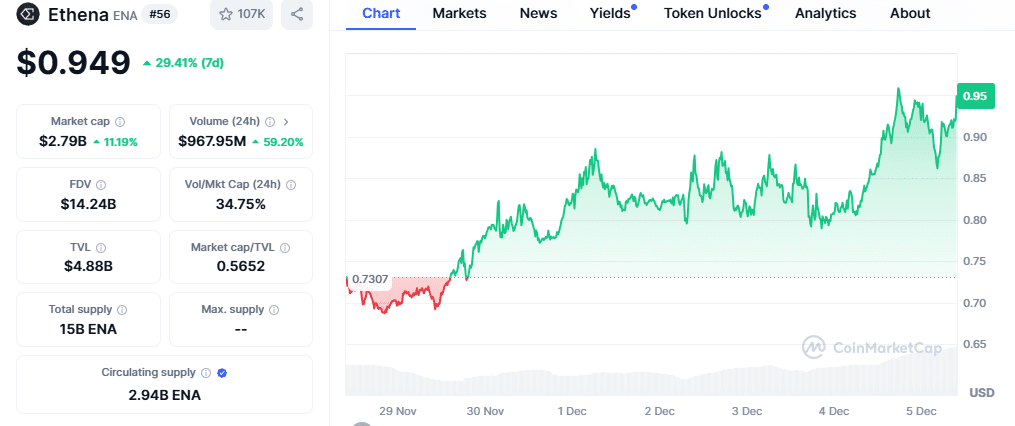

Ethena (ENA), a cryptocurrency backed by traditional finance (TradFi) institutions, is experiencing a meteoric rise, reaching record highs and captivating the crypto market. This surge coincides with growing interest in stablecoins, and Ethena’s unique offerings seem to be striking a chord with investors.

Technical Analysis Points to Upward Trend

Ethena’s price chart paints a bullish picture. Consistent “higher highs” and “higher lows” signal a strong upward trend. A key technical milestone was achieved with the breakout above $0.85 USD, which now acts as a crucial support level. Furthermore, minimal pullbacks suggest sustained demand, further bolstering bullish momentum.

Analysts like Ansem point towards a potential “cup and handle” formation on the chart, suggesting a continuation of the upward trajectory. While trading volume data isn’t explicitly mentioned, such breakouts often correlate with increased activity, reflecting growing confidence in ENA’s future value.

Strong Fundamentals Attract Investors

Beyond technical indicators, Ethena boasts impressive fundamental metrics. The project boasts a Total Value Locked (TVL) nearing $5 billion, offering an attractive annual percentage yield (APY) of approximately 30% on stablecoin investments. This combination – high returns and substantial TVL – makes Ethena particularly appealing, especially for institutional investors seeking yield in a low-interest-rate environment.

Institutional Backing Adds Credibility

Ethena’s credibility is further enhanced by the backing of financial powerhouses like Franklin Templeton and Fidelity. This collaboration with established TradFi players signals growing confidence in Ethena’s long-term viability and adoption potential.

Standing Out from the Stablecoin Crowd

Ethena enters a market dominated by established stablecoins like Tether (USDT) and USD Coin (USDC) – boasting market caps of $135 billion and $40 billion respectively. However, Ethena differentiates itself through its high interest rates and innovative approach, attracting investors seeking higher returns on their holdings.

Also Read: Ethena’s USDe Stablecoin Surpasses DAI, Soars to $4.77B Market Cap with 29% APY Yield Strategy

Analyst Ansem further highlights the untapped potential of billions in TradFi capital that could potentially flow into Ethena’s ecosystem. This aligns with the current bullish sentiment surrounding the token, as investors and institutions explore diversification opportunities within the evolving digital asset landscape.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.