|

Getting your Trinity Audio player ready...

|

- Ethereum (ETH) Poised for Record Highs as It Mirrors Bitcoin’s Historical Bull Run

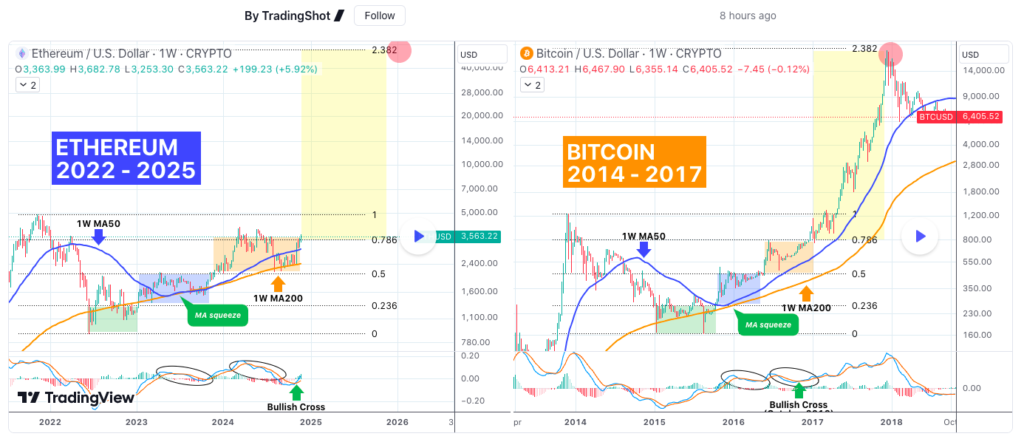

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, appears on the cusp of a major breakout, with analysts drawing parallels between its current price movements and Bitcoin’s (BTC) historic 2014-2017 bull run. This promising setup could signal a path to unprecedented highs for Ethereum in the ongoing market cycle.

Bitcoin’s 2014-2017 Playbook Reimagined for Ethereum

According to a TradingView analysis by TradingShot, Ethereum’s technical structure closely resembles Bitcoin’s trajectory leading up to its 2017 all-time high. Both assets experienced a prolonged bear market, followed by an early bull phase, marked by price consolidations and rallies along key technical levels.

Ethereum recently confirmed a bullish crossover in October 2024, a signal reminiscent of Bitcoin’s October 2016 breakout, which paved the way for its parabolic rise. If Ethereum follows this blueprint, the cryptocurrency could achieve its next target around the 2.382 Fibonacci level—potentially exceeding $50,000.

Institutional Interest Drives Momentum

One of the key drivers for Ethereum’s bullish outlook is increasing institutional interest. The approval of Ethereum spot exchange-traded funds (ETFs) has brought fresh capital inflows into the market, pushing ETH to break the $3,600 resistance for the first time in over five months.

On-chain analyst Ali Martinez recently predicted a potential surge to $6,000 in the short term, with a long-term target of $10,000. Meanwhile, Trader Tardigrade highlighted Ethereum’s breakout from an inverse head-and-shoulders pattern, a bullish indicator suggesting a move toward $5,800.

Caution Amid Optimism

Despite the bullish sentiment, experts have cautioned investors about possible pullbacks. Trading expert CrediBULL warned of a potential drop toward $3,000, contingent on Bitcoin’s price movements. Similarly, Ethereum’s immediate challenge is holding the $3,600 resistance level to validate the ongoing upward momentum.

Recent strength on $ETH is nice to see but we are now approaching the first "trouble area" on the ETH/BTC pairing.

— CrediBULL Crypto (@CredibleCrypto) November 27, 2024

A rejection here and lower high would give us a push into weekly demand, which, paired with a ~10% correction on $BTC would give us our major 2700-2800 buy zone.… pic.twitter.com/EaD59OmQao

Ethereum is currently trading at $3,609, with a modest daily gain of 0.1% and a weekly increase of nearly 10%. Short-term bullish indicators, such as the alignment of Fibonacci levels and moving averages, support a positive outlook, but the path forward will likely remain volatile.

What’s Next for Ethereum?

If Ethereum achieves its lofty $50,000 target, its market capitalization could exceed $6 trillion, positioning it as the second-largest asset globally behind gold. While such valuations seem ambitious, the growing institutional adoption and ETF-driven inflows could make these predictions a reality.

For now, Ethereum remains a critical asset to watch, as its performance could shape the broader cryptocurrency market in the months ahead. Whether you’re an investor or an observer, Ethereum’s journey is far from over—and its next chapter promises to be historic.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

The latest Crypto News on Blockchain, Crypto, NFTs, Bitcoin, DOGE, XRP, Cardano IOTA, SHIB, ETH, DeFi, and the Metaverse.