|

Getting your Trinity Audio player ready...

|

Ethereum co-founder Vitalik Buterin has once again sold a significant amount of ETH, raising questions about its impact on the market. According to data from Spotonchain, Buterin’s wallet, identified by the address “0xa7ef,” transferred 20,000 ETH (around $72.5 million at the time of the transaction) to a deposit wallet associated with cryptocurrency exchange Kraken on November 28th, 2024, at 12:59 UTC.

Jeffrey Wilcke, #Ethereum co-founder, deposited 20,000 $ETH ($72.5M) to #Kraken 30 minutes ago, just as $ETH made a strong comeback today!

— Spot On Chain (@spotonchain) November 28, 2024

This is the fourth time he unloaded $ETH in 2024, totaling 44,300 $ETH ($148M) at an average price of $3,342.

Follow @spotonchain now and… https://t.co/zriXX9jbKD pic.twitter.com/iDEeptqrKI

This marks Buterin’s fourth Ethereum sale this year. Spotonchain data reveals previous sales of 10,000 ETH in May (worth $37.38 million then), bringing his total 2024 sales to 44,300 ETH at an average price of $3,342.

Market Reaction and Analyst Predictions

The 20,000 ETH transfer coincided with a renewed downward pressure on the Ethereum price. After reaching an intraday high of $3,664, Ethereum has fallen over 2% and is currently trading below $3,600. This comes despite a broader market recovery yesterday, where the altcoin surged over 9% from the $3,300 zone to a five-month high. Analysts believe selling pressure and a general market correction are responsible for the recent price dip.

However, long-term optimism for Ethereum remains strong. Market commentator Ali Martinez recently predicted bullish upsides with mid-term targets of $6,000 and a long-term target of $10,000.

On-Chain Data Suggests Bullish Fundamentals

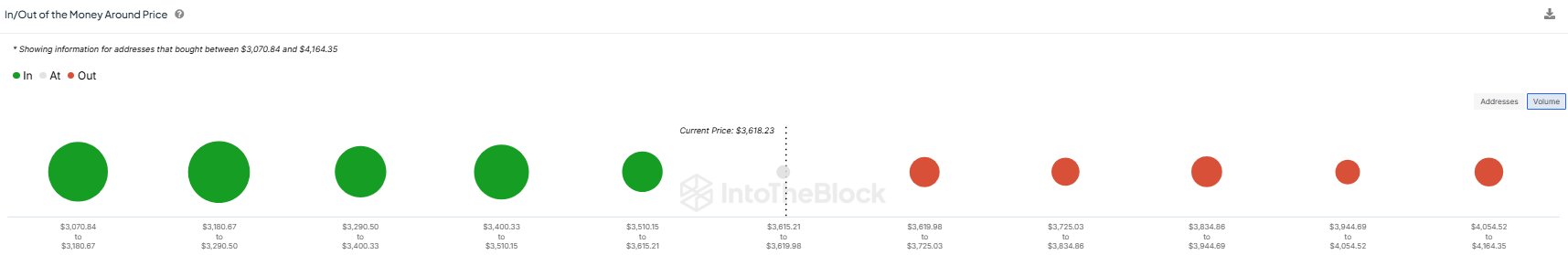

Despite the short-term price dip, on-chain analysis paints a bullish picture for Ethereum in the long run. Data from IntoTheBlock indicates “mostly bullish” signals for the second-largest cryptocurrency. While net network growth and large transactions remain neutral, metrics like “in the money” and concentration show positive signs.

The “in the money” metric indicates an increase in the number of Ethereum holders currently in profit. Additionally, the “concentration” metric highlights a rise in whales holding between 0.1% and 1% of the circulating Ethereum supply. This suggests growing institutional interest and potential buying power.

Another indicator reveals that a staggering 90.8% of Ethereum holders are currently in profit, the highest level since June. Conversely, the remaining 9.2% “out of the money” holders control only 2.8% of the supply, suggesting limited selling pressure from them in the near future.

While Vitalik Buterin’s recent ETH sale and a broader market correction may have caused a temporary price drop, long-term analysis suggests Ethereum remains fundamentally strong. Analyst predictions and on-chain data continue to paint a bullish picture, with potential for significant price appreciation in the coming months and years.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.