As the cryptocurrency market navigates the final stretch of 2024, VeChain (VET) has emerged as a standout performer, defying broader market corrections with impressive gains. While the overall market grapples with volatility, VET’s resilience across various timeframes paints a compelling picture.

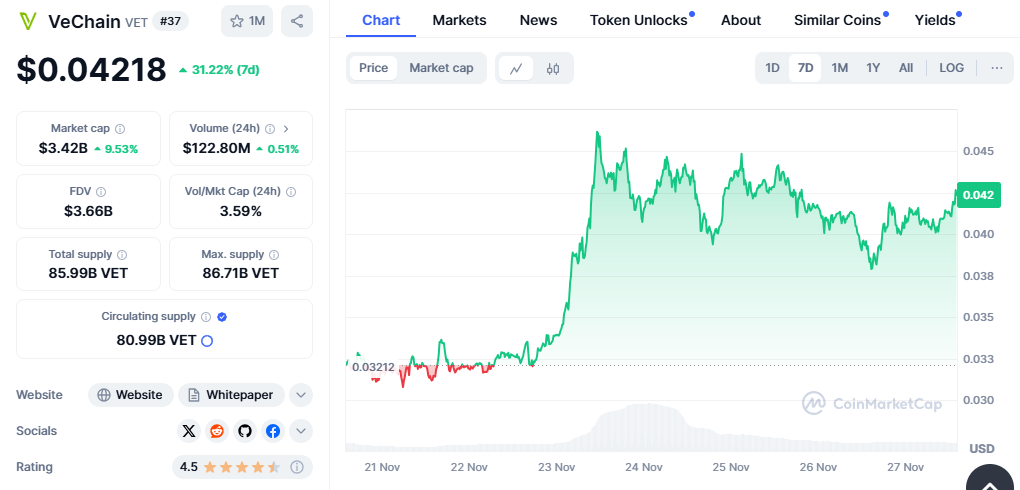

Recent market data reveals VET’s strength. While daily trading saw a modest 1.8% dip, the token boasts a stellar 37.9% weekly increase and a staggering 63.8% surge over the past two weeks. Looking at the bigger picture, VET has skyrocketed 97.7% in the last 30 days and a remarkable 98.9% since November 2023, highlighting its momentum despite short-term fluctuations.

External Factors Influencing VET’s Performance

Several external factors have undoubtedly influenced market dynamics. Bitcoin’s recent climb towards the coveted $100,000 mark sent ripples throughout the market, briefly reaching a high of $99,645.39 on November 22nd. The subsequent pullback coincided with CNBC analyst Jim Cramer’s bullish outlook, sparking discussions about market psychology and investor sentiment.

The political landscape has also played a role. The recent electoral victory of a prominent pro-cryptocurrency figure has introduced a new layer of optimism regarding future regulations, potentially benefiting the industry as a whole.

Technical Analysis Paints a Bullish Picture

Adding fuel to the fire, respected crypto analyst Ali Martinez has identified a bullish “bull flag” pattern in VET’s price action. This technical formation often precedes upward price movements, with Martinez projecting a potential 30% increase towards $0.056.

Independent analysis platform CoinCodex echoes this sentiment. Their technical indicators suggest VET could reach the $0.056 target by January 4th, 2025, with further projections indicating a potential move towards $0.080 by February 11th.

Market Dynamics and Investor Sentiment

Order book analysis reveals steady accumulation at current price levels, with resistance zones forming at key points above the market. This suggests a balanced market preparing for its next move. Healthy trading volumes further indicate sustained market interest in VET, with investors remaining engaged despite short-term price fluctuations.

Room for Growth and Historical Performance

Currently trading at a significant discount (approximately 85% below its 2021 peak of $0.281), VET presents a potential opportunity for upward movement in favorable market conditions. Technical indicators across multiple timeframes further support the bullish narrative, suggesting underlying strength in the current market structure.

Historically, VET has exhibited a tendency to correlate with Bitcoin’s movements, particularly during major market trends. This relationship could prove advantageous if Bitcoin successfully breaks through the $100,000 barrier.

Market structure analysis reveals the formation of strong support levels during the recent uptrend, bolstering analyst confidence in VET’s price action. The token’s ability to maintain its upward trajectory despite market corrections highlights its underlying strength and resilience.

Recent data confirms VET’s position as a top performer, boasting a near 99% annual growth rate that stands out in the competitive crypto market landscape. Whether this surge represents a sustainable bull run or a short-term FOMO (fear of missing out) frenzy remains to be seen. Only time will tell if VET can maintain its momentum and capitalize on the current market sentiment.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.