|

Getting your Trinity Audio player ready...

|

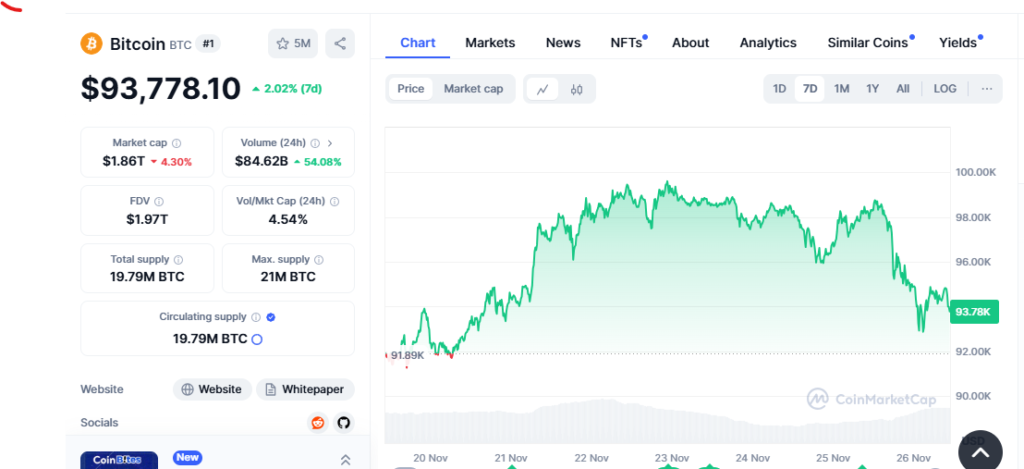

Bitcoin, the world’s largest cryptocurrency, experienced a slight dip below the $93,000 mark on November 26, 2023, but market analysts remain optimistic about its trajectory towards six figures before the year’s end.

The recent pullback, which saw Bitcoin shed nearly 7% from its all-time high of $99,645, is attributed to a combination of factors. Analysts suggest that the market is undergoing a consolidation phase after a rapid ascent, allowing for a healthy correction and reducing overbought conditions.

Markus Thielen, founder and CEO of 10x Research, explained that the dip is typical behavior towards the end of the month and that the upcoming Thanksgiving weekend could further dampen volatility. He also highlighted the potential impact of macroeconomic factors, such as the Federal Reserve’s interest rate decisions, on high-risk assets like Bitcoin.

Despite the short-term dip, the overall sentiment among analysts remains bullish. Trader and analyst Bluntz expressed confidence in Bitcoin’s upward trajectory, dismissing concerns about a significant price decline. Other market participants have referred to the current situation as a “flush before the rush,” suggesting that the pullback is a necessary precursor to further price appreciation.

Quick flush before the rush.

— ₿itcoin BTFD 🚀 (@bitcoin_BTFD) November 25, 2024

Paper hands won't make it. #BTFD #Bitcoin https://t.co/vbnyhhjrAv

Charlie Sherry, head of finance and crypto analyst at BTC Markets, emphasized the historical pattern of sharp gains followed by healthy corrections in Bitcoin’s price movements. He believes that the recent dip is part of this cyclical pattern and that the market is consolidating gains and reducing leverage before the next upward push.

While Sherry acknowledged the possibility of a deeper correction, he remains optimistic about Bitcoin’s long-term prospects. He pointed to the strong odds of Bitcoin reaching $100,000 before Christmas, as indicated by Polymarket.

CK Zheng, co-founder of ZX Squared Capital, also expressed confidence in Bitcoin’s ability to surpass the $100,000 milestone in the near future. He attributed this optimism to the potential for crypto-friendly policies under the new Trump administration.

As Bitcoin continues to navigate a volatile market, analysts and investors alike are closely monitoring its price movements and the broader macroeconomic environment. While short-term fluctuations may occur, the long-term bullish sentiment remains strong, driven by factors such as increasing institutional adoption, technological advancements, and favorable regulatory developments.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.