|

Getting your Trinity Audio player ready...

|

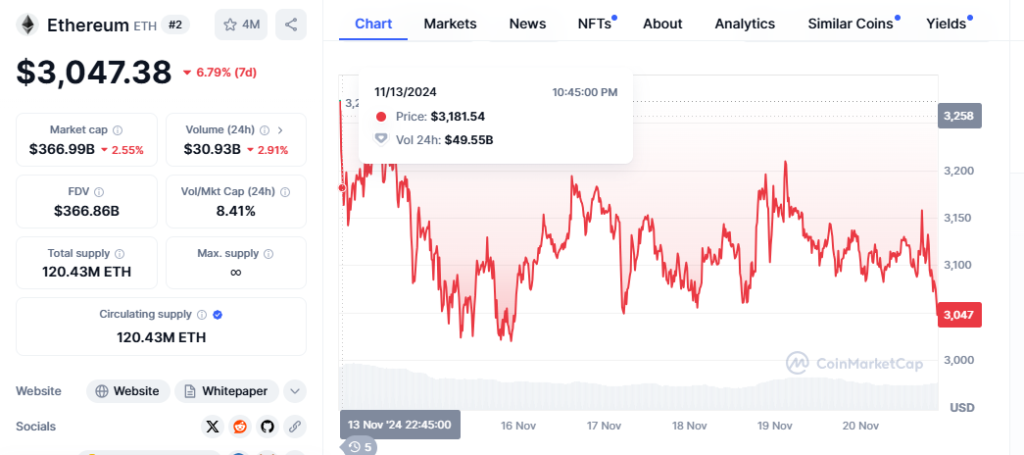

Ethereum, the world’s second-largest cryptocurrency, has been navigating a choppy market, lagging behind the broader crypto bull run. However, recent on-chain data and market sentiment suggest that a potential breakout could be on the horizon.

MVRV Momentum And Price Indicators

One key indicator to watch is Ethereum’s Market Value to Realized Value (MVRV) Momentum. This metric has historically signaled significant price appreciation when it crosses its 180-day moving average. While Ethereum’s price has recently shown strength, surpassing the $2,800 mark, the MVRV cross hasn’t yet materialized. Crypto analyst Ali Martinez believes this delay could be a precursor to a more substantial price rally.

#Ethereum $ETH is about to outperform #Bitcoin $BTC!

— Ali (@ali_charts) November 19, 2024

And here I show you the price targets 👇🧵

Whale Accumulation and Institutional Interest

Alongside technical indicators, significant on-chain activity points to growing investor confidence in Ethereum. Whale accumulation has surged, with over $1.4 billion worth of ETH being purchased in recent weeks. This trend is often seen as a bullish signal, indicating that large investors are anticipating a price increase.

#Ethereum whales have bought over 430,000 $ETH in the last two weeks, worth over $1.40 billion! pic.twitter.com/n7iTTADuax

— Ali (@ali_charts) November 14, 2024

Moreover, institutional interest in Ethereum has intensified. Ethereum spot exchange-traded funds (ETFs) have shifted from distribution to accumulation, with over $147 million worth of ETH being acquired in the past two weeks. This influx of institutional capital could further bolster Ethereum’s price.

Price Targets and Support Levels

Martinez suggests that Ethereum’s current price formation in an ascending parallel channel could lead to potential price tests at the $4,000 and $6,000 levels. Additionally, he draws parallels between Ethereum’s price movements and the S&P 500 index, suggesting that Ethereum could potentially reach a $10,000 valuation if it follows the S&P 500’s bullish trajectory.

To maintain a bullish outlook, Ethereum must hold critical support levels at $3,000 and $2,400. These levels have seen significant buying activity in the past and could act as a strong foundation for future price appreciation.

As the crypto market continues to evolve, Ethereum’s potential for significant growth remains a topic of intense speculation. Investors and analysts alike are closely monitoring on-chain data, market sentiment, and broader market trends to gauge the likelihood of a bullish breakout.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.